SPAC Risks and Strategies

Ya Dingus!

09/13/2020

*Disclaimer* Nothing in this write-up is investing advice and everything should be considered a lie from some random person on Twitter until you’ve done your own due diligence and understand the content of this document on your own. All of my opinions and viewpoints can change in a split second based on new information or new news being brought to light. If you haven’t read my discussion about SPACs and Warrants… Please do yourself a favor and read that first – I will not be discussing information I have already shared in that document. You can find it here: https://justpaste.it/8ygja.

When building a strategy there are plenty of different paths that SPAC traders are taking and none are right or wrong (unless you're losing a lot :D ) – this is primarily determined by what your level of risk is – NOTHING IS EVER GUARANTEED WHEN IT COMES TO EXPECTATIONS OF GAINS. If you are using money that is critical for your family to survive and are new to trading, It's my opinion that you take a low risk strategy while “paper trading” (not using real money) to learn the risks and flow associated with SPACs. Once you truly understand how to process the entire picture when it comes to the world of SPACs you can then begin to take on more risk.

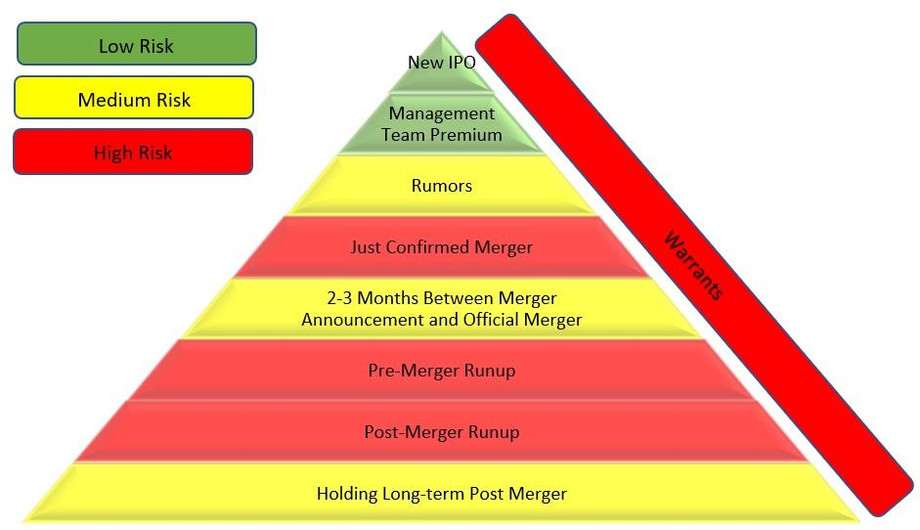

The below pyramid indicates the risk associated with trading SPAC equity shares and the sidebar displays the risk of trading Warrants.

***UPDATED NOTE FOR JANUARY 2021!!! ALL RISK LEVELS HAVE RAISED TO THEIR NEXT LEVEL UP IN RISK... THINGS ARE OUT OF CONTROL RIGHT NOW SO READ WITH THIS IN MIND****

New IPO – Risk Low

When a SPAC first IPOs it starts with units available typically at $10 each (consult SEC filings). Getting in units right at IPO is the lowest risk approach to trading SPACs since should anything go wrong with the SPAC you’ll get back the initial IPO price (sometimes minus fees). This is THE BEST SPOT to park your cash in a volatile market because there is such a small down-side with a potential huge blast off on an awesome merger being identified. If later on in the process they announce a company that you’re not excited about taking to the merger- you can always redeem essentially what you paid at IPO at a variety of steps in the process leaving you with no loss on the investment. For the ones that find exciting mergers, you’ll be able to reap the rewards of all the future steps with LOW risk since you’ve been in from the start.

Management Team Premium – Risk Low

This is essentially the same as the above; however, you stand to lose a few % more based on the run-up that may have already occurred to set a premium on the team in the SPAC. All of the above points are still valid for this.

Rumors – Risk Medium

When rumors are swirling about who a ticker will merge with this can be a little bit riskier time to jump into a company – especially when these rumors surface after hours or pre market when volume is thinner – a price could appear to be going higher than it will be once trading gets to normal volume during the day. Depending on how much a ticker has moved during this rumor phase the rumor may turn into truth and you could see big gains or the more common occurrence is that the rumor never surfaces to be true and the ticker will float back down to the management team premium price and you’ll lose the % increase it had already gained before you got in. Keep in mind that SPACs are not legally allowed to have a merger in place before IPOing – the conversations start right after IPO and many SPACs will sign NDAs and do thorough analysis with many companies. Any of these companies having that done could be leaked and it doesn’t assure any firm merger news is incoming.

Just Confirmed Merger – Risk High

This is the time that A LOT of people are making big money recently – All of Atlas seems to have made 50%-150% during this time period for KCAC last month since the news got release to everyone right after @SPACInsider posted it on their twitter (they’re the best – if you’re not following them you’re insane) and the information made its way swiftly into Atlas. If you can get in super early on this news release you’re going to be at a lower risk here; however, if you’re jumping into something after it’s already ran 50%+ you’re setting yourself up to a lot of downside exposure if excitement ends and the volume dries up or turns to people taking gains. Often times this Post announcement run is only a day or two and then we see a significant pull back over time into the next phase – so be careful chasing here and buying the top or you’ll find yourself red pretty quick.

2-3 Months Between Merger Announcement and Official Merger – Risk Medium

This is where you’ll see probably the best balance of SPAC play in the medium risk range – typically when a SPAC doesn’t break $20 on its confirmed merger spike, it will pull back towards the $11 range – thanks @DJohnson_CPA for some of his analysis on that. Jumping into an exciting company here that you’ve researched significantly and believe will have a great future in the $12 range is gonna give you a great risk to reward ratio with medium risk that the merger falls through or negative news is released about the company that cause a loss of excitement.

Pre-Merger Runup – Risk High

The pre-merger run-up is a time that can see some rapid gains the ~1.5 month runway into the merger occurring – we’re getting exciting SEC filings, we’re getting more talk from leadership, we’re getting hype from the trading community, etc. The stock will see a movement north leading into its merger and depending on where you get into the stock during this phase you may be putting yourself at some super high risk should anything fall through with the SPAC or negative news happen to the merging company. If you’re buying a SPAC that has seen a run-up before merger to $50+ it’s now at a 500% premium over where professionals have valued the business and there are a ton of things that could cause a rapid decline in price – with some brokers like Webull allowing people to trade at 4a.m. and others not letting folks trade until 7:30a.m. you could be in a very sticky situation should anything super bad happen outside of trading hours.

Post-Merger Runup – Risk High Just like the above you – everything still applies. You really have no clue how the world is going to react to this phase – There could be a rush of buyers or there could be a rush of folks trying to take their gains and run. As with every other high-risk time period – you’ll wanna keep a close watch and play the technicals.

Holding Long-term Post Merger – Risk Medium

Once a SPAC has gotten down to its resting place post-merger, this becomes similar to any other stock that trades – the only thing special to note about companies that go through SPACs is that they’re typically authorized to have upwards of 1B shares! Cash raises, warrant redemptions, and dilution among high growth companies is VERY typical which can cause a stock to run, tumble, run, tumble, run, tumble, and so on- until they’re closer into their business being a reality.

Investing Strategies

The first thing to remember when thinking about SPAC investing strategies is that just like every other style of trading…. Higher risk means higher rewards. The number of long-term-successful traders making a significant amount of money trading are taking high risk trades every single minute is very low; however, their expertise in their style of trading significantly lowers the risk that they personally are taking on. For the most part – when you hear about a trader that is killing it… please remember what they’re posting sounds like it’s free money, but they’ve spent years to a lifetime perfecting a connection with the market they’re in to be able to know what’s happening – Stocks are a part of their life like water in your body. Folks that get on a lucky win spree early on and do not realize this will ALWAYS get chewed up and spit out penniless and miserable. This doesn’t mean that you can’t come back and dominate the market- but it does mean you should realign your strategy to take a new fresh perspective and truly learn your craft by paper trading before you put your real money back into something risky.

Low Risk Traders

A great strategy for a low risk trader to take is to purchase a small position into each SPAC equity ticker on their IPO day. You should probably filter out the SPACs that have an inexperienced management team. Taking a little bit more on the strong management teams or the hot sector targets may give you a slight edge on your account. This diversifies your investment across many different SPACs lowering your chances that they will all have issues at once. It also gets you in at ground floor around IPO price which limits your downside to just a few % since you would be able to redeem cash for your shares or be paid out (consult SEC documents for terms) if the SPAC is dissolved. This style of trading could be making you ~20% annually with about a low chance ~5% risk exposure.

Medium Risk Traders

As a medium risk trader there are a lot more combinations you may want to start taking. The primary goal here is to ensure that you’re taking some calculated risks but aren’t tossing your entire account into just one thing or trading all high-risk phases of a SPAC. A good combination to me for a medium risk player is to take a 50% diversified low risk position, 30% medium risk position, and a 20% high risk position. I am personally in a transition from high risk to medium risk with elections on their way. My target by the end of October is to be in 50% recently IPOed SPACs such as JWS, IPOB, SNPR, and PSTH that have beast leadership that I believe in and are still in a reasonable entry range. I am already in some of these, but I’m not up to 50% yet. With 30% of my account I’ll be entering strong companies in their 2-3 month phase before their pre-market run-up… I’m still researching where my 30% holding is going to be next since I’m still a few week away from scaling out of my last position in this category. It’s critical to put in a significant amount of time researching who you’re going to take since you’re putting so much of your account into them it’s certainly risky to have this large of a position – you may want to divide this up to 15% into two different companies in this phase especially if you’re not able to watch what’s going on at all in the market during live trading hours. I do play warrants myself which is considered high risk for everyone- but with my knowledge and experience I view them as medium risk for myself. With the last 20% I’ll be entering into the higher risk phases of strong SPACs such as buying the announcements of mergers, jumping into pre-merger run-ups of different SPAcs, and perhaps playing some merger days on some. This 20% I’m playing I only trade with when I can actively pay attention to what’s going on and am able to play the technicals on it. Not including warrants, with this style you can usually keep your downside on the year to ~%35 with a potential gain of ~%250. Note: If you do get into warrant play here, you can see some greater gains than this but also need to make sure you know enough about them to have them reduce to a medium risk for yourself or you'll be increasing your downside as well.

High Risk Traders

As high risk traders, most of the time you’re playing all warrants and jumping into huge exposure positions such as 100% in a single SPAC, trading high volume movements, getting into SPACs that have already seen a significant rise in valuation, or trading entirely in warrants. This is a hugely dangerous way of trading; however, the gains can be astonishing. Anyone who has 100% of a specific SPAC, is jumping into merger announcements after the equity or warrants are already up significantly during the momentum, buying a lot of a SPAC equity and its warrants at a significant multiple of it’s IPO price, etc I would lump into this bucket. If you know what you’re doing and see the momentum- it can be a great way to take home a great short term returns. This style of trading certainly can leave your risk exposure at %100 and I’ve heard many stories of blown up accounts going hard like this – but you will also find some stories of people that are getting 500%+ returns annually taking this type of approach. I would highly advise that you gradually transition from low risk to high risk as you’re starting to play SPACs to reduce your odds of losing it all. Even for high risk traders I would NEVER advise a singular position that is driving your account.

In Closing

This write up is really to try to help new folks that have found SPACs and think it’s the holy grail of free gains – IT ISN’T FOR ALL PHASES OF A SPAC! There is still huge risk involved in trading SPACs just like there is in the penny world if you’re trading some of these higher risk phases. It’s imperative that you take the time to fully understand what’s happening and get the EXPERIENCE learning how things work before you start dumping tons of money into high risk plays. Reading will get you a portion of the way there -but there is no substitute to having skin in the game for an extended period of time.

Give me a follow on Twitter @DOC_STEVE_BRULE if this was helpful. Also, if you want to really become the best trader you can be – you should think about joining the Atlas discord. It’s a 45,000+ member community of like-minded individuals that are always sharing information with each other and pushing each other to learn and grow. We recently got a SPAC channel with tons of people collaborating. You can join that group by accessing this link: https://discord.com/invite/atlastrading