SPACS & WARRANTS…. FOR YOUR HEALTH… YA DINGUS!

August 10th, 2020

*Disclaimer* Nothing in this write-up is investing advice and everything should be considered a lie from some random person on Twitter until you’ve done your own due diligence and understand the content of this document on your own.

If you don’t care about what SPACs or warrants are, skip to 'Okay….. that’s a lot of stuff I don’t care about – tell me how warrants behave!’

What is a SPAC?

A SPAC is a special acquisition company sometimes also referred to as a ‘Blank Check’ company. A simple enough explanation for this context is that it’s a group of wealthy people that decide they want to make a ton of money using other people’s money. They don’t have a specific product or business, but they have a reputation, connections, or involvement in a private company they think should be brought public in the future through a SPAC. These folks IPO their SPAC under the SPAC’s business name and shares trade on the open market. Individuals and institutions can invest in these wealthy people with the hopes that they will also make them money. The wealthy people then have typically 24 months (look at specific SEC filings for exact length) to find a private company that wants to go public, merge with them, and change their ticker to the newly merged company ticker. This results in all of the SPAC shareholders getting shares of the newly merged company. If they don’t find a company in that ~24 months or need more time to complete the merger… they often will extend the time they have by 6 months as many times as needed until they get the deal done. In some worst case scenarios the SPAC will fail to get an extension and will be forced to dissolve the SPAC. What happens in this scenario is described later in this document.

What are a few examples of SPACs I may have heard of?

Post-Merger

Draftkings - SPAC Ticker (DEAC), POST Merger Ticker (DKNG)

Virgin Galactic – SPAC Ticker (SCH), Post Merger Ticker (SPCE)

Nikola Motors – SPAC Ticker (VTIQ), Post Merger Ticker (NKLA)

Pre-Merger

Golden Nugget Online Gaming – SPAC Ticker (LCA)

Fisker – SPAC Ticker (SPAQ)

Hyliion – SPAC Ticker (SHLL)

Pre-Merger

Same wealthy people that did the DraftKings SPAC – SPAC Ticker (FEAC)

A useful resource I’ve found online (Not my document) that lists a lot of the SPACs can be found here: https://docs.google.com/spreadsheets/d/e/2PACX-1vRzqxnlLQMDySgzpha7CqybelABhjuDIyWj8k9vpNS7YG_ED9oGHXQMRyhs6lCCuC6Pz8pU5xGfEopy/pubhtml?gid=634347005&single=true . Please note that this list isn’t exhaustive and some of their information is delayed being updated.

Why would a private company use a SPAC to go public?

The SPAC team has done all the hard work – They spent all the up-front money and put in the up-front effort to IPO the SPAC. This saves the private company a lot of time and money of having to do that on their own – They’re able to go public much faster, have less scrutiny of their business, and capitalize on market conditions while they’re hot. SPACs also provide a bit of ‘sex appeal’ – they don’t have a quiet period like IPOs do so folks can blast their company all they want up into the day of ticker change and beyond. If you’re not familiar with what a quiet period is, please check out this link: https://www.investopedia.com/terms/q/quietperiod.asp

What key phases are typically involved with a successful SPAC?

1. SPAC is listed public with Units available to trade.

2. Equity and Warrants are listed and available to trade.

3. Rumors are spread about who the company they’re merging with could be (These rumors may or may not be true!!!!!!) and then a letter of intent or binding merger is signed with a company and information about them is made public. There is often an investor deck like this: https://www.sec.gov/Archives/edgar/data/1768012/000110465920077710/tm2023623d3_ex99-2.htm available at this time and should be read in depth.

4. A vote to approve the merger occurs.

5. The ticker changes to the merged company’s ticker and the private company is now rolled into the new publicly traded ticker.

In total these phases are usually a ~12-24 month process for the SPAC. Further on you’ll see examples of these phases for different tickers.

PRO TIP: https://warrants.tech/ is a great site to look up warrants and have direct access to the SEC filings to see what’s been causing movements. Please note that this site has warrants that aren’t related to SPACs.

Do SPACs know who they’ll bring public before they create the fund?

Often Times, Yes –SPACs are often created with the intent to bring a specific company OR at least have an idea of the industry they’re targeting based on all the wealthy people’s backgrounds and experience.

Example #1: LCA is a SPAC brought public by Tilman Fertitta and the company they’re merging with is Golden Nugget Online which Tilman Fertitta owns.

Example #2: MFAC had BankMobile’s CEO as the director of the SPAC and they just announced a deal with BankMobile.

Often if you dig hard enough on the SPAC team’s backgrounds and piece together the info that’s been put out – you can get a good guess at who they’re going after. You can google the SPAC name and ‘management team’ and you will find a website or articles that list all the wealthy people involved in the SPAC and can do your own digging.

Is the Market Cap on the SPAC ticker the market cap of the merged company?

No! The market cap on the SPAC is a partial ownership of the newly merged company – on the merger day shares will dilute to incorporate the shares owned by other parties such as the private company being merged, the SPAC team that gets ownership, and for some extremely large SPACs like NKLA – there will be an additional set of funding coming in through a pipe. This is all defined in SEC filings and varies widely from SPAC to SPAC. I’m not going to go too much into detail on this here – but happy to answer questions.

I’ve seen three tickers associated with a SPAC… what’s the deal?

There are almost always three types of investments you can make in a SPAC – They consist of Equity shares, Warrants, and Units. These each trade using different tickers generally [SPAC Ticker], [SPAC Ticker].U, and [SPAC Ticker].WS respectively. to buy them you just purchase them like you do any other stock.

Equity – A normal share of the company that provides equity in the business. If the SPAC fails to merge with a company, original equity share price minus fees is returned to shareholders – this limits the downside risk of investing into SPAC equity shares.

Warrants – Essentially an option to buy the newly merged company any time for a defined amount of time for a defined price. These warrants have NO equity value in the company on their own. A common example of this is that you can purchase a share of the newly merged company for $11.50 at any time for 5 years after the merger date. There is a caveat to this 5 year timeframe we’ll discuss below under ‘*Warrant Redemption’. Please Note - If the SPAC fails to merge with a company and end up being dissolved… you’re boned and warrants will go to $0.

Note: $11.50 and 5 years are an example, below I’ll tell you what to look for in SEC filings to see what each specific SPAC is offering.

Units – an equity share and a portion of a warrant. Often times 1 unit = 1 equity share and 1/3rd warrant; however, you should ALWAYS consult the SPAC SEC filings to identify the amount of partial warrants that come with specific SPACs. At time of ticker change these units will convert to their shares and warrant tickers respectively. So if you had 90 units in this example, after merger/ ticker change, you’d have 90 equity shares and 30 warrants. If the SPAC fails to merge with a company, original equity share price minus fees is returned to shareholders – this limits the downside risk of investing into SPAC units.

I’m looking at a new SPAC but only see units available right now, how come?

Most of the time units trade live first and warrants and equity share tickers become available to trade about 2 months later in addition to the units.

I don’t see the warrants on my Robinhood… why not?

Some of the “beginner/small retail” focused platforms do not offer warrants – I’ve never inquired about it since I don’t use one that doesn’t…. but I suspect it’s because of the effort it takes to redeem shares. We’ll talk more about redeeming shares below.

How can I figure out what a warrant’s terms are?

The best place to start is with a search of their SEC documents. It is important to use the definition in THE MOST RECENT FILING as things could change over time - https://www.sec.gov/search/search.htm – look for where they describe the types of shares that will be available and you’ll find text like this: “Each whole warrant entitles the holder thereof to purchase one share of our Class A common stock at a price of $11.50 per share” “will expire five years after the completion of our initial business combination or earlier upon redemption” “if the reported closing price of our Class A common stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrantholders.”

So I can trade warrants just like a normal stock for up to the defined number of years (often 5)?

Yes*- you can keep trading the warrant ticker post-merger. The warrant ticker will change with the equity ticker so you’ll have warrants for the merged company post-merger. You can buy and sell warrants until the expiration period unless the company redeems them. A sample redemption term can be seen above this in the last quote – often if the SPAC trades over $18 for 20 trading days within a 30-day period.

How can I get equity shares after the merger using my warrants?

After the merger if you wish to pay $11.50 (Example price) to get your equity shares, you must do this by calling a broker from your platform and having them do this for you. It is typically an involved process where they must work with the company to create new shares and allocate them to your account.

*Warrant Redemption

A company that does really well can essentially redeem all warrants and reduce the amount of dilution that occurs by the public redeeming warrants – based on the SPAC terms, if the stock maintains a price over a certain amount for a certain amount of time they can redeem all outstanding warrants – you’ll get a notice that warrants are being redeemed and you have x days to turn them in for shares. At this point you often no longer have the option of getting one equity share per one warrant and instead they force you to do a cashless redemption where you don’t have to pay any money to convert your warrants – the $11.50 instead is reduced in the share count you get – so if a stock is trading at $23 at the time the company redeems warrants- they do a cashless redemption where instead of you paying $11.50 with each warrant to get one whole equity share…. You get .5 shares per warrant without putting any cash forward. This is good for the company because it causes less dilution to occur, but bad for you because you get less shares of the company with your warrants. Any warrants not redeemed get bought by the company often for $.01 and you’re SCREWED. So keep an eye out for the stock to meet their redemption terms because you’ll probably want to do something with them before that happens. Here is an example of a warrant redemption: https://www.businesswire.com/news/home/20200313005549/en/Virgin-Galactic-Announces-Redemption-Public-Warrants

Okay….. that’s a lot of stuff I don’t care about – tell me how warrants behave!

SPAC warrants are a GREAT WAY to make insane amount of returns in comparison to the equity shares. The greatest gain from warrants over equity shares I’ve seen to date is on the SPAC VTIQ that merged with Nikola Motors and converted to the ticker NKLA. If you bought VTIQ warrants the day the SPAC warrants went live for $.40 and sold them at their peak when they hit $40… you would have turned a $10,000 investment into $1,000,000. This is a 100x return in comparison to if you just bought VTIQ equity shares when they went live at $10 and sold them at their peak around $93 which would have turned your $10,000 into $93,000. Warrants would have made you $907,000 MORE! WOW!!!!! So why isn’t everyone buying warrants instead of equity shares? HIGHER REWARDS COME WITH HIGHER RISK! If a merger falls through and the SPAC dissolves, the SPAC never finds a company to merge with and dissolves, or the stock price never gets over the $11.50 (CHECK SEC FOR EACH SPAC) strike price in the time you have allocated to being able to convert shares…. you own NO equity in the company and you could lose it all on warrants. Additionally, if the public doesn’t like the merging company or there’s bad news that happens to the merging company– warrants swing south MUCH FASTER than regular shares.

What are the best times to make money on warrants and how do they compare to equity tickers?

The below events are for GOOD SPACS – ones that have known teams made up of known players that are merging with KNOWN companies or companies in hot sectors. This behavior is NOT for every single SPAC in existence. Every % movement suggested below could see the opposite direction with equally negative occurring news or events.

1) First few minutes the Warrant and Equity tickers go live

Sample: JWS is a recent SPAC that had their warrants and equity shares go live on July 6th.

Equity Shares (JWS): On the first day of trading you can see the equity shares opened at $10.35 and had a high of $10.36. This means trading the equity shares you could have best made $.01 if traded to perfection.

Warrants (JWS WS): If you look at the below information – on July 6th they opened at $1.45 and saw a high of $3.53. That’s a 140%+ gain if timed properly. Most people likely realized a gain of more like 50% because it’s hard to time the rush. The reason that warrants see this epic first day move is because there is a rush to grab them up – this will be a new ‘premium’ that will likely never have the warrant price available at it’s opening price again.

#2 During the ‘rumor period’ where unsubstantiated rumors are swirling about who the merging company is going to be.

Sample: FEAC is a SPAC run by the same team that brought Draftkings public that was hugely successful on their last SPAC. Rumors started swirling that FEAC was going to be merging with Sportradar. The rumors were never confirmed; however, this rumor phase can certainly give you some great gains.

Equity shares (FEAC) These went from $10.59 to $12.44 at their highest on July 16th based on these rumors – a gain of ~17%. You can see rumors were never confirmed which caused the price to go back down to where it was.

Warrants (FEAC.WS): Warrants went from $2 mid June to $6 in early July. A gain of 200% was potential there. You can see that rumors cooling down equally saw a drop from that $6 high back down to the high $2s.

#3 Right when a letter of intent / binding agreement is announced

Sample: SHLL announced that they were merging with Hyliion.

Equity Shares (SHLL) Saw a move from $10.20 mid June to $34.67 peaking on June 29th. This would have been a 240%+ gain.

Warrants (SHLL.WS): Warrants saw a move from $1.35 mid June to $13.85. peaking on June 29th - This would have been a 920%+ gain.

#4 News comes out around the company the SPAC is going to merge with.

Sample: When news happens around the company that the SPAC is intending to merge with, you’ll frequently see the SPAC ticker swing up or down based on how the public receives the news. A recent example of this is when the SPAC SPAQ (I know this is confusing, but the ticker SPAQ is a SPAC) that is merging with Fisker Automotive filed an SEC filing and shared an update that their previously published roadmap to secure a cornerstone agreement with VW to provide their MEB platform hadn’t been closed in July as anticipated. Immediately the news started flying around to new traders or traders who don’t understand what’s going on that the “Deal with VW Failed”. If you looked into the SEC filings and read more about it (https://www.sec.gov/Archives/edgar/data/1720990/000121390020019492/ea124799ex99-1_spartan.htm) specifically the text of interest was “It is also a reality when working with world-class partners that they might not move at our speed. This is something of which we must be respectful. To this point, we have not achieved our goal of signing a cornerstone agreement with VW by the end of July 2020 as we previously anticipated. We look forward to continuing discussions with VW again in September after the traditional European summer holidays.” You can see that the deal hasn’t failed, it just didn’t close in the desired timeline. With all the uninformed traders panicking, there was a large dump in the warrants and a perfect time for entry into some shares for an incredible price to hold for the recovery from the over-reaction.

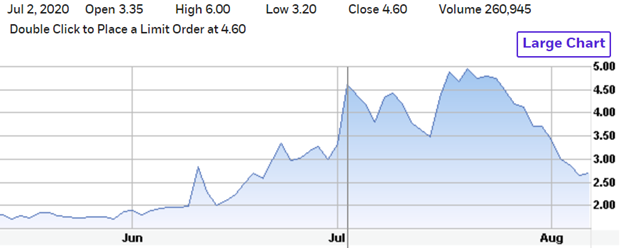

Equity Shares (SPAQ) You can see the equity shares went from $14.06 on July 30th to $12 on August 5th. A loss of -14%.

Warrants (SPAQ.WS) saw a move from $3.85 on July 30th to $2.50 on August 5th. That’s a loss of -35%

Note: Good news sees equal types of moves but in the positive direction!

#5 Sympathy Plays

Sample: When an industry or a company similar to the company the SPAC is going to be merging with has a good ER or has great news about it… you will see that sympathy plays begin to gain because of this over-all movement. An example of this was on August 7th PENN gaming just had their ER and the public started buying the stock up. In response to PENN gaming’s success, investors started flocking to other casino and gambling stocks. This sympathy purchasing spilled over to the SPAC LCA which is merging with Golden Nugget Online Gaming which is an online casino and sports book. These sympathies apply to every industry SPAC this is just one example.

Equity Shares (LCA) You can see that LCA equity shares moved from $11.98 to $13.01. That’s a move of about 8%.

Warrants (LCAHW) You can see the warrants moved during that same sympathy buying from $2.96 to $3.70. That’s a change of about 25%.

Note: When an industry or peer is having negative things happen to them, you may go down as a sympathy as well.

#6 Merger vote day anticipation / merger vote day

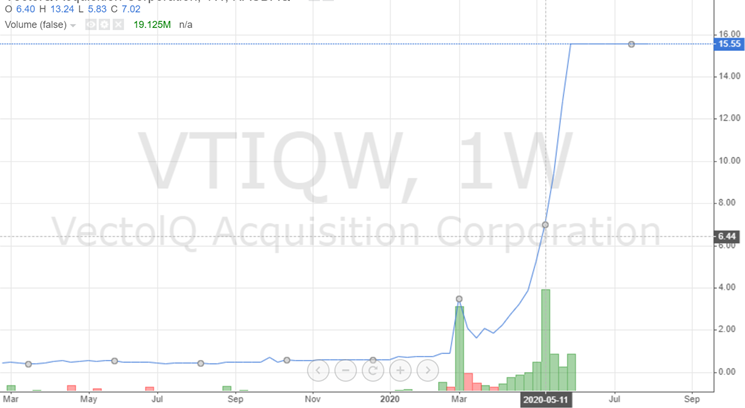

Sample: VTIQ had a merger vote on May 12th to formally merge with Nikola Motors.

Equity (VTIQ) shares saw a move from early May to the vote May 12th from $13.10 to $35.38 which would have been about a 170% gain.

Warrants (VTIQ.WS) Saw a move from $4 early May to May 11th’s High of $13.24 which was a 230%+ gain.

#7 Merger Day!!!

Sample: VTIQ Merged with and changed ticker to NKLA on June 4th .

VTIQ Warrants Converted to NKLA (Equity) Opened at $37.55 on the 4th and moved to a high of $93.99 on June 9th. That’s a return of 150%.

VTIQW converted to NKLAW (Warrants) And these saw a move from June 4th from $17.73 to $40.30 on June 23rd. That’s a 125%+ gain.

What are the quirks about SPAC warrants?

Warrants commonly trade with very thin volume premarket and after hours. Trading them during these windows can cause you to pay WAY too much for them or to have to sell them at a horrible price. The bid and ask spread on warrants PM and AH are often a 20%-30% difference. If bad news drops about the SPAC or merging company during AH or PM you may be forced to make a decision that will not be kind to your wallet. On the flip side, when good news happens PM or AH and you already own warrants – people buying them up are often slapping the ask on that wide spread and causing them to run way higher than they’re worth. You can really capitalize on selling during the PM or AH and buying back during regular trading hours. Often times you can see someone slap an ask or sell at a bid and it looks like the warrants are flying or crashing but really it’s just a handful of people making stupid decisions.

RISKS! RISKS! RISKS!

Warrants move violently in the same direction as the main equity ticker – if the equity ticker goes down 5%.... the Warrants could go down a significant multiple of that %. This is because Equity shares typically don’t move under $10 but warrants can go all the way to $.00. This means that a bad performing SPAC could really destroy your account. It could equally make you insane returns – so you should know what you’re doing and really have faith in the company you’re trading them for.

Sample: NFIN warrants had been run up after they announced a letter of intent to merge with a blockchain commodities company Tritteras; however, when they announced a binding merger with Tritteras the new deal is a portion of what original deal was and way worse numbers than were expected from the letter of intent. Equity Shares only lost ~5% and warrants lost ~50% on this news.

NFINW (Warrants)

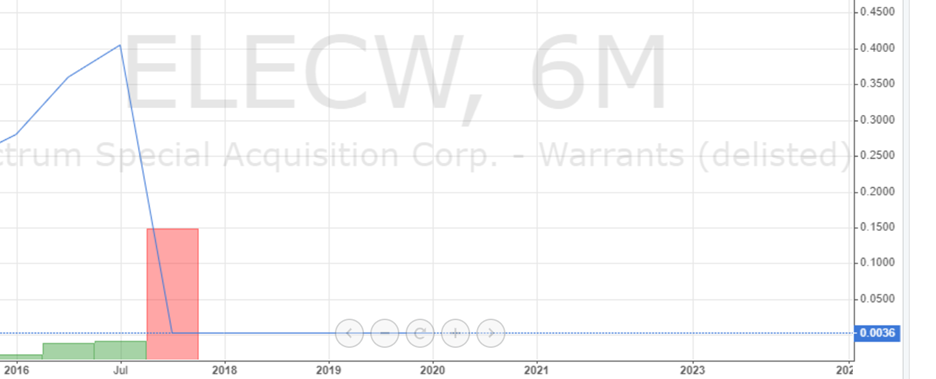

If a SPAC never finds a merger and ends up dissolving, the equity shares get back the original share price + interest – fees. So you can expect on a $10 SPAC that you’ll get back at least $8+ if things go south and the SPAC is dissolved; however, warrants to not provide you any reassurances – if the SPAC is dissolved, they will go to $0. I repeat – you WILL lose everything.

Sample: ELCECW was a dissolved SPAC. Warrants went from $.40 to $.00

ELCECW (Warrants)

Sample: The GPAQ SPAC merged with the hall of fame and merged into the new ticker HFOV. On merger day – this SPAC saw rapid selling from everyone likely due to the continued Coronavirus impact to the tourism industry. The equity shares and the warrants both saw a 50% drop over the few days following the official merger.

Closing Summary

I almost exclusively trade warrants for the SPACs that I love – I typically only play these events listed here and don’t hold them through the dull periods between each event unless there’s an active CEO pushing a lot of information out about the company. I always buy one equity share of the stock with the warrant so that I can see in my account how the main ticker is moving compared to the warrants. Warrants inherently have a much greater risk than SPAC equity and should only be traded if you know what you’re doing – you can certainly lose far more playing these warrants than you can the equity shares. Give me a follow on Twitter @DOC_STEVE_BRULE if this was helpful. Also, if you want to really become the best trader you can be – you should think about joining the Atlas discord. It’s a 40,000+ member community of like-minded individuals that are always sharing information with each other and pushing each other to learn and grow. You can join that group by accessing this link: https://discord.com/invite/atlastrading