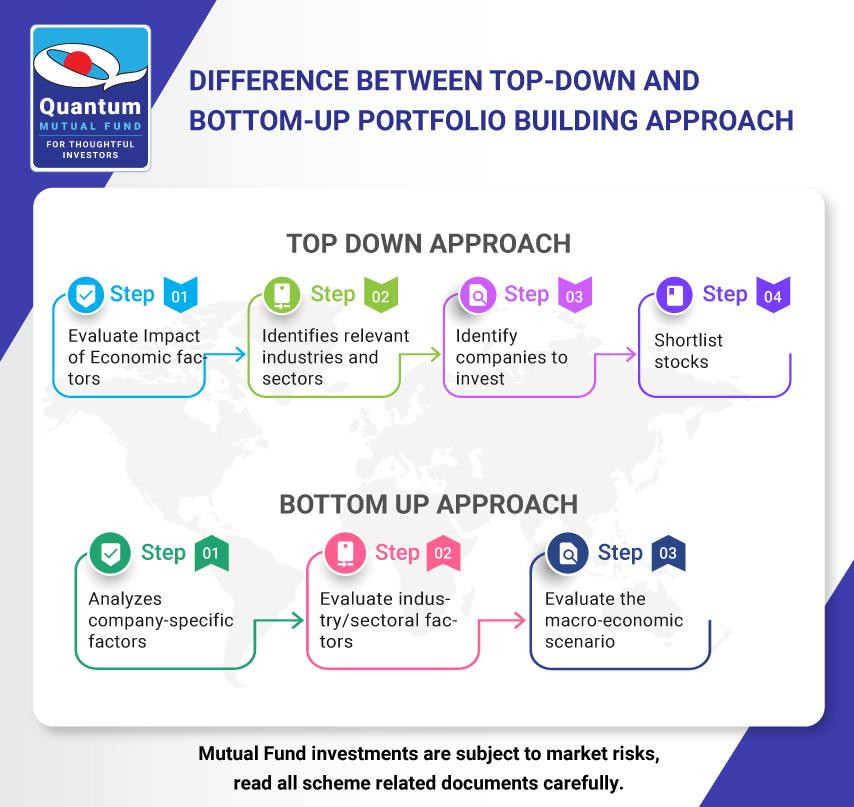

There are primarily two types of portfolio building approach – top-down and bottom-up. In a top-down approach, the fund manager evaluates economic factors such as inflation, interest rates, GDP growth, etc. He then narrows down the sectors or industries suitable for investment. Thereafter, he selects a portfolio of stocks based on certain pre-determined criteria. A bottom-up approach on the other hand analyses the company, industry factors and finally the macro-economic parameters & its impact on the companies that are included in the portfolio.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

www.Quantumamc.com