Accounting and Bookkeeping Services: Benefits and Tips

Introduction

Accounting and bookkeeping services are essential for businesses of all sizes, ensuring accurate financial tracking, compliance with regulatory requirements, and informed decision-making. While often used interchangeably, accounting and bookkeeping are distinct yet complementary functions.

Understanding Accounting and Bookkeeping

- Bookkeeping is the systematic recording of financial transactions, including sales, purchases, receipts, and payments. Bookkeepers maintain ledgers, manage accounts receivable and payable, and handle payroll. The primary goal of bookkeeping is to keep an accurate and complete record of all financial activities.

- Accounting, on the other hand, involves interpreting, classifying, analyzing, reporting, and summarizing financial data. Accountants use bookkeeping records to prepare financial statements, perform audits, and provide financial analysis. They offer strategic insights and advice on financial planning, tax management, and business growth.

Benefits of Accounting and Bookkeeping Services

-

Accurate Financial Tracking

- Maintaining accurate records ensures that all financial transactions are recorded correctly, minimizing errors and discrepancies.

- Helps in tracking cash flow, which is critical for maintaining liquidity and operational efficiency.

-

Regulatory Compliance

- Ensures adherence to local, state, and federal regulations, including tax laws and financial reporting standards.

- Helps avoid penalties and legal issues associated with non-compliance.

-

Informed Decision-Making

- Provides detailed financial reports and analyses, aiding in strategic planning and decision-making.

- Allows business owners to identify trends, assess financial health, and make data-driven decisions.

-

Time and Cost Efficiency

- Outsourcing bookkeeping and accounting services can save time, allowing business owners to focus on core operations.

- Reduces the need for in-house accounting staff, lowering overhead costs.

-

Improved Financial Management

- Helps in budget preparation and monitoring, ensuring efficient allocation of resources.

- Enhances financial forecasting, enabling businesses to anticipate future financial needs and challenges.

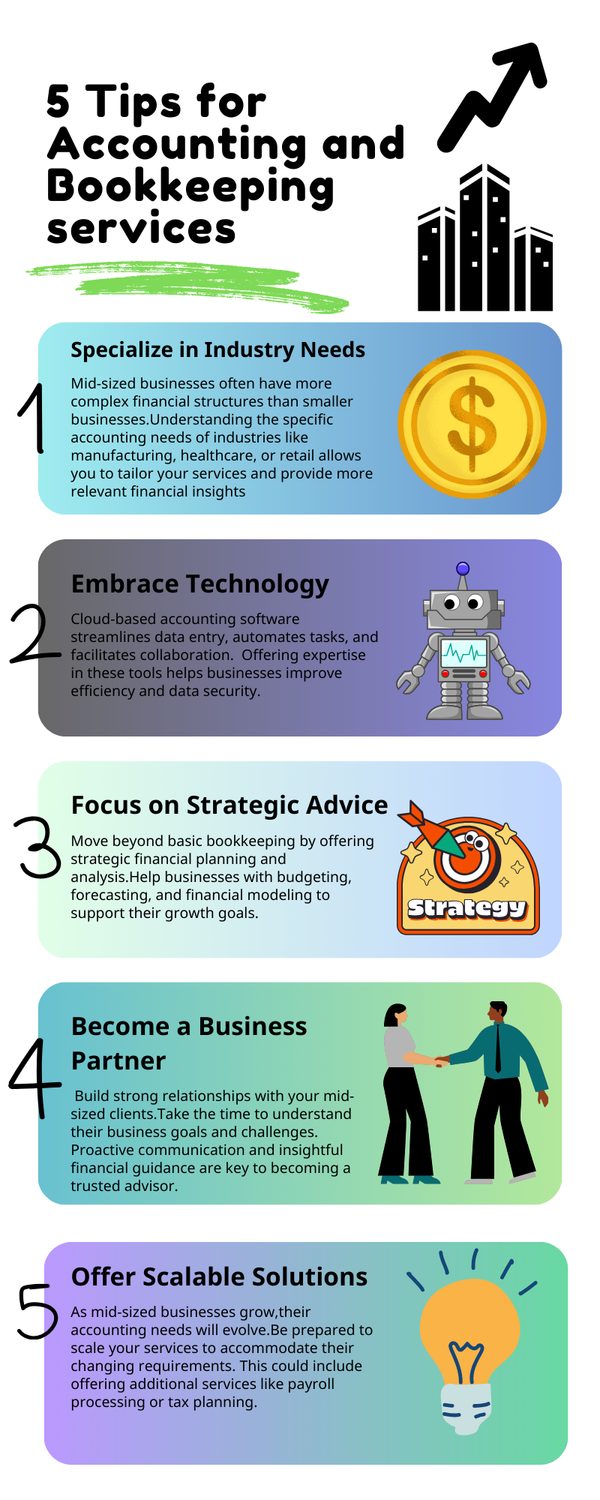

Tips for Effective Accounting and Bookkeeping

-

Choose the Right Software

- Invest in reliable accounting software that suits your business needs. Popular options include QuickBooks, Xero, and FreshBooks.

- Ensure the software is user-friendly and integrates well with other tools you use.

-

Maintain Consistency

- Record transactions promptly and regularly to avoid backlogs and errors.

- Establish a routine for reviewing and reconciling accounts to maintain accuracy.

-

Separate Personal and Business Finances

- Keep personal and business accounts separate to avoid confusion and simplify financial management.

- Use dedicated business credit cards and bank accounts for all business transactions.

-

Stay Organized

- Keep all financial documents, such as receipts, invoices, and bank statements, organized and easily accessible.

- Use digital tools to scan and store documents electronically, reducing physical clutter.

-

Regularly Review Financial Statements

- Analyze financial statements, such as income statements, balance sheets, and cash flow statements, on a regular basis.

- Look for patterns, discrepancies, and areas of improvement to ensure financial health.

-

Seek Professional Help

- Consider hiring a professional accountant or bookkeeping service, especially if your business finances are complex.

- Professionals can provide valuable insights, ensure compliance, and help optimize your financial strategy.

-

Stay Updated on Tax Laws

- Keep abreast of changes in tax regulations and ensure your business complies with the latest requirements.

- Utilize tax planning strategies to minimize liabilities and maximize deductions.

-

Plan for the Future

- Use financial data to plan for future growth, investments, and potential challenges.

- Create a financial roadmap that includes short-term and long-term goals.

Conclusion

Accounting and bookkeeping services are vital for maintaining the financial health of a business. By ensuring accurate financial tracking, regulatory compliance, and informed decision-making, these services enable businesses to thrive and grow. Implementing effective accounting and bookkeeping practices, whether through software or professional services, can lead to improved financial management and long-term success.