There are different types and forms of business. You can always choose the one among them that best suits your needs and budget. While doing so, you also need to ensure that you choose such a form of business that can bring back more advantages for you and can help you do business in a more flexible manner. If you will invest money to start a business and put in hard effort to run it and despite such fact you have to run the business in a more complicated and stiff manner, then there is no mean to do such business. With this type of business, you may face loss and may need to pay heavy taxes that can wreck your budget completely. So, the best thing that you need to consider now is to register LLC company.

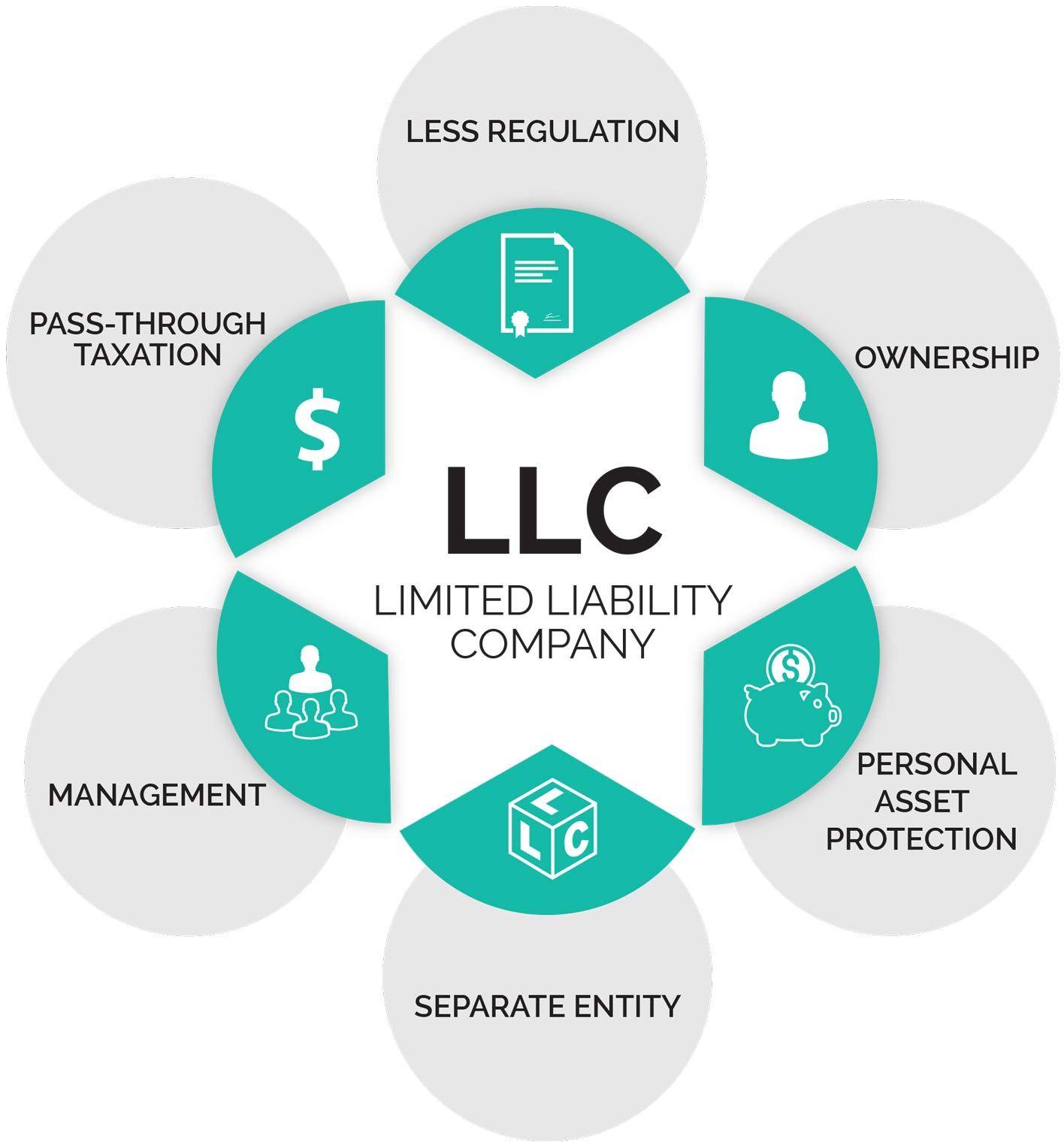

Most of the startups when they are new are considered as the LLC companies. This type of business brings great advantages with comparison to the other forms of business. When you have a LLC to deal with, it adds more positive elements. The state laws to run a LLC can vary from one state to the other but LLC is something that can get back to you with some major advantages and that you should know before you set up LLC company.

If you are among those people who prefer to operate own show, then register LLC company now and you will have some sure sort benefits. Most of the states out there allows for a single owner LLC. And that means the person who set up LLC company will also be the single owner of that business. When you operate as a single business owner, you can take own decision and there is no need to consult with the others and get approval from them to implement those decisions. This occurs for those businesses that are based on the general partnership like element and have several directors that run the board.

When you register LLC company, you become the sole proprietor of the business. That means you can run, manage, own and operate that business but here you will not have to face the liability issues. In case there is more than one owner for such a business, then an agreement can be crafted that tells more about the roles of each partner and their obligations towards the company. In this way, it will also become easier for the partners to structure that business in such a way that perfectly suits your needs and preferences.

When you set up LLC company, you also ensure that you can have limited personal liability. Often a LLC is considered as the legal entity that is separate from the partners involved with it. That means the owners and LLC itself are considered as the separate entities. So, this type of business will not remain liable to pay back those unpaid debts that the owners or the partners have. However, such an owner may lose the capital contribution that he made from the business such as shareholders. Due to this reason, the personal assets of the owners also not remain liable in case of lawsuit or when it comes to pay back that debt.