India Online Payments Snapshot -During the last couple of years, india's payments technology has continually advanced. New payments infrastructure and the proliferation of smartphones have blurred offline and online payment lines more and more. Payments and lending are still undergoing a massive transformation as both penetrate the market even further.

The advancement of payments technology has been steady over the past two decades. The boundaries between online and offline payments have been blurred by the introduction of smart phones and new infrastructure for payments.

The first instruments to work in both offline and online channels were credit and debit cards. Digital wallets were the next big thing in payments and are now the dominant method of payment for small-ticket transactions. Then UPI was created. It was amazing to be able to instantly make bank-to-bank payment using your mobile number. Its simplicity and affordability has made it a popular choice in India.

(Source - RBI and NPCI)

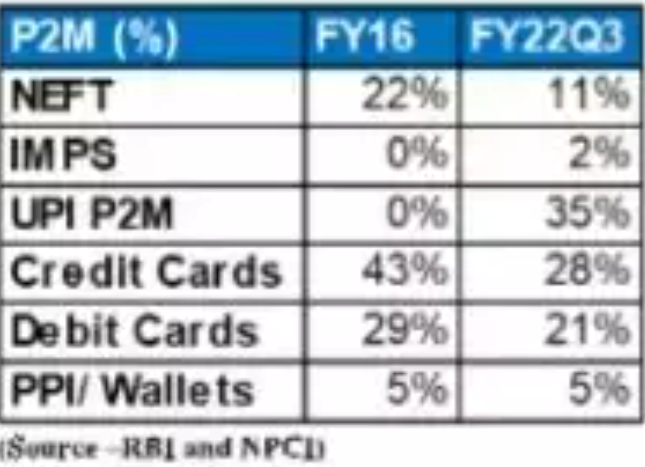

In 2016, the total value of digital retail P2M (merchant payments) transactions was Rs. 5.6 trillion. That has grown to Rs. 26 trillion as of FY21. While that growth itself is impressive, the growth of UPI is more remarkable. From zero in 2016 UPI now makes up close to 35% of the total transacted value in P2M transactions.

Lending firms have access to increasing amounts of data to help them create credit scoring models. Even offline transactions are digitalized. Every transaction is a potential loan opportunity. We will be focusing on latest trends we see in the lending and digital payments space.

Get your free online store with just a few clicks

Online Payments and lending trends to keep an eye on

In the original avatar, digital wallets are struggling

In India, Digital wallets were poised to be the next big thing in payments. But stricker RBI rules and newly UPI 2.0 put a stop to this. Digital Wallets cannot compete with UPI because both customers and merchants are free of fees on UPI transactions. Merchant fees form the basis of digital wallets.

Do payments have the potential to generate money?

Several Consumer-facing apps have launched consumer payment apps in recent years. Many of these also offer their own payment services, which raises the question of whether they will succeed against stiff competition.

Payment apps such as phonepe that are consumer-facing will not be able to generate revenue by simply offering payments. Since most of their transactions flow through UPI, they generate no revenue. Lending Capital apps are useful for assuring customer acquisition and selling insurance, mutual funds, and loans via the app. Credit cards and BNPL are payment instruments that have built-in credit. However, one could argue that this money isn't really from payments, but from lending capital.

Our opinion is that consumer payments companies cannot succeed unless they offer additional product/services. The payment services provided by merchants are more likely to be profitable.

Card companies will face tougher competition

The industry has offered rewards to attract customers over the years. These rewards have been funded by the Merchant Discount Rates (MDR) charged by the cards. They are less likely to be funded now that UPI pressure is affecting the MDR.

With UPI, small-ticket transactions have largely fallen away. Debit cards have mostly been replaced by credit cards, but credit cards remain the most popular for high-value transactions. Credit cards are preferred because they offer rewards and free credit. When credit cards become increasingly virtualized (such as CRED), they might become indistinguishable from other BNPL/Wallet solutions. The ability of these solutions to maintain their lucrative economics would be compromised.

BNPL (Buy Now, Pay Later) - Higher Growth in India Consumer Market

BNPL has experienced rapid growth in india for multiple reasons. The majority of Indians have yet to obtain credit cards. BNPL offers are reaching an increasingly wide audience. Various platforms are offering post-paid (BNPL) option as a means of financing small ticket transactions that were previously not suitable for EMIs.

Over time, every merchant with many customer transactions will be able to offer BNPL loans. If you look back into history, you will find that Macy's, JC Penney, and many more offered store cards. While BNPL might seem like a new concept, it is basically the exact same product packaged differently.

Online Payments: Underwriting will remain as important

It's important to understand that BNPL may seem like a great opportunity, but poor underwriting means that there could eventually be three types of people. Portfolio manager Lyall Taylor mentioned that there will eventually be three types of people.

1. People who do not need credit are not required to obtain it.

2. Credit is available to those who really need it and will repay it on time.

3. People who need credit, but cannot manage the money they get responsibly will eventually default.

In the multi-directional fight between wallets, credit cards, BNPL, and other financial institutions, it will be essential to distinguish between the first and third categories of credit. The ability to evaluate and analyze credit will be key to success.

As traditional investors compete with fintechs, collaboration and joint ventures may prove the most beneficial strategy. Both parties can benefit from each other's collaborations, according to the above trends in online payments.