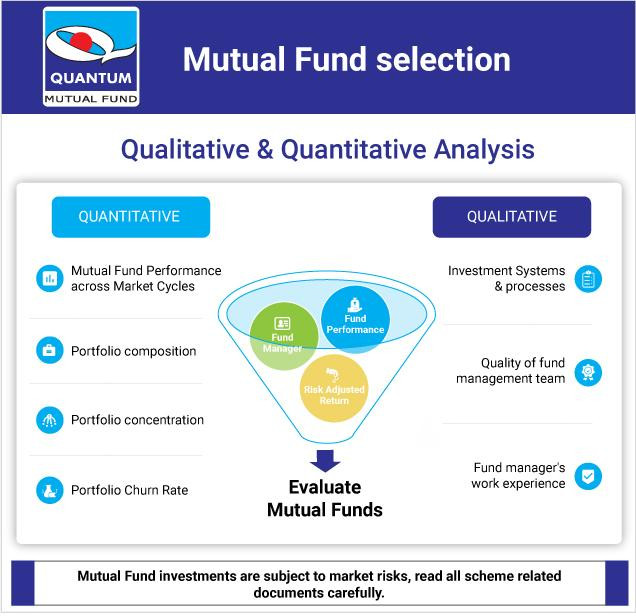

When going about searching for the best mutual fund, there are certain parameters that one should take into consideration. Evaluating historical returns could be the starting point for the analysis of mutual funds. Since mutual funds are market-linked, historical returns may or may not be indicative of future performance. If you are making the mutual fund selection, you may want to consider certain quantitative and qualitative parameters as listed below:

The quantitative parameters could include the performance across tenures and against the benchmark. Evaluate the performance over longer tenures like 3, 5 and 10 years and check for consistency of performance and against the benchmark. Also, check the portfolio concentration levels and whether the portfolio is diversified across different asset classes, stocks, sectors or geographies. You may also want to assess the portfolio churn levels; if the portfolio is churned many times during a year, the fund will incur higher transaction costs, which could impact your investment.

The qualitative parameters include the quality of the fund management team, the investment systems and processes, the fund manager’s work experience and whether the total mutual funds managed by him do not exceed 5.

Based on these parameters, you can then decide to select your mutual funds based on your goals, risk profile and investment tenure.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.