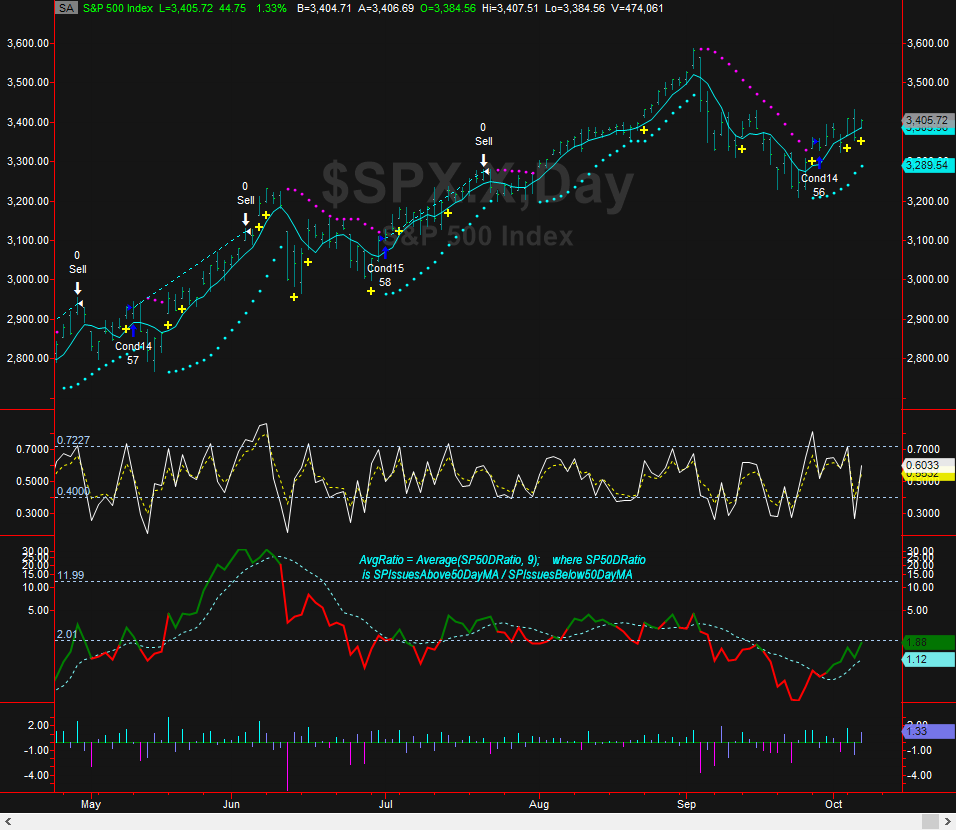

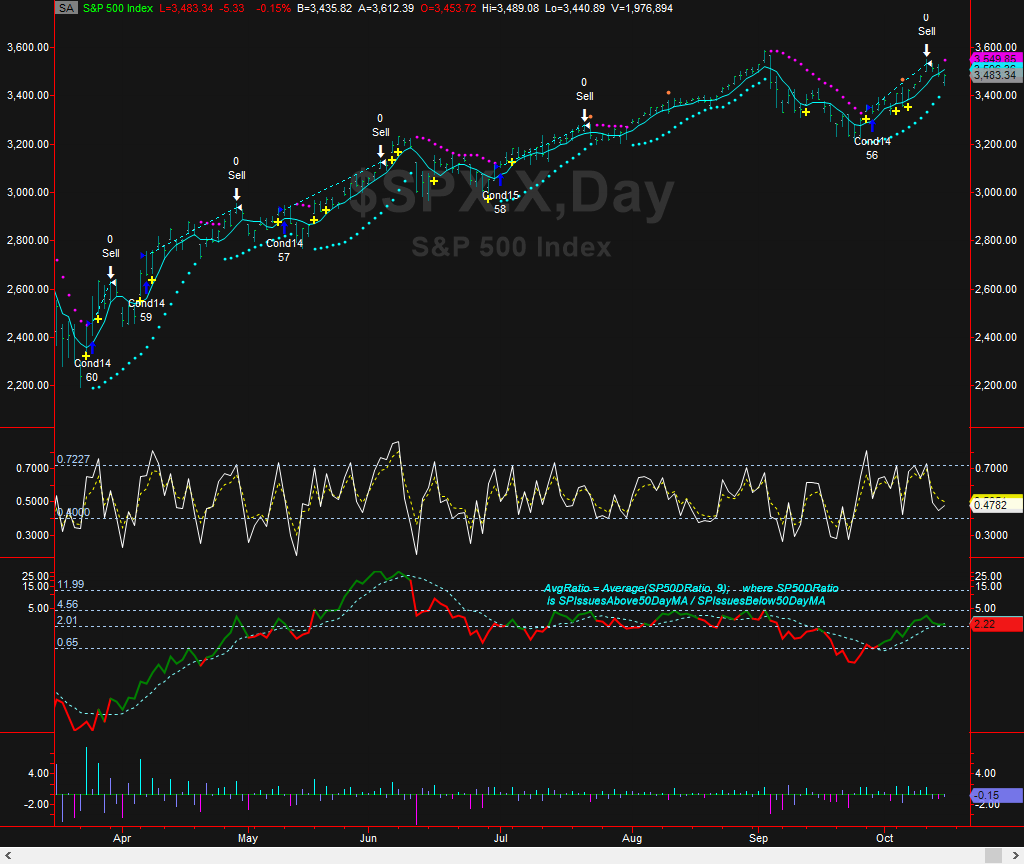

*updated 10/15/20

Note that the Parabolic SAR has reversed to bearish even as the bar retraced most of the losses with $SPX down only 0.15%. The other breadth indicator such as the 9 period SP50DRatio remained in an uptrend even as it dipped below the 9 period MA (dotted line). In previous instances such as this, $SPX will trade sideways and slowly rise and then re-take the Parablic SAR.

We had an interruption of the Zweig thrust yesterday afternoon but the market keeps on ticking, the 5 day MA continues in an uptrend and so far buying on pullbacks on the 5 day MA has been working. When the markets behave like this with bad news, you have to ask yourself - do you want to take a position and if you do, in case you get stopped out, do you want to be stopped out going long or going short?