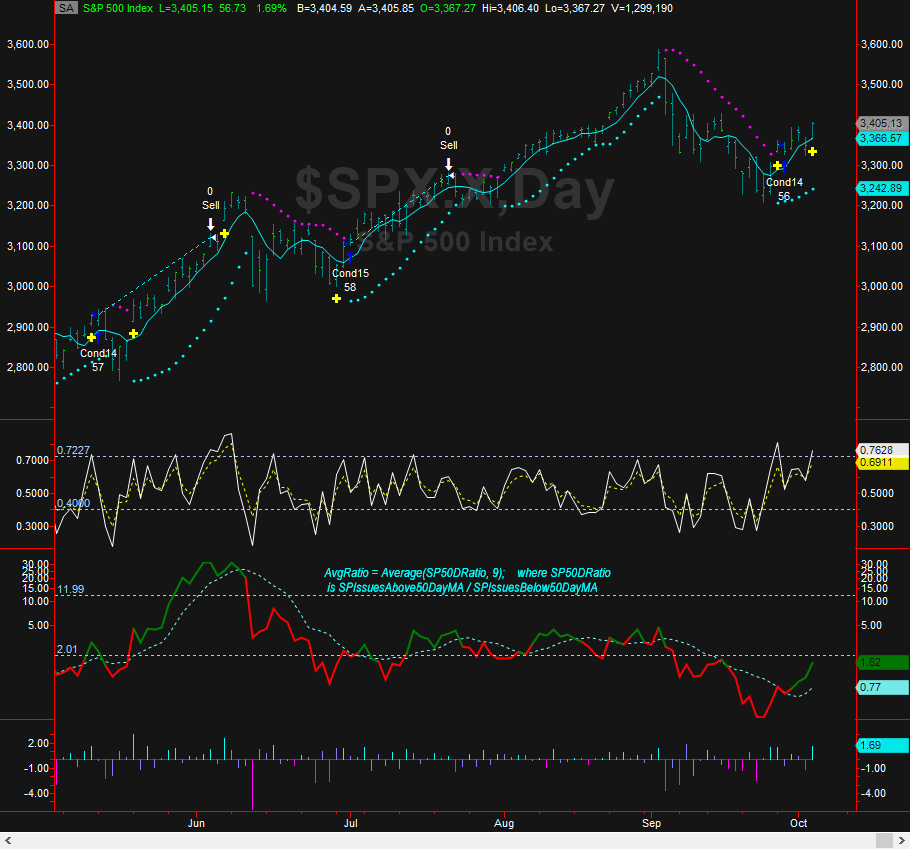

You can view breadth thrusts as a process over 10 days as Zweig described for the advancing issues or you can look at them individually and parse them to examine their values. In most cases they will lead to a bullish thrust and today is an affirmation of the thrust that began on 9/28. The last time we saw this was a rally from 5/18 to 6/08 where every pull back to the 5 day MA was a buy. Today we are having a advancing issues thrust as well as an up volume thrust. Either way, if you are a bull, you don't mind seeing these at all - unless the market is really peaking as in 6/08 or 9/02 which we are not as determined by the relative position of where we are to other breadth indicators such as the summation indices or IssuesAbove50 dayMA.