Market Overview

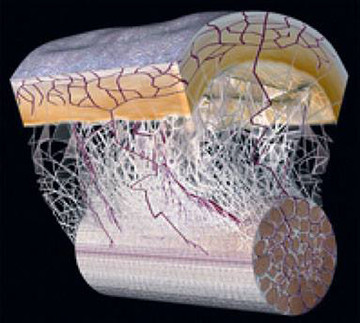

Automotive fascia systems encompass the exterior panels, grilles, and trim components that define a vehicle’s front and rear ends, combining functionality with aesthetics. Constructed from high-strength plastics, composites, and lightweight alloys, fascia products offer enhanced impact resistance, corrosion protection, and design flexibility. As OEMs strive to improve fuel efficiency and meet stringent emissions standards, lightweight fascias contribute to overall vehicle weight reduction, driving down fuel consumption and CO2 output.

Moreover, fascias serve as mounting platforms for sensors, cameras, and advanced driver-assistance systems (ADAS), fostering safety enhancements and seamless integration of modern electronics. The evolving consumer preference for custom styling and seamless brand identity has further spurred demand for fascia designs that blend aerodynamic efficiency with distinctive visual appeal.

The automotive facia market is estimated to be valued at US$ 24.77 Bn in 2025 and is expected to reach US$ 35.58 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2032.

Key Takeaways

Key players operating in the Global Automotive Fascia Market are Magna International, Inhance Technologies, Flex-N-Gate Corporation, Dongfeng Electronic Technology Co. Ltd., Eakas Corporation, MRC Manufacturing, Chiyoda Manufacturing, Sanko GOSEI, Gestamp Automocion, Plastic Omnium, Aisin Corporation, Dakkota Integrated System LLC, Revere Plastics System, Guardian Industries, Samvardhana Motherson, and Toyoda Gosei. These market companies command a significant industry share by leveraging expansive R&D pipelines, strategic acquisitions, and partnerships with OEMs across

Automotive Fascia Market Opportunities driven by the shift toward electric vehicles (EVs) and autonomous driving platforms. Fascia components are increasingly integrated with lidar, radar, and camera modules, creating demand in market segments focused on ADAS. Additionally, the rise of ride-hailing fleets and shared mobility services is boosting aftermarket needs for durable, easy-to-replace fascia assemblies.

Growing acceptance of 3D-printed prototypes and sustainable, recyclable materials opens avenues for market growth strategies centered on reduced lead times and lower production costs. Collaborations between material scientists, OEMs, and tier-1 suppliers are poised to unlock new scope in customizable fascia designs, enhancing business growth across segments.

Market drivers

One of the foremost market drivers for the Global Automotive Fascia Market is the increasing emphasis on vehicle weight reduction to enhance fuel efficiency and lower emissions. Lightweight fascia materials such as polypropylene, thermoplastic olefins, and carbon-reinforced composites offer high strength-to-weight ratios, directly impacting overall vehicle weight. As environmental regulations tighten worldwide, automakers are compelled to integrate lightweight components across exterior assemblies, including fascias.

Concurrently, advancements in material science and manufacturing processes, such as structural foam molding and multi-shot injection techniques, enable fascia suppliers to deliver complex geometries with reduced cycle times and minimal scrap rates. This combination of regulatory pressure and technological innovation propels market growth, as OEMs seek to meet both sustainability targets and consumer expectations for stylish, high-performance vehicles.

PEST Analysis

Political: In major automotive hubs in North America, Europe, and Asia Pacific, stringent emissions standards, safety regulations, and trade policies shape fascia design and production processes, while shifting import-export tariffs, regional localization mandates, and geopolitical uncertainties compel manufacturers to enhance compliance frameworks, engage in strategic government relations, and diversify supply chains to mitigate political risk and ensure uninterrupted market access.

Economic: Fluctuating polymer and composite material costs, currency exchange volatility, and inflationary trends influence production expenses and pricing strategies, prompting suppliers to pursue operational efficiencies, economies of scale, and strategic partnerships to manage costs effectively, while fiscal policies and investment incentives in emerging economies create avenues for manufacturing expansion and optimized capital allocation, while shifting consumer purchasing power and supply chain resilience considerations encourage investment in regional distribution and inventory optimization strategies, offering market insights and highlighting market opportunities amid evolving market challenges.

Social: Growing consumer focus on vehicle aesthetics, personalization, and sustainable design drives demand for innovative fascia solutions, with preferences for eco-friendly materials and lightweight construction, while demographic shifts and rising urbanization in developing regions influence purchasing patterns and create differentiated styling trends across markets, shaping distinct market segments.

Geographical Value Concentration

In terms of value concentration, the Global Automotive Fascia Market is heavily centered in Asia Pacific, Europe, and North America, which collectively account for the majority of industry value due to robust automotive ecosystems and high-volume production. Asia Pacific maintains the largest share, propelled by extensive vehicle manufacturing hubs in China, India, Japan, and Thailand. The region’s competitive labor costs, government-supported industrial parks, and strong presence of contract manufacturing firms drive manufacturing efficiencies and attract tier-1 suppliers.

Rapid urbanization and rising consumer purchasing power further stimulate demand for personalized vehicle exteriors, consolidating the region’s influence on market dynamics. Additionally, export-oriented production facilities in China serve global OEMs, reinforcing Asia Pacific’s dominant position. Europe holds a significant value concentration, rooted in its premium automotive heritage and strict safety and environmental regulations that mandate advanced fascia designs and high-quality materials. Germany, France, Italy, and the United Kingdom contribute notably, leveraging cutting-edge 3D printing, lightweight composites, and sustainable material innovations.

Get this Report in Japanese Language

Get this Reports in Korean Language

About Author:

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/ )