Market Overview

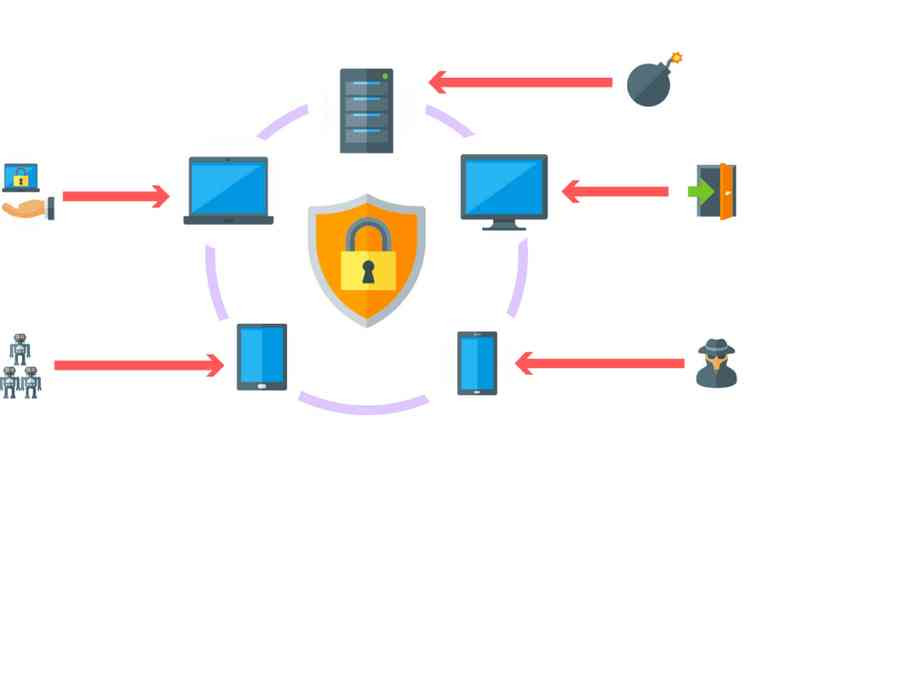

Endpoint Detection and Response (EDR) solutions provide real-time continuous monitoring and automated response to advanced cyber threats targeting endpoints such as laptops, servers, and mobile devices. These platforms leverage behavioral analytics, threat intelligence integration, and machine learning to detect anomalies, contain breaches, and remediate attacks before they spread across the network.

Key advantages include rapid incident response, reduced dwell time for attackers, and improved visibility into endpoint activity addressing critical market challenges around insider threats, ransomware outbreaks, and zero-day exploits. As organizations increasingly prioritize robust cybersecurity frameworks, the need for EDR technology has surged, driven by stringent regulatory compliance requirements, rising remote work adoption, and growing concerns over data breaches.

The EDR market also benefits from strong market drivers such as expanding cloud infrastructure and heightened demand for integrated security operations. By enabling centralized threat hunting and forensic analysis, EDR platforms enhance overall business growth, support proactive threat mitigation, and deliver actionable market insights for IT teams.

Endpoint Detection and Response (EDR) Market is estimated to be valued at USD 5,456.6 Mn in 2025 and is expected to reach USD 27,695.5 Mn in 2032, exhibiting a compound annual growth rate (CAGR) of 26.12% from 2025 to 2032.

Key Takeaways

Key players operating in the Endpoint Detection and Response (EDR) Market are RSA Security (DELL EMC), Carbon Black Inc., and McAfee Corporation. These market companies lead in product innovation, strategic partnerships, and extensive global channel networks. Their comprehensive market share stems from continuous investments in R&D, enabling robust threat intelligence capabilities and seamless integration with broader security information and event management (SIEM) solutions.

Endpoint Detection and Response Market demand for solutions is fueled by escalating cyber threats, including ransomware-as-a-service and advanced persistent threats. Organizations across finance, healthcare, and government sectors are investing in advanced endpoint protection to comply with data privacy regulations and to safeguard critical infrastructure. Market research indicates that demand is also driven by increased digital transformation initiatives and the adoption of hybrid work environments, which expand the attack surface and create new market opportunities for unified endpoint security.

Global expansion of the EDR market is evident as vendors extend their footprints into emerging regions such as Asia Pacific and Latin America. Market forecast reports highlight partnerships with local managed security service providers (MSSPs) and targeted acquisitions as key strategies to capture industry share in these high-growth territories. Furthermore, tailored solutions addressing region-specific compliance requirements and threat landscapes are accelerating adoption, reinforcing the market scope and supporting sustained market growth strategies on a global scale.

Market Key Trends

One prominent market trend is the convergence of EDR with extended detection and response (XDR) frameworks. This integration unifies endpoint, network, cloud, and identity telemetry into a cohesive security operations platform. By correlating data from multiple telemetry sources, XDR-enabled EDR tools provide enriched context for faster threat detection and comprehensive incident response. The extended visibility helps security analysts prioritize alerts, reduce false positives, and automate remediation workflows across complex IT environments. As enterprises seek holistic security stacks, this shift intensifies competition among market players and drives innovation in analytics engines. Ultimately, the move toward integrated XDR solutions represents a significant market driver that addresses both current market challenges and future industry trends in proactive cyber defense.

Porter’s Analysis

Threat of new entrants: In the Endpoint Detection and Response market, high technical expertise requirements, stringent certification processes, and heavy initial investment create formidable barriers to entry. Well-established vendors leverage integration with existing security suites, while specialist newcomers must innovate rapidly to capitalize on niche market opportunities.

Bargaining power of buyers: Large enterprises and government agencies command significant negotiation leverage due to bulk procurement and long-term contracts.

Price sensitivity intensifies as buyers demand seamless interoperability with existing infrastructure, prompting vendors to address key market challenges around customization and service-level guarantees.

Bargaining power of suppliers: Core technology providers of advanced analytics engines, threat intelligence feeds, and hardware accelerators exert influence over pricing and feature roadmaps. Vendors dependent on a limited pool of high-quality data sources must navigate rising costs and shifts in licensing terms, underscoring the importance of strategic partnerships to align market drivers with product innovation.

Threat of new substitutes: Alternative cybersecurity approaches—like network-centric monitoring, managed detection services, and emerging zero-trust frameworks pose pressure on traditional EDR solutions. These substitutes introduce market restraints by offering varied risk coverage models, driving incumbents to integrate broader telemetry and automated response capabilities to stay relevant.

Competitive rivalry: Intense competition among dedicated EDR purveyors and broader endpoint security suites spurs continuous feature enhancements and aggressive go-to-market strategies, reflecting high market dynamics.

Geographical Regions Where Value Is Concentrated

The EDR landscape exhibits a pronounced regional distribution of value. North America represents the largest concentration, backed by extensive regulatory mandates, mature IT infrastructures, and a strong appetite for advanced threat hunting tools. U.S. federal and state privacy regulations alongside heavy investment from financial services and healthcare sectors bolster demand and reinforce North America’s lead. Europe follows closely, with stringent GDPR enforcement and pan-EU cybersecurity directives driving local enterprises to deploy comprehensive endpoint security stacks.

Fastest Growing Region

Asia-Pacific emerges as the fastest growing EDR region, fueled by rapid digitalization, expanding cloud adoption, and heightened awareness of sophisticated cyberthreats. Government initiatives such as India’s National Cyber Security Strategy and Australia’s cybersecurity reforms encourage enterprises to integrate proactive endpoint controls. Rising penetration of IoT devices across smart cities and manufacturing hubs accelerates demand for automated threat detection tools.

Get this Report in Japanese Language

Get this Reports in Korean Language

About Author:

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)