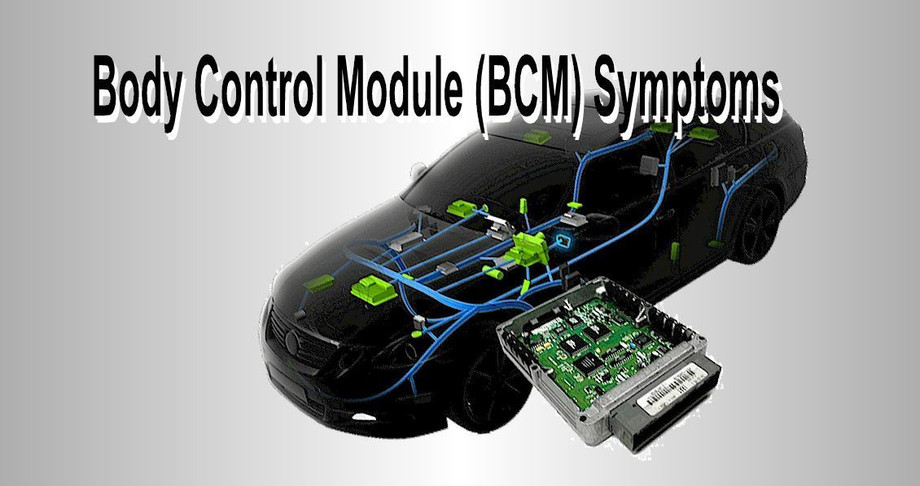

Body control modules (BCMs) serve as the central electronic hub for controlling and monitoring various vehicle functions, including lighting, door locks, wipers, and power windows. These modules integrate microcontrollers, communication interfaces, and software to deliver real-time diagnostics, improved safety features, and enhanced user convenience. The rising complexity of automotive electronics, coupled with stricter safety and emissions standards, drives automakers to adopt advanced BCMs that optimize energy consumption and enable over-the-air updates.

Advantages such as reduced wiring harnesses, lower system weight, and enhanced functionality contribute to better fuel efficiency and reduced total cost of ownership. In addition, the increasing prevalence of connected cars and the Internet of Things (IoT) in vehicles calls for robust BCMs with cybersecurity features, ensuring secure data transmission and system resilience. Growing demand for automated driving assistance and integration with infotainment systems further accentuates the need for sophisticated Body Control Module Market solutions. OEMs and Tier-1 suppliers are investing heavily in research and development to expand module capabilities, supporting features like remote diagnostics, predictive maintenance, and vehicle-to-everything (V2X) communication.

The body control module market is estimated to be valued at USD 35.91 Bn in 2025 and is expected to reach USD 44.77 Bn by 2032. It is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2025 to 2032.

Key Takeaways

Key players operating in the Body Control Module Market are:

-Continental AG

-Robert Bosch GmbH

-Denso Corporation

-Delphi Automotive PLC

-Mitsubishi Electric Corporation

Growing demand for electrified and autonomous vehicles presents significant market opportunities for BCM suppliers. As OEMs focus on vehicle electrification, the requirement for integrated power distribution, battery management, and energy-efficient lighting control increases. This shift opens avenues for developing modules with enhanced power management, fault tolerance, and scalable architectures. Additionally, the aftermarket segment offers growth potential, driven by the need for retrofitting older vehicles with modern safety and convenience features. Companies can leverage market research and market insights to tailor products for emerging markets where vehicle parc expansion is robust. Integration of AI-driven diagnostic algorithms and cloud connectivity can unlock new services such as subscription-based feature activation and over-the-air software upgrades. Strategic partnerships with software vendors and cybersecurity firms represent further growth strategies to address evolving market challenges.

Global expansion is being fueled by regional automakers in Asia-Pacific and Latin America aiming to increase industry share and market footprint. Market forecast analyses indicate that emerging economies in China, India, and Brazil will witness accelerated adoption of advanced BCMs as vehicle electrification and smart city initiatives gain momentum. European manufacturers continue to lead in high-end applications, leveraging stringent regulatory standards to validate safety and quality. North America remains a critical region due to robust R&D infrastructure and early adoption of connected car technologies. To capitalize on these trends, BCM companies are establishing local production facilities, forging joint ventures, and enhancing aftersales support networks. This global expansion strategy not only addresses supply chain optimization but also aligns with the growing emphasis on region-specific market dynamics and end-user preferences.

Market Drivers

A key market driver for the Body Control Module Market is the rapid escalation of automotive electronics complexity spurred by consumer expectations and regulatory mandates. Modern vehicles are increasingly equipped with advanced driver-assistance systems (ADAS), connected infotainment platforms, and smart lighting systems—all of which rely on sophisticated BCMs to function seamlessly. As manufacturers push for higher levels of automation and connectivity, demand for modules capable of processing large data volumes, ensuring functional safety (ISO 26262 compliance), and supporting secure vehicle-to-everything (V2X) communication rises sharply. Moreover, stringent emissions and fuel-efficiency regulations worldwide compel automakers to optimize electrical architectures and reduce vehicle weight, roles in which BCMs are instrumental by consolidating control functions and minimizing wiring harness length. This trend towards electrification and enhanced in-vehicle networking continues to drive robust market growth, prompting OEMs and Tier-1 suppliers to expand R&D efforts and streamline market entry strategies. Consequently, investment in BCM technology innovation remains a critical component of broader market development plans, reinforcing the module’s position as a foundational element in next-generation automotive architectures.

PEST Analysis

Political: With increasing global emphasis on vehicular safety and environmental regulations, governments across major automotive markets are mandating advanced electronic modules that also integrate diagnostics and remote communication capabilities, thereby influencing procurement policies of OEMs, promoting localization through trade incentives and tariffs, and shaping collaborative frameworks among local and international suppliers to address compliance requirements and potential political uncertainties affecting long-term supply agreements.

Economic: Fluctuating costs of raw materials and semiconductors, coupled with periodic supply chain disruptions and varying interest rates, significantly sway production expenses and investment decisions for body control module suppliers, while shifts in consumer purchasing power, driven by inflationary pressures and disposable income trends, impact vehicle sales volumes, aftermarket demand, and ultimately influence revenue streams, pricing models, and strategic expansion plans of industry participants.

Social: Growing consumer awareness regarding vehicle safety and connectivity, paired with rising demand for personalization features and sustainable mobility solutions, is driving the adoption of intelligent body control modules that can support user-centric interfaces, comfort systems, and energy-efficient functions, while shifts in demographic trends, urbanization, and eco-conscious lifestyles exert pressure on manufacturers to deliver customizable, environmentally responsible electronics that align with evolving consumer expectations and lifestyles.

Technological: Rapid advancements in microelectronics, software architectures, and sensor technologies are enabling more integrated and secure control modules that support functions ranging from lighting management to advanced driver assistance systems, elevating the importance of real-time diagnostics, over-the-air updates, and cybersecurity protocols. Furthermore, emerging trends in artificial intelligence, vehicle-to-everything communication, and the convergence of automotive electronics with cloud platforms are set to redefine module capabilities, streamline development cycles, and open new avenues for aftermarket services and remote monitoring solutions.

Geographical Concentration of Value

In terms of value, the body control module market is heavily concentrated in North America and Western Europe. In North America, stringent safety regulations and high consumer demand for advanced connectivity features drive a robust market share, bolstered by a strong presence of OEMs investing in innovative electronic architectures. Meanwhile, Western Europe commands a significant industry share thanks to rigorous environmental standards, mature automotive supply chains, and early adoption of scalable module platforms by leading automakers, resulting in elevated average selling prices. Japan and South Korea also contribute notable market revenue due to their advanced manufacturing capabilities and export orientation, reinforcing regional market dynamics. Comprehensive market insights reveal that established markets benefit from stable aftermarket sales and recurring demand, providing a solid foundation for business growth and opening fresh market opportunities in adjacent segments such as smart lighting and door control systems. This value concentration enables suppliers to refine product portfolios, optimize supply networks, and deploy targeted market growth strategies that capitalize on deep customer relationships and sophisticated quality standards.

Fastest Growing Region

As for the fastest growing region, Asia Pacific stands out with remarkable expansion rates driven by increasing vehicle production, rising consumer affluence, and a surge in government initiatives supporting intelligent transportation systems. Countries such as China and India are at the forefront of this market growth, where investments in electric vehicles and connected-car infrastructure amplify demand for advanced body control modules. Southeast Asia is also emerging as a hotbed for growth, with local manufacturers partnering with global market players to develop cost-effective solutions that cater to regional preferences for modular electronics. A combination of favorable demographics, urbanization trends, and supportive regulatory frameworks is catalyzing expansion, prompting suppliers to establish local production facilities, forge strategic joint ventures, and tailor product offerings to address distinct market challenges and capitalize on burgeoning market opportunities.

‣ Get this Report in Japanese Language: ボディコントロールモジュール市場

‣ Get this Report in Korean Language: 차체제어모듈시장

About Author: