Reinsurace: Challenges Of Evolution And Ground-Breaking Innovations

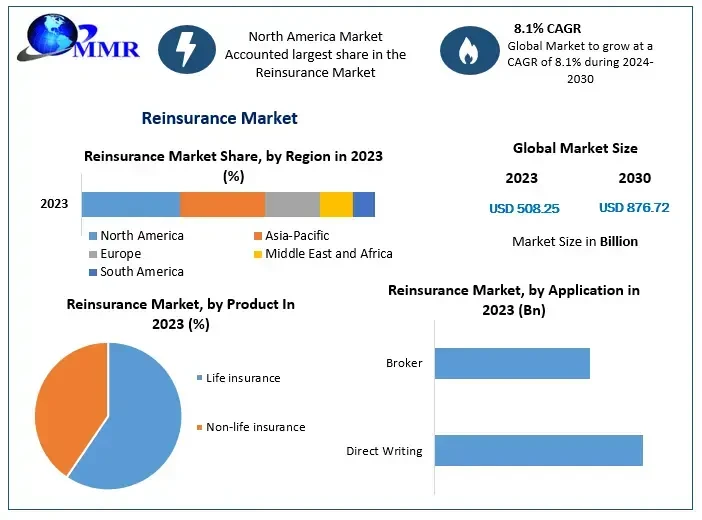

The reinsurance market size sector is expected to grow considerably, led by enhanced understanding of insurance advantages, regulatory imperatives, and advancement in technology. Based on extensive research conducted by Maximize Market Research, the market was valued at around $508.25 billion in 2023 and is expected to be worth $876.72 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.1% during the forecast period.

Request Sample Link For More Details:https://www.maximizemarketresearch.com/request-sample/42133/

Market Research, Growth Factors, & Opportunities

The reinsurance industry is a major component of insurance risk management, since insurance firms can share risks and avoid being financially devastated by a catastrophe. Such a mechanism not only strengthens insurers' balance sheets but allows them to take on potentially more insurance. The reinsurance market is witnessing growth due to factors such as:

Growing Awareness of the Need for Insurance and Regulatory Demand: Policymakers around the world are becoming increasingly aware of the importance of insurance and are implementing more rigorous regulations requiring its purchase. And this trend is in favor of reinsurance — primary insurers are looking at their larger risk portfolios and deciding to transfer that risk to the reinsurer.

Expansion of Emerging Markets: As emerging economies grow quickly (both in terms of development and to how many assets they have accumulated), there is a need for insurance and reinsurance coverage to follow. The growth of reinsurance, particularly in Asia-Pacific countries like China, India, and Japan, supports regional and global market growth.

Technological Changes: The use of AI, machine learning, and RPA is making significant changes in the landscape of reinsurance. From highly reliable risk assessment to faster turn-around time for claim settlements and decreased operational costs, these innovations provide an attractive proposition for significant efficiencies and profitability enhancement opportunities for the global policy and supporting personnel.

Monitoring U.S Market – Looking at 2024 Investments

Here are some reinsurance trends and M&A activity that took place across the U.S. reinsurance market in 2024:

Litigious Natural Disasters: January 2024 saw massive losses from record-spanning Los Angeles wildfires, with industry estimates perhaps reaching $40 billion ($5 billion excess) in damages, potentially the most costly U.S. fires on record. For Swiss Re, one of the largest reinsurers in the world, losses would be less than $700 million for the company; and for Hiscox, the predicted loss as a result of the wildfires would be about $170 million. Reinsurance was therefore pivotal in all these events with respect to the management of large-scale natural disasters.

Dedicated Capital and Rate Movement: In 2024, the reinsurance industry capitalized with a record $463 billion of dedicated capital, which drove an 8% overall decline in property catastrophe reinsurance costs worldwide. The increase was due to asset appreciation and $17.7 billion in new catastrophe bonds issued in 2022. As a result, in regions such as the U.S. and Europe, reinsurance rates were down as much as 15% for loss-free accounts.

Want to access more insights? The journey starts from requesting Sample : https://www.maximizemarketresearch.com/request-sample/42133/

Market Insights: Leading Segments

Based on product type such as there are many applications of reinsurance market segmented: Of these, property and casualty reinsurance segment accounts for maximum share of the market. One of the reasons for this dominance is the alarming trend of natural disasters that are currently sweeping the world, and therefore, the insurance companies apply to the reinsurers for protection against losses because the natural disasters are expected to continue with this frequency and intensity. Moreover, increasing awareness of health risks, along with subsequent demand for life and health insurance products, is driving the life and health reinsurance segment growth.

Market Landscape: Major Companies Driving the Market

Several key players of the global reinsurance market contribute substantially in shaping the reinsurance scenarios. Five companies with the biggest market shares;

Munich Re — one of the largest reinsurers in the world, Munich Re announced a $3.238 billion net income in 2024, barely missing expectations. The company sees net income exceeding $4.4 billion in 2025 and is planning an 8% dividend hike. Climate change connected global disasters are to blame for big claims, says Munich Re.

Swiss Re: Swiss Re estimates that the recent Los Angeles-area wildfires will cost the firm under $700 million in January 2024; however, the overall industry has had in the region of $40 billion in losses, as these may become the U.S. costliest fires provided the insurance market.

The LA wildfires in January 2024 will spark a $170 million loss for Hiscox, one of the top insurers on the London stock market. Still, the number, $685.4 million, was a record pre-tax profit for Hiscox – and this was for 2024.

Hannover Re: Hannover Re has ever been proactive in adopting advanced analytics and smart data extraction techniques to boost its claims processing efficiency. This gravitation towards AI and machine learning within the company is going to enable it to benefit from new avenues opening in the reinsurance industry.

SCOR SE: SCOR SE has recently been on a path to expanding its emerging market presence, especially in the Asia-Pacific region. These investments in high-quality growth segments have helped cement the states firm position in the broader global reinsurance sector.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/market-report/global-reinsurance-market/42133/

Regional Analysis

The Geography segment is categorized into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. North America led the global reinsurance market in 2023, due to the awareness, enhanced health care systems and availability of diagnostic tests. Europe is the second-largest market, backed by significant health services funding and an aggressive roll out of vaccination programs. The fastest growth in the Asia-Pacific region is expected during the forecast period due to a greater number of patients, rising middle-class income, development of the health insurance industry, and increasing awareness regarding good healthcare. This growth sequel is hard to miss in the countries such as Japan and India.

Conclusion

Owing to increasing insurance awareness, economic growth in developing countries, and technology development, the global reinsurance market is witnessing strong growth. Severe weather events and the regulatory environment continue to create challenges, but also point to the vital importance of reinsurance for insuring the insurance sector itself.

AI and big data in risk assessment, a steady demand for property and casualty reinsurance as climate change-related disasters continue to grow, and expansion opportunities in hot growth areas like Asia-Pacific are all key growth drivers as the sector looks to the future. Those with a clear vision for leveraging digital transformation, diversified their reinsurance portfolios, and adapt to the evolving risks that are anticipated ahead will be best positioned to extract the potential from the market.

Related Reports :

global cholesterol management devices market https://www.maximizemarketresearch.com/market-report/global-cholesterol-management-devices-market/67722/

Fibrate Drugs Market https://www.maximizemarketresearch.com/market-report/global-fibrate-drugs-market/102243/

Global Carborundum Market https://www.maximizemarketresearch.com/market-report/global-carborundum-market/54875/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 9607365656