Invoice reconciliation is a critical process for ensuring that your financial records are accurate and up-to-date. Proper reconciliation helps in maintaining smooth operations, avoiding discrepancies, and ensuring that payments and receipts are accurately recorded. In this blog post, we will explore best practices for invoice reconciliation and provide tips on avoiding common mistakes, with insights on how Agency Simplifier can support your reconciliation efforts.

Understanding Invoice Reconciliation

Invoice reconciliation involves matching your invoices with corresponding payments and receipts to verify accuracy. This process ensures that all transactions are correctly recorded and helps identify discrepancies that could affect your financial records. Effective reconciliation is crucial for maintaining accurate accounts receivable and payable, managing cash flow, and ensuring financial integrity.

Best Practices for Invoice Reconciliation

-

Regularly Schedule Reconciliation Conducting regular reconciliations is key to keeping your financial records accurate. Set a consistent schedule for reconciling invoices, such as monthly or quarterly, depending on your transaction volume. Regular reconciliation helps catch discrepancies early and ensures that your financial records are always up-to-date.

-

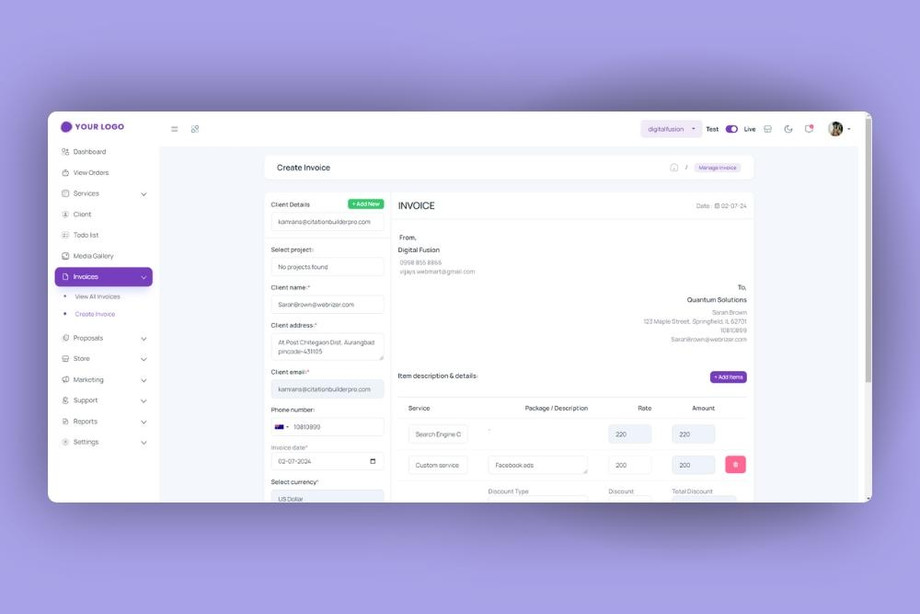

Implement Automated Tools Leveraging automated reconciliation tools can significantly enhance the accuracy and efficiency of the process. Automated systems can match invoice data with payment receipts and bank statements, reducing manual effort and minimizing the risk of errors. Tools like Agency Simplifier offer advanced automation features to streamline the reconciliation process.

-

Verify Invoice Details Ensure that all invoice details are accurate before processing payments. This includes verifying invoice amounts, dates, and terms. Discrepancies in invoice details can lead to errors in reconciliation and affect your accounts payable and receivable. Implementing a thorough review process can help prevent these issues.

-

Maintain Accurate Records Keeping accurate and organized records is essential for effective reconciliation. Ensure that all invoices, payment receipts, and bank statements are properly filed and easily accessible. This organization helps in quickly locating necessary documents and facilitates smoother reconciliation.

-

Communicate with Vendors and Customers Effective communication with vendors and customers can resolve discrepancies quickly. If you notice any inconsistencies between invoices and payments, reach out to the relevant parties to clarify and correct the issues. Maintaining open lines of communication helps ensure that all parties are aligned and reduces the likelihood of errors.

Common Mistakes to Avoid

-

Neglecting Regular Reconciliation Skipping regular reconciliation can lead to accumulating discrepancies and inaccuracies in your financial records. Regularly scheduling reconciliation helps identify and address issues promptly, preventing larger problems down the line.

-

Inaccurate Data Entry Manual data entry is prone to errors, which can affect the accuracy of reconciliation. Ensure that data is entered correctly and verify the information before processing. Automated tools can help reduce the risk of errors associated with manual data entry.

-

Ignoring Discrepancies Ignoring discrepancies between invoices and payments can lead to unresolved issues and inaccurate financial records. Address discrepancies as soon as they are identified to maintain accurate records and ensure that all transactions are correctly accounted for.

-

Lack of Documentation Failing to maintain proper documentation can hinder the reconciliation process. Ensure that all invoices, payment receipts, and related documents are properly recorded and organized to facilitate effective reconciliation.

How Agency Simplifier Can Help

Agency Simplifier offers advanced solutions to streamline invoice reconciliation and avoid common mistakes. Their tools provide automated invoice reconciliation, real-time tracking, and detailed reporting, helping businesses maintain accurate financial records and manage discrepancies effectively. With Agency Simplifier’s expertise, businesses can enhance their reconciliation processes, reduce manual effort, and achieve better financial control.

Conclusion

Effective invoice reconciliation is essential for accurate financial management and smooth business operations. By following best practices and avoiding common mistakes, businesses can ensure that their financial records are accurate and up-to-date. Leveraging tools and solutions from Agency Simplifier can further streamline the reconciliation process, improve accuracy, and support overall financial health.

Contact Us