What if your bank could predict your financial needs before you even ask? Or if fraud detection was so advanced it caught threats before they even happened? These aren’t far-fetched dreams but everyday realities that highlight the role of AI in fintech. In the world of Fintech, AI has gone beyond being a buzzword to become the driving force of innovation.

But what’s behind this synergy, and why is AI considered a cornerstone of the Fintech revolution? This blog uncovers the top benefits and real-world applications of AI in Fintech.

What is AI in Finance?

Fintech, or financial technology, represents innovation in the financial sector powered by technology. It encompasses everything from managing transactions to combating fraud. Over the past decade, the rapid growth of fintech companies has revolutionized how consumers handle their finances, offering personalized and innovative solutions.

For instance, AI-driven chatbots are now employed across the industry, serving as both customer service agents and virtual sales representatives.

The impact of fintech has been transformative, especially in recent years. Traditional banks have taken note of the disruption caused by fintech firms, adopting advanced technologies like artificial intelligence and robotics to streamline operations, cut costs, and address customer challenges more effectively.

| AI Application | Benefits in Fintech |

| Fraud Detection & Prevention | Identifies fraudulent transactions in real-time, reducing financial losses. |

| Customer Service Chatbots | Provides 24/7 personalized support, improving customer satisfaction. |

| Credit Scoring & Risk Analysis | Enhances loan approvals with accurate risk assessments using AI algorithms. |

| Automated Trading Systems | Executes trades at optimal times, increasing profitability for investors. |

| Personalized Financial Planning | Offers tailored financial advice based on customer spending and saving habits. |

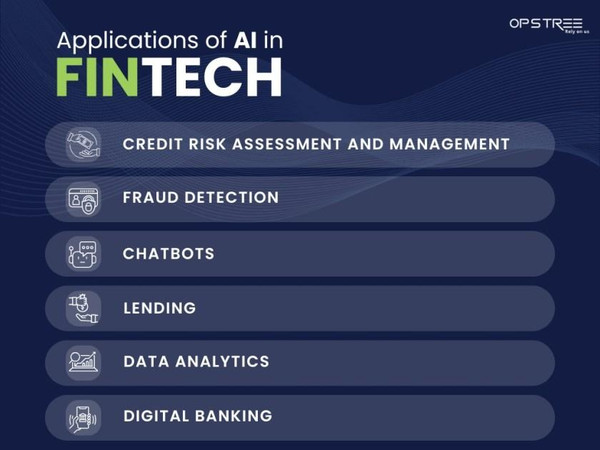

Use Cases for AI in Fintech

AI in fintech is transforming the financial industry by enabling efficiency, accuracy, and personalized services. Here are some key use cases for AI in fintech:

- Credit Risk Assessment and Management

Banking inherently carries certain risks, with credit risk being one of the most significant. Traditionally, financial institutions have used credit risk modeling to estimate the likelihood of customers repaying loans.

AI can play a transformative role in risk management. By processing large volumes of data, AI algorithms can uncover patterns and trends that indicate potential risks. For example, AI can identify customers at a higher risk of defaulting on loans, helping financial institutions make more informed decisions and manage risks effectively.

AI algorithms can also replace traditional statistical models used in credit score calculations. They can rapidly analyze factors such as income, transactions, credit history, and employment, incorporating real-time data and the latest information from online activities. This results in more accurate assessments of creditworthiness. Moreover, AI technologies streamline the credit approval process, reducing the time and effort needed to prepare and analyze reports.

- Fraud Detection

Fraud is a significant risk faced by banks, but AI models and deep learning offer effective solutions for combating this issue. These technologies excel at identifying patterns and detecting anomalies. By analyzing transactions in near real-time and monitoring user behavior, AI can be trained to recognize fraudulent activities.

For instance, AI can detect credit card fraud by spotting unusual spending patterns or transactions that deviate from the customer’s typical behavior.

AI systems can also evaluate multiple factors such as transaction frequency, number of purchases, geographic locations, and the amount spent on individual transactions.

Beyond identifying fraud in customer accounts, financial institutions can integrate AI-driven solutions into their cybersecurity strategies to swiftly identify cyber threats and vulnerabilities within their networks.

How can AI for fraud detection in financial transactions enhance your security? Let OpsTree help you implement advanced AI solutions to protect your business from fraudulent activities!

MUST READ – The Role of AI in Edtech

- Chatbots for Customer Service

AI-powered chatbots are reforming customer service in the FinTech industry. These intelligent bots can comprehend and respond to customer inquiries in natural language.

They offer real-time support, address frequently asked questions, and manage transactions effortlessly, ensuring a smooth and efficient customer experience.

- Lending

Several financial institutions are leveraging AI technology to assess credit scores and determine lending eligibility. By analyzing various data points such as social media activity, payment behavior, and employment history, AI algorithms can evaluate risk beyond traditional credit histories.

This approach is believed to promote more inclusive lending by identifying creditworthy individuals who might otherwise be overlooked by conventional methods.

Incorporating AI into fintech can enhance decision-making efficiency, lower default rates, and expand credit access to underbanked communities.

- Data analytics

The stock market has emerged as a top investment choice for millennials, driving the demand for AI-powered apps that enhance the way individuals navigate this space.

Today, many smartphone apps leverage AI to analyze both historical and real-time data about companies and their stocks. These apps provide valuable insights, helping investors identify promising stocks to invest in while steering them away from potentially risky choices.

- Digital banking

Traditional banks, often referred to as incumbent financial institutions, are facing increasing competition from a new breed of digital players known as neobanks or challenger banks. These challengers are shaking up the financial orbit, putting pressure on long-established institutions.

Digital banking eliminates geographic limitations, offering round-the-clock access to financial services and enhancing customer convenience regardless of location. Mobile apps and online platforms make it easy for users to manage accounts, make payments, and conduct transactions from the comfort of their smartphones or computers.

Moreover, the automation and absence of physical branches in digital banking significantly cut down operational costs, resulting in lower fees and improved interest rates for customers, making financial services more accessible and affordable.

For those unable to leverage AI to gain an edge in fintech, exploring other options is crucial. Many established financial institutions have responded by digitizing their services, forming partnerships with fintech companies, or launching their own digital banking platforms to stay competitive.

DON’T MISS THIS BLOG – The Role of AI in Healthcare: Applications and Use Cases