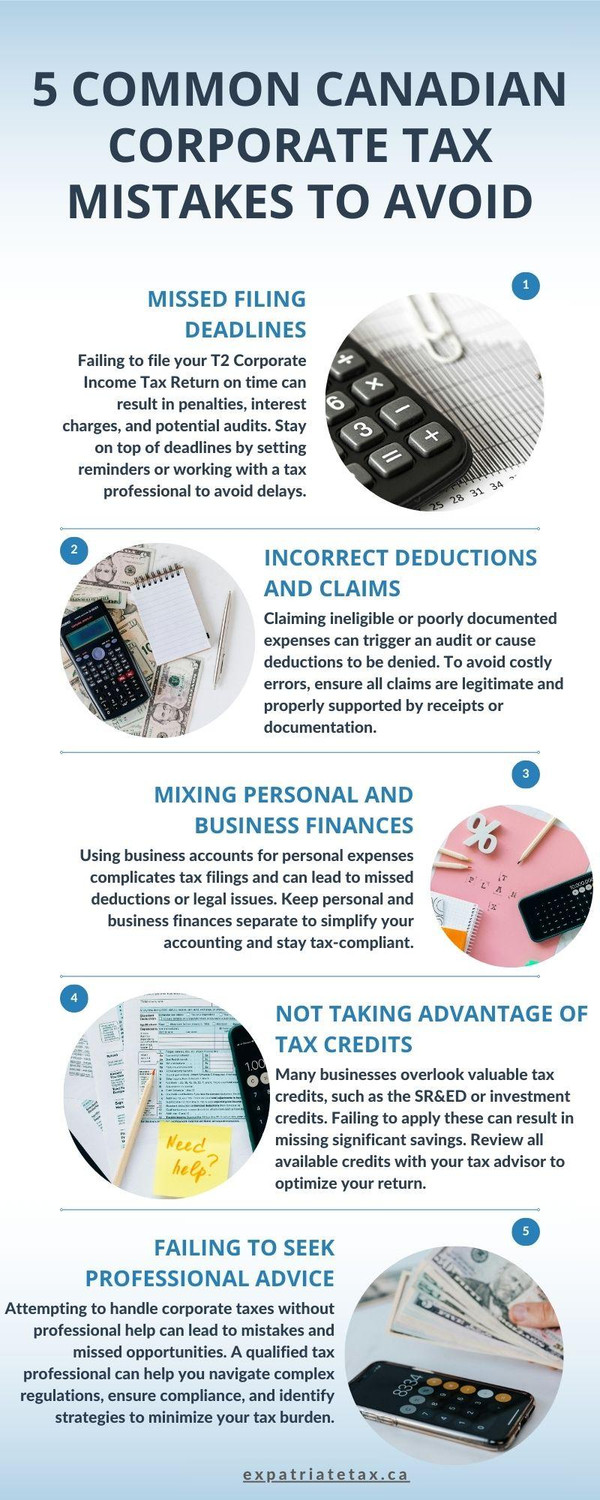

Avoid common corporate tax mistakes that can lead to penalties, missed opportunities, and compliance issues in Canada. Key mistakes include missing filing deadlines, incorrectly claiming deductions, mixing personal and business finances, overlooking valuable tax credits, and failing to seek professional advice. By staying organized, understanding tax laws, and consulting with a tax expert, businesses can ensure they minimize liabilities, maximize savings, and avoid costly errors during tax season.