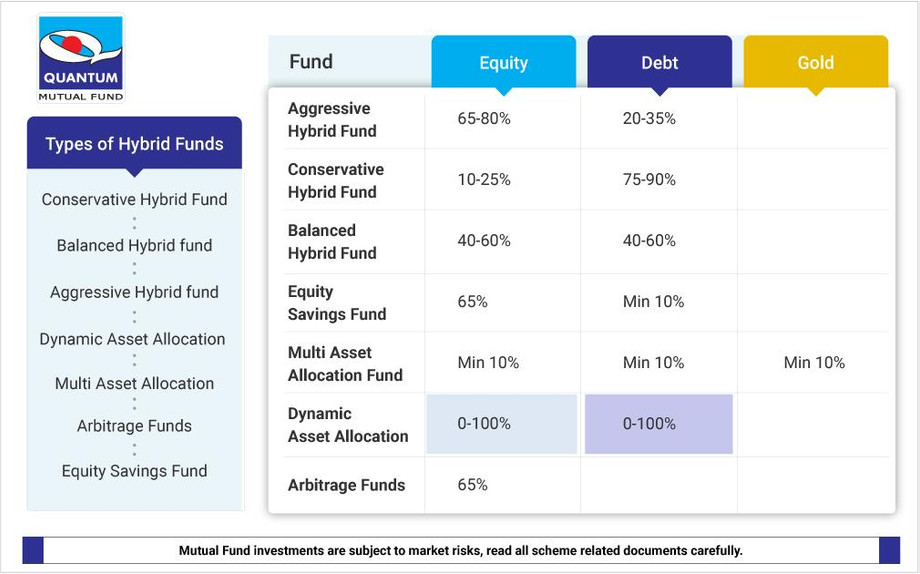

As the name suggests, hybrid funds are a combination of equity and debt investments. These funds could be suited for investors seeking allocation to equities but are looking for less risk as compared to a pure equity fund or a stock. The fund manager builds a portfolio and allocates the funds in equity and debt instruments in varying proportions based on specific pre-determined triggers and valuations. There are different types of hybrid funds such as Aggressive Hybrid Funds investing 65-80% of total assets in equities and 20% 35% of total assets in Debt. Conservative Hybrid Fund invests 10-25% in Equity and 75-90% in Debt.

Balanced Hybrid Fund invests 40-60% in Equity and balance 40-60% in Debt. Equity Savings Fund, in contrast, invests a minimum of 65% in equities and a minimum 10% in debt, Arbitrage Funds invest min 65% in Equities. There are also multi-asset allocation funds that invest a minimum of 10% across three asset classes such as Equity, Debt and Gold. Investors seeking to invest in all three asset classes and do away with the hassle of stock/mutual fund selection can also look at Fund of Funds which is like a hybrid fund and investing in Funds with underlying investments in Equity, Debt and Gold. Balanced advantage fund or Dynamic Asset Allocation Fund allocates dynamically between equity and debt.

It is important to consider your risk tolerance, financial goals, and investment horizon before choosing a scheme.

www.Quantumamc.com