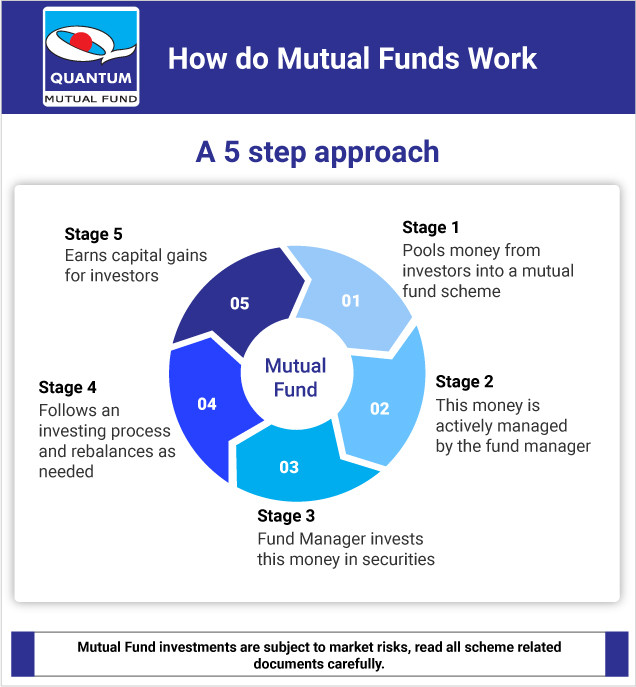

One of the easiest ways to begin your journey as an investor is to invest in a mutual fund. The concept of a Mutual fund is simple. It has just 5 steps as detailed below:

Step 1: A mutual fund pools money from investors who wish to grow their money to fulfill their financial goals. Each investor holds a portion of the fund in the form of mutual fund units.

Step 2: This money is then actively managed by the fund manager.

Step 3: He invests the cash on behalf of the investors in securities, bonds, or gold assets.

Step 4: His goal varies depending on the type of fund he manages and the investing style. For example, a fixed-income fund manager seeks the highest yield at the lowest risk for his investors. Similarly, a value fund manager is looking for good quality stocks that are undervalued but with long-term growth potential. The fund manager decided to rebalance the mutual fund portfolio according to the market conditions

Step 5: The capital gains generated from managing this fund (selling mutual fund units) are then distributed proportionately among investors after deducing the expense ratio.

Website: www.Quantumamc.com