Home Loan Eligibility is an internet based apparatus to compute home loan eligibility. Banks considers different qualities like month to month pay, credit reimbursement residency, different wellsprings of month to month pay, and EMIs due and so forth. A home loan eligibility calculator works out the different fields of qualification. It helps the purchasers in settling on a very much educated choice prior to purchasing another home.

Each individual ought to meet the home loan eligibility prerequisites prior to applying for a home loan. It is secure to reimburse the home loan with next to no trouble any other way the loan application could get dismissed which can result a negative blemish on candidate’s profile. So guaranteeing every one of the connected prerequisites of home loan eligibility is protected.

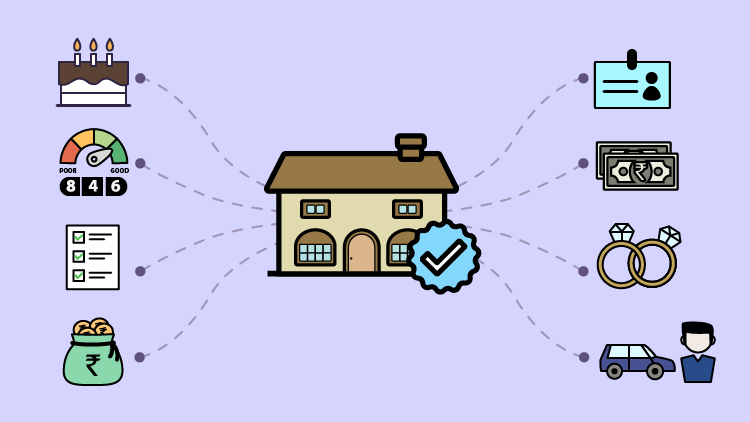

Factors Affecting Home Loan Eligibility

Credit Score

Credit Score assumes a significant part in home loan eligibility. A bank checks the candidate’s credit score before home credit endorsement. A credit score is a pointer the shows an individual’s capacity to take care of home loan on time.

A credit score is a 3 digit number from 300 to 850 which shows a loan applicant’s reliability. It comprises of a candidate’s monetary profile like month to month pay, liabilities, reimbursement history and so forth.

A high financial assessment not just builds your possibilities getting a low loan fee home loan, however it might likewise imply that you could be qualified for a huge loan amount of Rs. 5 Crore* or higher.

Pay Strength

Pay strength is vital viewpoint as far as home loan eligibility as it shows your home loan repayment capacity. Salaried and capable competitors, stand to secure on their home loans assuming they meet the bank’s base pay models with the need of work understanding and pay dependable qualities.

Property Subtleties

Property subtleties likewise assumes a fundamental part in deciding the home loan eligibility. Under development home in a famous region can get a home credit at lower interest. On the off chance that the property profile doesn’t meet the qualification prerequisites, it would be challenging for the bank to get the home loan approval.

Favored Age

The candidates who fall under the expected age range get additional serious proposals from the moneylenders. It is challenging for the more seasoned candidates or the candidates whose age section falls over the expected reach to get low home loan interest rates. The most extreme age limit for a home loan applicant is 62 at the hour of development.

Extraordinary Loans

Indian banks generally propose to keep the EMI to Pay Proportion somewhere in the range of 50 and 60%. This is to leave a window open for future loans or to take care of any current loans. Neglected loans, then again, may seriously restrict your qualification.

How Can You Improve Home Loan Eligibility?

Various variables can further develop home loan eligibility.

- To expand your possibilities getting a bigger credit, apply for a joint home loan with a co-candidate.

- Getting a very much organized reimbursement plan.

- Keeping a consistent pay as well as normal reserve funds and ventures.

- Giving insights regarding your typical wellsprings of additional pay.

- Monitoring your variable compensation’s different parts.

- Doing whatever it takes to address any credit-related issues you might have.

- Taking care of current obligations and momentary commitments

How Home Loan Eligibility Calculator Works

The calculator depends on a mathematical formula that works out the eligible loan amount in light of several predefined boundaries. These contemplations incorporate gross month to month pay, loan term, existing month to month commitments, etc. At the point when you enter the fundamental data, the calculator returns results right away.

How to Calculate Home Loan Eligibility:

A few boundaries might vary starting with one bank then onto the next. A couple of banks have various boundaries to finish up too. In the calculator, enter the accompanying qualities:

- Your ongoing area

- Date of birth or age

- Select net month to month pay.

- Add one more type of revenue.

- Pick the credit term that turns out best for you.

- A few banks might demand data about the ongoing EMIs you are at present overhauling.

We trust that this fast introduction on qualification has assisted you with figuring out the basics of qualification. If it’s not too much trouble, utilize the home loan eligibility calculator beneath to get everything rolling on your quest for your fantasy home.