Introduction

Australia is a thriving hub for Forex trading, thanks to its well-regulated financial markets, strong economy, and increasing interest in global trading. Finding the Forex Brokers Comparison in Australia can be challenging, as traders need to navigate through various options to find a platform that aligns with their trading goals. In this comprehensive guide, we will compare the best Forex brokers in Australia for 2025, helping you make an informed decision based on trading costs, platforms, regulations, and more.

Why Choose Regulated Forex Brokers in Australia?

Trading with regulated brokers is crucial for ensuring the safety of your funds and transparency in transactions. The Australian Securities and Investments Commission (ASIC) is a globally recognized regulator that ensures brokers comply with stringent standards, providing traders with a secure trading environment. ASIC-regulated brokers offer benefits such as:

-

Investor Protection: Segregated client funds and compensation schemes.

-

Transparent Pricing: No hidden fees or unfair practices.

-

Advanced Trading Tools: Access to cutting-edge trading platforms and tools.

Top Forex Brokers in Australia for 2025

Here are the top brokers that have proven to be reliable and efficient for Australian traders:

-

Pepperstone

- Regulation: ASIC, FCA, CySEC

- Features: Low spreads, high-speed execution, and access to MetaTrader 4, MetaTrader 5, and cTrader platforms.

- Account Types: Standard and Razor accounts are tailored for beginners and advanced traders.

- Trading Instruments: Forex, CFDs, commodities, and cryptocurrencies.

-

IC Markets

- Regulation: ASIC, CySEC, FSA

- Features: Raw spreads starting from 0.0 pips, flexible leverage options, and an excellent suite of trading platforms.

- Account Types: Standard, Raw Spread, and Islamic accounts.

- Trading Instruments: Forex, indices, futures, and commodities.

-

FP Markets

- Regulation: ASIC, CySEC

- Features: Competitive spreads, robust customer support, and a wide range of educational resources.

- Account Types: Standard and Raw accounts with tailored solutions for different trading styles.

- Trading Instruments: Forex, CFDs, stocks, and cryptocurrencies.

- Axi

- Regulation: ASIC, FCA

- Features: Commission-free trading, access to PsyQuation analytics, and seamless integration with MetaTrader platforms.

- Account Types: Standard and Pro accounts.

- Trading Instruments: Forex, CFDs, and cryptocurrencies.

Factors to Consider When Choosing a Forex Broker

When selecting a Forex broker, Australian traders should evaluate the following factors:

-

Regulation and Security:

Ensure the broker is regulated by ASIC or other reputable authorities.

Check for features like segregated accounts and negative balance protection.

-

Trading Costs:

Compare spreads, commissions, and overnight fees.

Look for brokers offering low-cost trading without compromising on quality.

-

Trading Platforms:

Access to popular platforms like MetaTrader 4, MetaTrader 5, or cTrader.

Evaluate the availability of mobile apps and web-based platforms.

-

Customer Support:

24/7 customer support via multiple channels, including live chat and email.

Availability of multilingual support for diverse traders.

-

Educational Resources:

Brokers offering tutorials, webinars, and market analysis reports.

Demo accounts for practice trading without risking real funds.

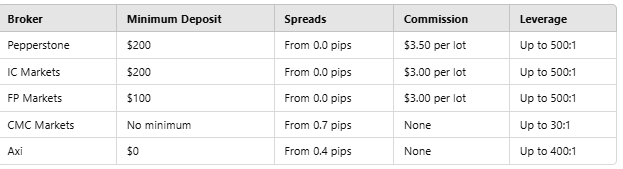

Comparing Trading Costs and Fees

Understanding trading costs is essential to maximize profitability. Here’s a quick comparison:

Tips for Successful Forex Trading in Australia

-

Stay Updated with Market Trends:

- Follow economic news and updates that impact currency pairs.

- Use tools like an economic calendar and live market updates.

-

Leverage Risk Management Tools:

- Set stop-loss and take-profit levels for every trade.

- Avoid over-leveraging your account.

-

Continuous Learning:

- Stay informed with webinars, tutorials, and trading courses.

- Practice strategies on demo accounts before trading live.

-

Choose the Right Account Type:

- Select accounts that suit your trading style and capital.

- For beginners, start with a standard account to avoid high costs.

Conclusion

Finding the Forex Brokers Comparison in Australia for 2025 involves evaluating your trading needs, comparing costs, and ensuring robust regulatory compliance. With options like Pepperstone, IC Markets, FP Markets, CMC Markets, and Axi, Australian traders can access some of the best platforms to achieve their trading goals. Take advantage of demo accounts and educational resources to hone your skills, and always prioritize safety and regulation when making your final choice. Happy trading!