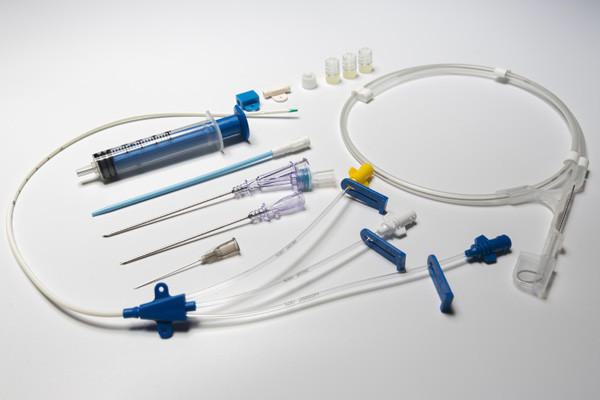

Central venous catheters (CVCs) are specialized tubes inserted into large veins to deliver medications, fluids, and parenteral nutrition, while facilitating blood sampling and hemodynamic monitoring for critically ill patients. These devices, available in tunneled, non-tunneled, peripherally inserted central, and implantable port formats, offer advantages such as reduced insertion trauma, reliable long-term access, and minimized site infection when paired with antimicrobial coatings. Growing rates of chronic diseases like cancer, renal failure, and cardiovascular disorders have amplified the need for continuous vascular access, underscoring the importance of CVCs in intensive care units, oncology wards, and home healthcare settings.

Innovations in catheter materials, integrated safety valves, and infection-control features address market challenges by enhancing patient outcomes and reducing hospital-acquired bloodstream infections. As healthcare providers emphasize efficiency and patient safety, demand for technologically advanced catheters is surging, reflecting shifting market dynamics and emerging market opportunities. Healthcare institutions rely on market research and market insights to optimize procurement strategies, while manufacturers pursue market growth strategies to capture expanding business growth avenues.

The global central venous catheter market is estimated to be valued at USD 2.52 Bn in 2025 and is expected to reach USD 4.03 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 6.9% from 2025 to 2032.

Key Takeaways

Key players operating in the Central Venous Catheter Market are ICU Medical, Inc., B. Braun SE, Becton, Dickinson and Company, and Poly. These market players leverage robust R&D pipelines and strategic partnerships to maintain competitive market share and enhance their product portfolios with advanced safety and infection-control features.

Growing Central Venous Catheter Market Demand for central venous catheters is driven by an aging global population, rising incidence of chronic conditions requiring parenteral nutrition and long-term intravenous therapies, and increasing ICU admissions. Furthermore, the surge in outpatient oncology treatments and home healthcare services has expanded the market scope for peripherally inserted central catheters (PICCs) and implantable ports.

As healthcare systems expand capacity, market drivers such as heightened focus on patient safety, stringent clinical guidelines for catheter care, and reimbursement reforms also fuel uptake. Market research reports highlight that rising healthcare expenditure in emerging economies presents significant market opportunities, while persistent efforts to reduce catheter-related bloodstream infections act as both a market driver and a restraint, pushing manufacturers to innovate.

Global expansion of the Central Venous Catheter Market is underpinned by strategic investments in Asia Pacific, Latin America, and the Middle East & Africa, regions characterized by improving healthcare infrastructure, growing industry size, and increasing medical tourism. North America and Europe continue to dominate due to well-established distribution networks, favorable reimbursement frameworks, and high adoption of advanced medical devices. However, untapped markets in APAC and MEA, driven by rising per capita healthcare spending and supportive government policies, are expected to witness substantial market growth and business growth opportunities. Market forecast projections indicate that regional market dynamics will shift as emerging economies prioritize critical care capacity and rural healthcare delivery.

Market Key Trends

One of the prominent market trends in the Central Venous Catheter Market is the escalating adoption of antimicrobial- and antiseptic-coated catheters to combat catheter-associated infections. Driven by stringent regulatory requirements and clinical guidelines, manufacturers are incorporating silver alloy, chlorhexidine-silver sulfadiazine, and antibiotic-impregnated materials into catheter designs. This trend addresses a critical market challenge—catheter-related bloodstream infections—which impose significant clinical and economic burdens on healthcare systems.

Enhanced coatings and surface modifications reduce microbial adhesion and biofilm formation, directly impacting patient safety and healthcare costs. Simultaneously, the trend toward integrating smart sensors and pressure transducers into catheter hubs provides real-time monitoring of infusion parameters and early detection of occlusions or infections. These technological advancements, supported by market insights and continuous market research, are expected to shape market growth strategies by improving clinical outcomes, driving product differentiation, and expanding market opportunities over the forecast period.

Porter’s Analysis

Threat of new entrants: Developing and marketing central venous catheters requires extensive regulatory approvals, stringent quality certifications, and specialized manufacturing capabilities, creating steep entry barriers. Clinical trials and adherence to international health authorities’ guidelines demand substantial investment and time. New players must cultivate trust among healthcare professionals through robust market research and navigate complex market dynamics to establish credible offerings.

Bargaining power of buyers: Large hospitals, specialty clinics, and healthcare networks leverage consolidated purchasing volumes to negotiate favorable terms on pricing, service agreements, and delivery schedules. High-volume procurement enables these buyers to demand consistent quality, comprehensive training, and extended warranties. Participation in group purchasing organizations further amplifies buyer leverage by standardizing product evaluations across networks, intensifying market challenges for many manufacturers.

Bargaining power of suppliers: Providers of specialized raw materials—such as medical-grade polymers, precision components, and proprietary coatings—exert moderate influence, particularly when alternatives are limited. Catheter manufacturers often mitigate this through multi-sourcing strategies, long-term supply contracts, and targeted inventory management. Global supply chain disruptions, especially for critical inputs, can further elevate supplier leverage and impact production scheduling within the industry.

Threat of new substitutes: Alternative vascular access devices, including peripheral intravenous lines, peripherally inserted central catheters, and midline catheters, cater to distinct clinical scenarios but offer limited direct substitution for central access. Emerging wearable monitoring systems and noninvasive imaging techniques present potential technological shifts. Clinicians often weigh cost-benefit trade-offs between less invasive substitutes and central catheters, particularly in outpatient care contexts.

Competitive rivalry: Intense rivalry among established medical device companies drives continuous innovation, aggressive pricing strategies, and strategic alliances to enhance competitive positioning.

Geographical Regions

The central venous catheter market exhibits a pronounced value concentration in North America and Europe, where advanced healthcare infrastructure, high patient volumes, and robust reimbursement policies converge. In North America, a vast network of hospitals, ambulatory surgery centers, and oncology clinics underscores the region’s commanding market share and drives innovation adoption. European markets—particularly the United Kingdom, Germany, and France—mirror this trend, supported by universal healthcare coverage and an aging demographic requiring frequent vascular access. Collaborative procurement strategies, involving device manufacturers and major healthcare systems, further reinforce revenue concentration and drive co-development of tailored solutions.

Conversely, Asia Pacific, Latin America, and the Middle East & Africa currently account for smaller portions of total market value due to varying healthcare budgets, limited rural access, and diverse regulatory frameworks. Nevertheless, urban centers in China, Japan, and India are emerging as key revenue generators, spurred by government-led hospital expansion, rising clinical awareness, and targeted infrastructure investment. Although reimbursement hurdles and fragmented procurement processes persist, these growth dynamics hint at future shifts in regional value distribution.

Within leading regions, the segmentation of central venous catheters into single-lumen, double-lumen, and antimicrobial-coated variants aligns with distinct clinical applications, driving market penetration across intensive care, oncology, and hemodialysis segments. On-site technical support and clinician training programs enhance product adoption, while lean inventory management and resilient supply chains mitigate potential disruptions. Advanced market research enables stakeholders to anticipate clinical preference shifts and cost drivers, empowering strategic planning and sustaining the dominant position of North America and Europe in global market dynamics.

Despite their dominance, these regions face evolving market challenges related to cost containment, regulatory changes, and competitive pricing pressures. Strategic emphasis on value-based procurement and outcome-driven product performance is shaping procurement policies. As central venous catheter utilization expands across emerging care settings—such as ambulatory infusion centers and home healthcare environments—the potential for sustained market growth remains significant, even in traditionally lower-value geographies.

Geographical Regions

Asia Pacific is poised as the fastest growing region for central venous catheters, driven by rising prevalence of chronic diseases, expanding critical care infrastructure, and a growing geriatric population. Rapid urbanization in countries like China and India is leading to the construction of modern hospitals and specialized treatment centers. Enhanced access to advanced medical technologies and increasing healthcare expenditure per capita are fueling adoption of sophisticated catheter variants, including antimicrobial-coated and multi-lumen designs. Additionally, private healthcare providers are investing heavily in catheterization laboratories and intensive care facilities, further spurring market growth.

Government initiatives and favorable regulatory reforms across the region are playing a pivotal role in accelerating market growth. In China, the “Healthy China 2030” national strategy emphasizes modernizing healthcare delivery, while India’s National Health Policy 2025 aims to expand access to tertiary care services. These policy frameworks are complemented by public-private partnerships that facilitate technology transfer, capacity building, and clinical training programs. Local manufacturing hubs in emerging economies are also gaining momentum, reducing production costs and improving supply chain resilience.

Despite significant potential, the Asia Pacific region faces market challenges such as inconsistent reimbursement structures, limited rural healthcare access, and fragmented regulatory landscapes. Stakeholders must navigate diverse approval pathways and adapt to local procurement practices. Manufacturers are addressing these obstacles by offering bundled service models, conducting targeted educational initiatives for clinicians, and establishing regional distribution networks.

Southeast Asia—particularly Indonesia, Malaysia, and Vietnam—is emerging as a high-potential submarket, driven by urban modernization and growing awareness of vascular care. Japan continues to exhibit strong growth due to technological innovation and a rapidly aging population, while South Korea’s focus on medical tourism contributes to increasing procedural volumes. Overall, the Asia Pacific region’s combination of regulatory support, infrastructure expansion, and demographic trends positions it as the fastest expanding geography in the global central venous catheter landscape.

Get this report in Japanese Language – 中心静脈カテーテル市場

Get this report in Korean Language - 중앙 정맥 카테터 시장

Read More Articles Related to this Industry:-

Camera Modules in Medical Devices: Revolutionizing Diagnostics and Treatment

Nanofiber Applications in Medical Devices: Revolutionizing Healthcare

About Author

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)