Financial institutions are constantly adapting to keep up with the ever-changing needs of their customers in today’s fast-moving digital world. One of the most important areas of this evolution is loan servicing. A lot has changed over the years. The Loan Management Software (LMS), which was once a reliable tool for simplifying the loan process and helping people and businesses achieve their goals, no longer meets the demands of today’s environment. Without an efficient Loan Management System (LMS) in place, many are facing financial setbacks, whether it’s through small personal loans or large corporate financing.

In economic development loans are a very important part that gives the money to individual and other business to grow them in there full potential. Nonetheless, efficient management of loans necessitates strong systems to tackle difficult tasks such as loan application, loan approval process, disbursement, repayment and compliance monitoring. This is when a Loan Management System comes into the picture to allow financial institutions for simplifying their operations and delivering better customer experiences.

1.What Is a Loan Management System?

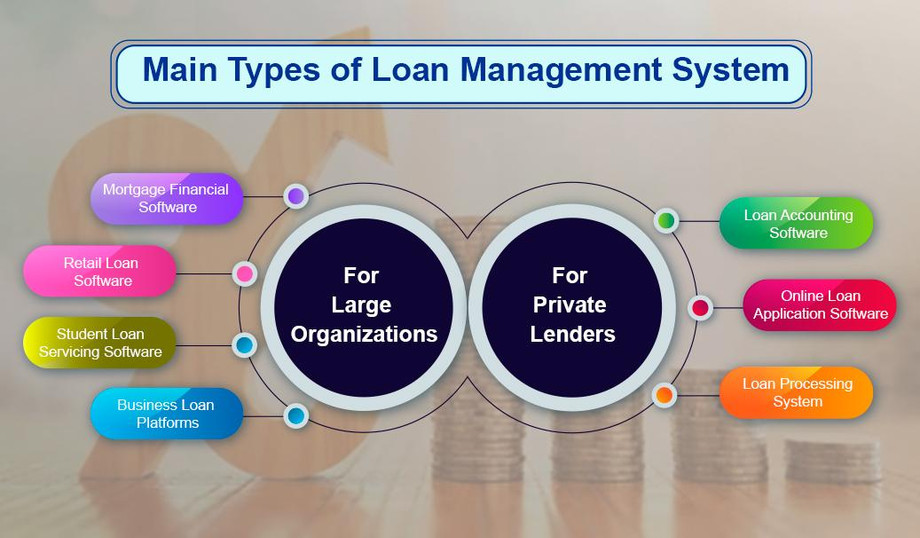

A loan management system allows banks, credit unions, captives, and other lenders to streamline the management of all their lending processes, thus reducing operational (and other) expenses. This advent of digital technology has made it possible for smaller consumer lenders to enter the industry. This technology has allowed many such lenders to identify niches for their portfolios, enabling them to make loans to those lacking significant traditional credit histories without increasing their risk exposure.

When it comes to loan management, systems generally are no longer on-premise solutions, as was the case with legacy lending software and the onsite servers that supported it. Instead of involving massive upfront investments, modern lending platforms use cloud-based servers. This offers lenders numerous benefits, including increased flexibility, scalability, and security, along with enabling easier compliance with regulations like those concerning the security and storage of customer data. Smart automation of processes through artificial intelligence (AI), data analytics featuring machine learning algorithms, almost limitless data storage in the cloud, software apps that improve user experience, and other technologies all have advanced lending software.

Key features of an LMS include:

- Loan Origination: Simplifies the borrower application process, credit checks, and underwriting. Automation speeds up approvals and minimizes errors.

- Loan Servicing: Manages payments, calculates interest, tracks balances, and handles ongoing loan maintenance after approval.

- Loan Accounting: Tracks financial details like interest earned, principal payments, and other loan-related data.

- Customer Service: Includes tools for seamless communication between lenders and borrowers.

- Reporting and Analytics: Generates insights on loan status, portfolio risk, and performance metrics.

- Compliance and Regulation: Ensures all processes adhere to local and international regulations.

- Debt Collection: Helps manage delinquent accounts, contact borrowers, and streamline recovery efforts.

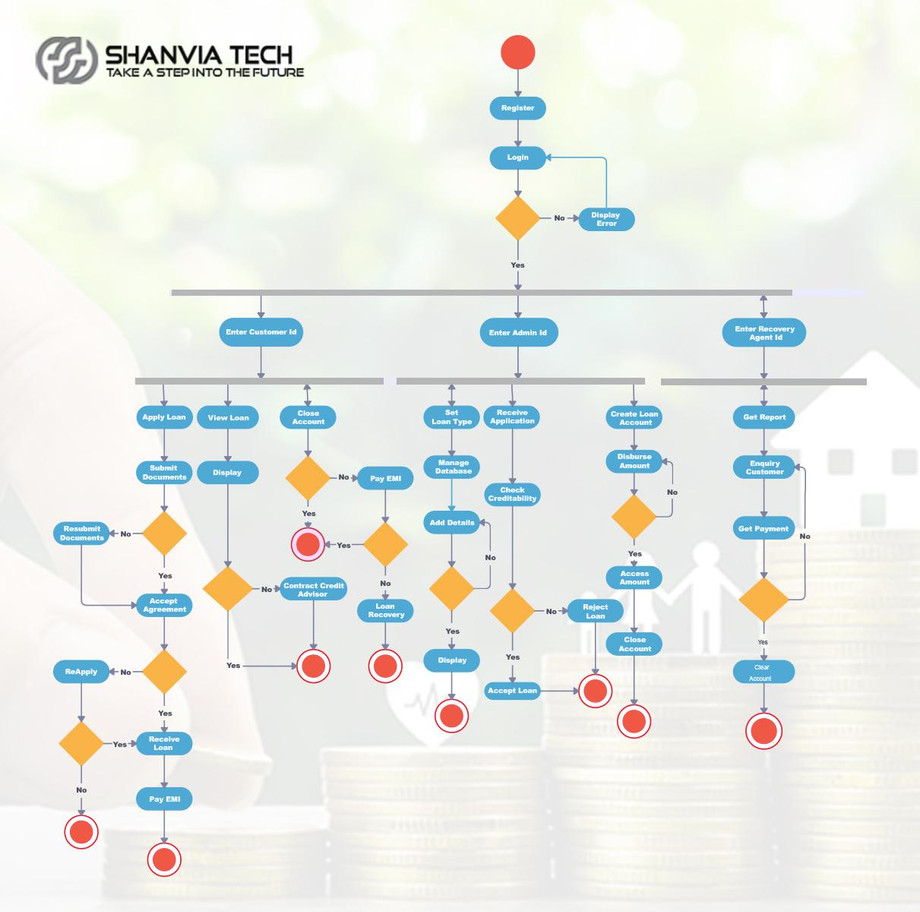

2.How to Build a Loan Management System?

Developing a loan management system requires a thoughtful and structured approach. It's about creating a powerful tool that streamlines the lending process, making it more efficient and organized. To get it right, you need to understand the system's building blocks and how they fit together. Choosing the right technology is also crucial. But that's just the starting point. You also need to incorporate essential features, rigorously test the system, and ensure it's properly deployed and maintained. By taking a meticulous and comprehensive approach, you can deliver a reliable loan management solution that truly meets the needs of your users.

Step 1: Understanding the Components and Architecture:

Building a robust loan management system starts with a clear understanding of its core components and architecture.

- Front-End User Interface: This is what borrowers and lenders see and interact with. A user-friendly and responsive design is essential.

- Back-End Database: This is the system's core, storing all loan data. Data security, efficient retrieval, and scalability are critical.

- Modules: These handle different stages of the loan lifecycle:

- Loan Origination: Manages the loan application and approval process.

- Loan Servicing: Handles ongoing loan management, including payments and adjustments.

- Debt Collection: Activated when payments are missed.

- Reporting: Provides insights into loan performance and other key metrics.

- Data Structure: How data is stored and accessed within the database.

- Workflows: Streamlined, often automated processes for handling various loan-related tasks.

- Integration Points: Connections with external systems, such as credit bureaus or payment gateways.

As well-designed loan management system improves operational efficiency, enhances user experience, and boosts overall performance for lending institutions.

Step 2: Selecting the Right Technology Stack

Selecting the right technology stack is absolutely critical for a high-performing loan management system. Here's a breakdown of key considerations:

- Programming Languages: Common choices include JavaScript, typescript and java, offering robust and scalable solutions.

- Web Frameworks: Frameworks like Express, React, flutter and Ruby on Rails provide structure and speed up development.

- Databases: GraphQL and PostgreSQL are popular database options, known for their reliability and performance.

- Cloud Infrastructure: Utilizing cloud services provides scalability and ensures system reliability.

APIs (Application Programming Interfaces): APIs are essential for seamless integration with external systems, like payment gateways or credit bureaus. - Third-Party Services: Integrating third-party services can enhance functionality, adding features like fraud detection or automated reporting.

Careful selection of each of these components ensures the loan management system is efficient, effective, and meets the needs of both lenders and borrowers.

Step 3: Implementing Key Features and Functionalities:

A robust loan management system requires key features tailored to specific needs. These include:

- Loan Origination: Streamlined processing of loan applications and approvals.

- Borrower Management: Comprehensive handling of borrower data and profiles.

- Automated Payments: Efficient and automated processing of borrower payments.

- Document Management: Organized storage and easy retrieval of loan documents.

- Credit Scoring: Integration with credit bureaus for borrower creditworthiness assessment.

- Risk Assessment: Tools to evaluate loan risk levels and inform lending decisions.

Crucially, these features must align with the organization's specific loan types and operational requirements. Customization ensures the system effectively supports unique business processes and optimizes loan management.

Step 4: Testing and Quality Assurance

A comprehensive loan management system hinges on key features and functionalities. These often include:

Loan Origination: Efficient processing of loan applications, from submission to approval.

Borrower Information Management: Comprehensive storage and management of borrower data.

Automated Payment Processing: Streamlined handling of borrower payments, including automated reminders and processing.

- Document Management: Organized storage and easy retrieval of all loan-related documentation.

- Credit Scoring: Integration with credit reporting agencies to assess borrower creditworthiness.

- Risk Assessment: Tools and processes to evaluate the risk associated with each loan.

Critically, these features must be tailored to your organization's specific needs and the types of loans you manage. This customization ensures the system effectively supports your unique requirements and operational workflows.

- Deployment Options: On-premises gives you full control, while cloud deployment (using platforms like AWS, Azure, or Google Cloud) reduces infrastructure management.

- Maintenance and Support: This includes bug fixes, security updates, and adding new features as needed.

- Updates and Monitoring: Regular security patches and performance monitoring ensure the system stays secure and runs smoothly.

- Scalability: You'll need to be able to scale the system as your organization grows, whether that means expanding cloud resources or adding hardware to your on-premises setup.

- User Training and Support: Proper training and support for users will ensure they can use the system effectively.

- Backup and Disaster Recovery: Having solid backup and disaster recovery plans is essential to protect your data in case of an emergency.

- Automation Reduces Errors: A major benefit of loan management software is the reduction of human error. Manual loan processing is susceptible to mistakes, including incorrect calculations, data entry errors, and processing delays. Automation minimizes these risks, ensuring accurate loan calculations, proper documentation, and consistent application of lending policies. This leads to improved data integrity, reduced compliance issues, and increased overall efficiency in loan processing.

- Optimizing Loan Processes for Time Savings: Loan management software significantly saves time. Automating loan origination, document verification, credit checks, and loan servicing eliminates time-consuming manual tasks. Organized workflows and automated processes speed up loan application processing, reducing turnaround time and boosting operational efficiency. This allows staff to focus on higher-value activities and improves the customer experience.

- Real-Time Loan Performance Reporting: Loan management software empowers lenders with digital reporting and analytics, providing valuable insights into loan portfolios and performance. Real-time data analysis enables tracking of key metrics, risk assessment, and informed decision-making. By leveraging these analytics, lenders can identify trends, detect potential defaults, and optimize loan strategies, ultimately improving risk management and profitability.

- Competitive Advantage in Lending: Loan management software provides a competitive edge. Enhanced efficiency, faster processing, and accurate decisions enable lenders to offer a superior customer experience. Quick approvals, seamless digital interactions, and personalized loan offerings differentiate lenders, attracting more borrowers and building loyalty.

- Optimize Your Lending Processes: Loan management software streamlines lending by automating key tasks. From application intake and credit assessment to document management, payment processing, and collections, automation boosts efficiency, reduces processing times, and ensures timely procedures. This empowers lenders to offer faster, more accurate, and organized services, while also improving internal efficiency and compliance.

4.The Features That Make a Loan Management System Effective

- Loan Origination: Loan origination is critical, and a robust system must support it comprehensively. This includes efficient application intake and processing, encompassing borrower data collection, credit checks, and document verification. Automated workflows, regulatory compliance, and a seamless borrower experience are essential.

- Loan Servicing: Effective loan servicing is vital for managing loans throughout their lifecycle. A robust loan management system should include

- Automated Payment Processing: This streamlines the collection and tracking of borrower payments, reducing manual effort and minimizing errors. It may include features like automated reminders, recurring payment setups, and various payment gateway integrations.

- Accurate Interest Calculation: The system must accurately calculate interest accrual based on different interest rate types (fixed, variable), compounding frequencies, and loan terms.

- Escrow Management: For loans with escrow accounts (often for property taxes or insurance), the system should manage these funds, including collection, disbursement, and reporting.

- Versatile Loan Handling: Lenders often deal with various loan types (e.g., mortgages, personal loans, commercial loans). The system should accommodate these different loan types and their unique characteristics, as well as various repayment plans (e.g., amortizing, balloon payments). It should also allow for account adjustments, such as payment changes or deferrals.

- Borrower Portal: A self-service portal empowers borrowers to access their loan information, view payment history, make payments online, download statements, and communicate with the lender. This enhances the borrower experience and reduces the workload for customer service.

3. Unpaid Dues Management: Effective debt collection capabilities are essential for lenders to efficiently manage delinquent loans. A robust loan management system should automate collection processes by sending timely payment reminders, tracking overdue accounts, and generating collection notices. Seamless integration with communication channels such as email, SMS, and phone systems can streamline collection efforts, enhance borrower engagement, and improve overall recovery rates.

4. Data Insights & Reporting: Comprehensive reporting and analytics are essential for lenders to gain valuable insights and optimize loan management. A well-equipped loan management system should include:

- Insightful Reporting.

- Evaluate loan portfolio performance.

- Assess risk exposure and profitability.

- Pre-Built Reports & Customizable Dashboards.

- Monitor key financial metrics.

- Track loan delinquency rates.

- Analyze lending trends for strategic decision-making.

Advanced Analytics Capabilities:

- Predictive Modeling – Forecast potential loan outcomes and risk scenarios.

- Data Visualization – Transform complex data into intuitive, actionable insights.

By leveraging these powerful features, lenders can make data-driven decisions, enhance operational efficiency, and refine their loan strategies for sustained success.

- How Development Costs are Influenced

Factors Affecting the Cost of Developing Loan Management System Software:

- Feature Complexity: The more complex the features, the higher the development costs.

- Technology Stack: The choice of technologies used for the system can significantly influence development expenses.

- Team Expertise: The skill level and experience of the development team play a major role in determining overall costs.

- Project Timeline: A shorter project timeline can lead to higher costs, as more resources may be required to meet deadlines.

- Customization Needs: Tailoring the software to meet specific business needs can increase development costs.

- System Integrations: Integrating the loan management system with existing systems can add to the overall expenses.

- Regulatory Compliance: Adhering to industry regulations may require additional investment for compliance measures.

Considering these factors is essential for accurately estimating the total investment required for developing a loan management system.

- Personal Loans: Loan management software adeptly handles personal loans, automating origination, credit checks, document generation, and repayment schedules. It securely stores borrower information for efficient servicing.

Main Characteristics

- Automates loan origination

- Facilitates credit checks

- Generates loan documents

- Manages repayment schedules

- Securely stores borrower data

2. Commercial Loans

- Streamlines loan applications.

- Assesses creditworthiness.

- Tracks collateral.

- Manages complex repayment structures.

- Integrates with financial analysis tools.

- Automates loan applications.

- Manages disbursements.

- Tracks loan balances.

- Offers flexible repayment options.

- Facilitates direct billing.

- Facilitates collaboration among lenders.

- Automates participation agreements.

- Tracks payments with accuracy.

- Provides real-time reporting.

- Simplifies syndicate management.

- Automates loan origination.

- Manages property valuation.

- Handles escrow management.

- Calculates payments.

- Ensures smooth loan servicing.

6. Payday Loans:

- Automates loan processing.

- Ensures compliance with regulations.

- Calculates interest and fees.

- Manages repayment schedules.

- Integrates with payment gateways.

- Leveraging Blockchain Technology: Blockchain technology in DeFi and loan management brings several key benefits:

- Immutable Ledger.

- Records all transactions.

- Ensures data permanence and protection against tampering.

- Transparent Transactions.

- Enables participants to view transaction history.

- Builds trust and confidence among all parties.

- Enhanced Trust & Security.

- Attracts both lenders and borrowers.

- Reduces fraud and ensures data integrity.

- Efficient Loan Management.

- Organizes loan systems effectively.

- Streamlines loan servicing and enhances reliability.

- Embracing Advanced Technologies: Lenders are progressively incorporating advanced technologies such as AI, machine learning, and blockchain to enhance product offerings and improve customer experiences. These technologies are poised to revolutionize loan management by automating and optimizing processes throughout the loan lifecycle:

- AI Integration.

- Streamlines origination by automating application processing and credit assessments.

- Improves borrower experience with personalized recommendations and instant approvals.

- Enhances risk assessment through the analysis of large data sets for more accurate lending decisions.

- Machine Learning Benefits.

- Predicts default risks by analyzing historical borrower data.

- Optimizes loan pricing and terms, boosting profitability.

- Automates fraud detection, providing protection against financial crimes.

- Blockchain’s Role.

- Establishes an immutable ledger for transparent and secure transaction records.

- Builds trust and reduces fraud in loan management processes.

- Simplifies complex tasks like syndicated loans by enabling efficient collaboration.

- The adoption of these technologies marks a major shift in the lending industry, fostering greater efficiency, trust, and innovation throughout the loan management process.

2.Emphasis on End-to-End Loan Servicing Software: As businesses pursue digital transformation, there is a growing emphasis on developing robust loan servicing software. A progressive loan management system prioritizes key features such as AI-driven decision-making, seamless automation, and intuitive user interfaces. Together, these elements minimize the need for manual inputs, enhance accuracy, and streamline loan servicing, ensuring that processes meet the dynamic needs of today’s financial services landscape.

- Emerging Trend: The demand for mobile app development in loan management is growing rapidly.

- Digital Transformation: As lending processes become digital, customers are seeking mobile-responsive and user-friendly loan servicing solutions.

- Competitive Advantage: Lenders are expected to invest heavily in app development to meet customer expectations and stay competitive.

- Customer-Centric Focus: Mobile apps provide convenience, accessibility, and improved user experiences, aligning with the changing preferences of borrowers.

- Exceptional Expertise: At Core Devs, we offer unmatched expertise in developing efficient and robust loan management systems. Our team of skilled developers combines in-depth knowledge of the financial sector with technical excellence, ensuring that your system aligns with the complexities of lending operations and regulatory compliance. With a proven track record of successful projects, Core Devs is more than just a service provider – we’re a strategic partner committed to making your loan management system a key asset that drives your business forward.

- Advanced Technology Solutions: In today’s fast-paced digital world, staying ahead of technological trends is essential. At Core Devs, we continuously integrate the latest innovations, such as AI, blockchain, and data analytics, into our loan management solutions. We ensure that your system is not only up-to-date but also ready for future market demands. By partnering with Core Devs, you future-proof your system, keeping it adaptable and competitive in an ever-evolving landscape. Our focus on technological excellence ensures you’re always ahead of the curve.

- Tailored Customization: We understand that every business has unique requirements. At Core Devs, we specialize in tailoring loan management systems to meet your specific needs, whether you manage personal, commercial, or specialized loans. Our solutions are designed to integrate seamlessly with your business processes, making them as efficient as possible. When you work with us, you get a partner who understands your unique challenges and objectives, and we craft solutions that are perfectly suited to your organization.

- Robust Reliability and Security: In the world of financial technology, security and reliability are non-negotiable. Core Devs prioritizes these aspects, implementing robust security protocols and data encryption to protect both your data and your clients’ information. With us, you can rest easy knowing that your system is secure and reliable. Our stringent security measures protect sensitive data, while our unwavering commitment to reliability ensures that your loan management system is always up and running when you need it.

- Outstanding User Experience: User experience is a critical factor in today’s digital landscape. At Core Devs, we design intuitive, user-friendly interfaces that allow both your team and clients to navigate the system effortlessly. Our focus on simplicity and ease of use boosts productivity and enhances customer satisfaction. By choosing Core Devs, you choose a partner who understands the importance of a seamless user experience, which ultimately leads to greater efficiency, customer loyalty, and a stronger reputation for your business.