It is not difficult to navigate through claiming a refund of the GST; still, business houses, financial professionals, entrepreneurs, and also individual taxpayers must understand the easiest mode of claiming these refunds. In this article, we have segregated the process of refund under GST, the eligibility criteria, and timeline so you can claim your refund.

What is GST Refund?

A GST refund arises from the situation where registered taxpayers have overpaid the amount of tax owed. This amount can be recovered through an online procedure on the GST portal. In a timely manner, GST refunds are crucial for businesses as well as exporters to keep cash flow and working capital healthy.

Who Can Claim Refund in GST?

● Businesses and companies with excess paid taxes or ITC accumulation.

● Exporters who have paid Integrated GST (IGST) on exports.

● Individual taxpayers who have paid more in error or eligible for refunds pertaining to special purchases. As defined, special purchases include those of the UN agencies and embassies.

● International tourists can claim a refund of GST paid on goods purchased from India at the time of departure from the country.

When can GST Refund be claimed?

The following are circumstances under which a GST refund can be claimed:

● Excess GST paid due to calculation errors or over-payment.

● Amount of ITC on exports/deemed exports.

● GST paid on exports.

● Inverted Duty Structure, which refers to a structure where input tax exceeds the output tax.

● Refund on provisional assessments.

Time Limit for Claiming GST Refund Application

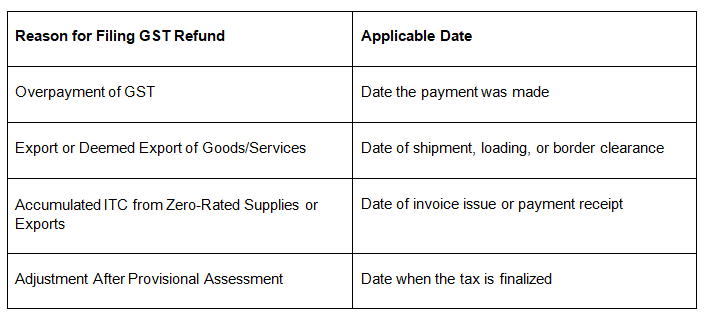

Taxpayers are expected to file their GST refund applications within two years from the relevant date. Time limitation and grounds for filing in a GST refund application are as stated below:

This deadline ensures that companies and tax payers file within a stipulated time frame before losing their rightful refunds.

How to Apply for a GST Refund Step by Step

1. Login to the GSTN Portal: Login into your account at the GSTN Portal .

2. Fill Form RFD-01: This would be the form on which refund claims would be supported, and the form should be filed online. All details like the amount to be refunded and relevant invoices must be correctly filled in this form.

3. Submission of Supporting Documents: Invoices, ITC statements, etc. that may be necessitated.

4. Track Refund Status: For this, follow the GST portal to track the application

5. Confirmation: After submission, you will receive an ARN (Application Reference Number) for tracking the status of a refund

6. Processing of Refund: In most cases, authorities take 30 days to process applications for claiming a refund. Once approved, the amount would directly be credited into your bank account.

How to Monitor Your GST Refund Status

Post-submission

● Checking Post-Login: Log in to the GST portal. From the Services tab, click on "Track Application Status".

● Pre-Login Tracking: Clicking on "Track Application Status" on the homepage of the GST portal and then filling up the ARN without login.

Key Points to Ensure a Smooth Refund Process

● Ensure all invoices and documents are accurate and correctly uploaded.

● Monitor the refund status regularly for any updates.

● Be mindful of the two-year time limit for refund claims to avoid rejection.

How Online Chartered Makes Your GST Refund Claims Easy

Online Chartered has made the refund process under GST quite smooth and effortless. Our knowledge in GST compliance at Online Chartered would ensure that you receive your refund claim on time. We take our time to help you individually, keeping you oblivious of the persisting turmoil of tax consultancy.

Conclusion

Filing a GST refund does not necessarily need to be so overwhelming. Provided proper steps and observation of important dates are taken, businesses and taxpayers can effectively retrieve their excess payments and give control of their cash flow. Online Chartered is your expert on GST compliance. Streamlined help and support is aimed at simplifying your GST refund claims and getting you the results you need.