The "Trade Deficit": Defective Language, Deficient Thinking - Econlib

In a trade, one thing—a good or service—is exchanged for another. Sometimes we trade a kindness for a kindness. I’ll walk the dog if you give me a ride to work. In the United States, one type of thing often traded is dollars. In this article, we divide all things into two groups: (1) dollars and (2) all non-dollar things that dollars are traded for. Let’s call the second kind of things “stuff.”

Some economic terminology implicitly elevates dollars above what dollars buy. When speaking of international trade, or the current account (which is made up principally of exports and imports of goods and services), the terminology calls it a “deficit” if the value of imports exceeds the value of exports, with both imports and exports valued at the prices at which they are transacted.

“What in the conventional view is a ‘trade deficit’ is in the stuff view a ‘current-stuff surplus.'”

Notice that if imports exceed exports, as they have done for decades in the United States, then, on net, more dollars leave the United States by Americans’ purchases of imports than come in by Americans’ sales of exports. Such a situation is termed a current-account deficit, or “trade deficit.” But the terminology could just as well be formulated the other way around, in a framework of husbanding stuff. Then, under the same condition of imports exceeding exports, the focus is on the stuff that, on net, is flowing into the United States. Now we view the exact same world but see a surplus. Instead of looking at matters as the conventional language does, we might call this new view the stuff view. What in the conventional view is a “trade deficit” is in the stuff view a “current-stuff surplus.”

President Trump promises Americans “good trade deals.” But isn’t it a good trade deal for Americans to get stuff from abroad, to use and enjoy, in an amount larger than the value of the stuff that Americans give up? That is a current-stuff surplus! But Trump and others prefer to call it a trade deficit.

Our point here is not to repeat the important truth that the trade deficit corresponds to the capital-account surplus. Rather, our point is that the whole conventional framework is one of husbanding money rather than the goods and services bought. Maybe that framework stems from the government’s basic instinct and natural interest in finding the dollars and taking a portion of them. Taxes are paid in dollars, not in stuff.

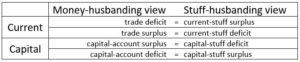

Our point is that we can use an inverse, stuff-husbanding framework to create parallel terminology that transposes deficits and surpluses. In the stuff-husbanding framework, Americans today have a current-stuff surplus and a capital-stuff deficit.

For more information, see Balance of Payments, by Herbert Stein in the Concise Encyclopedia of Economics.

The accounts—the current account and the capital account—are about transactions occurring during the period in question, typically a year. The capital side is harder to understand than is the current-account side. The reason has to do with the prospective transacting of the entities that are transacted in that year.

Take consumer goods and services—say, coffee imported into the United States. We naturally view them as coming into and passing out of existence (as far as future transacting goes) within the year (thus the name “current account” for the side of the ledger on which such transactions are recorded). Coffee is imported in year t and sold to the final consumer within a year’s window from the time of importation. Such is the underlying basis for why food transactions are designated to the current account (as imports and exports) rather than to the capital account. Imported steel is also designated to the current account, not the capital account, because the steel gets used in a building constructed in the United States. If the building is sold to a foreign purchaser, that transaction would go into the capital account. But the steel is deemed not viable for being transacted as steel yet again beyond the current window. Transactions designated to the capital account are ones in properties, such as a building, shares of a company, or even a residential home, viable for sale yet again at some point in the future beyond the current window.

We are concerned only with such investments made internationally—that is, either foreign investment made in the United States or American investment made abroad, and made during year t. In these days of U.S. capital-account surpluses, each year the amount of foreign investment in America exceeds the amount of American investment abroad. From the perspective of the conventional framework, this situation is called a capital-account surplus: From a money-husbanding point of view, think of the dollars associated with acquiring the ownership of such stuff in a given year. Dollar-wise, more such investments by foreigners are being made in America than are being made abroad by Americans.

But from the perspective of our alternate, stuff-husbanding framework, the situation would be called a capital-stuff deficit: Americans’ share of the stuff acquired in such cross-border investments is less than that of foreigners.

The following table shows that the two terminologies line-up according to the two conventions:

So we have two frameworks, the money-husbanding framework, which is conventional, and our stuff-husbanding framework. Does one make more sense than the other? Are they equally good? Are they equally bad?

Our answer has two parts.

First, they are equal. There is no reason to think that one thing that passes from owner to owner in an exchange is more important than the thing it is exchanged for. If Mary pays dollars to Jim for a sandwich, there is no sense in saying that dollars are more important than sandwiches. Indeed, the fact that Mary gave up dollars for sandwiches means that the sandwiches were more valuable to her than the dollars she gave up. And the dollars were more important to Jim than the sandwiches he gave up. There is also no sense in saying that “we,” as a whole, should be more concerned with husbanding money than with husbanding stuff. The two frameworks are equal. The late Thomas C. Schelling, who was co-winner of the Nobel Prize in economics in 2005, said likewise. He explained the accounts employing the conventional money-husbanding framework in his 1958 textbook International Economics, and noted: “We could as well have subtracted exports from imports and designated the net balance as a negative one” (it is positive in his numerical example). He says that there is “no significance, other than custom, in the choice of sign.”2 Schelling affirms that there is no reason to elevate the money-husbanding framework above the stuff-husbanding framework.

Second, from either of the two frameworks, any talk of “deficit” and “surplus” is bad, and is equally bad whether formulated one way or the other. The conventional terminology of “trade deficit” and “capital-account surplus” is bad, and the new terminology of “current-stuff surplus” and “capital-stuff deficit” is bad.

In general, the term “deficit” has a negative valence. When it comes to a government budget deficit, it may well be appropriate to consider that a problem. The budget deficit really does represent a growing debt that will impinge negatively on someone in the future. Debts must be repaid—or defaulted on, either openly or through inflation.

A true deficit is a shortfall. In sports, scoreboard deficits spell defeat. The word deficit comes from the same French and Latin roots as deficient. A deficit reflects a defect.

Both of the frameworks we have examined—the money-husbanding framework and the stuff-husbanding framework—give rise to language with misleading valence. All such “deficit” and “surplus” talk is fundamentally phony. As we’ve seen, “deficit,” with its negative valence, is entirely inappropriate when discussing the difference between exports and imports. “Deficit” expresses the money-husbanding sign on that difference. But from the stuff-husbanding perspective, the same phenomenon is positive, a surplus!

Likewise, the term “surplus” has a positive valence. If we keep running a surplus, we accumulate wealth, right? But, again, that is inappropriate when speaking of capital because the exact same phenomenon, from the stuff-husbanding view, is a deficit.

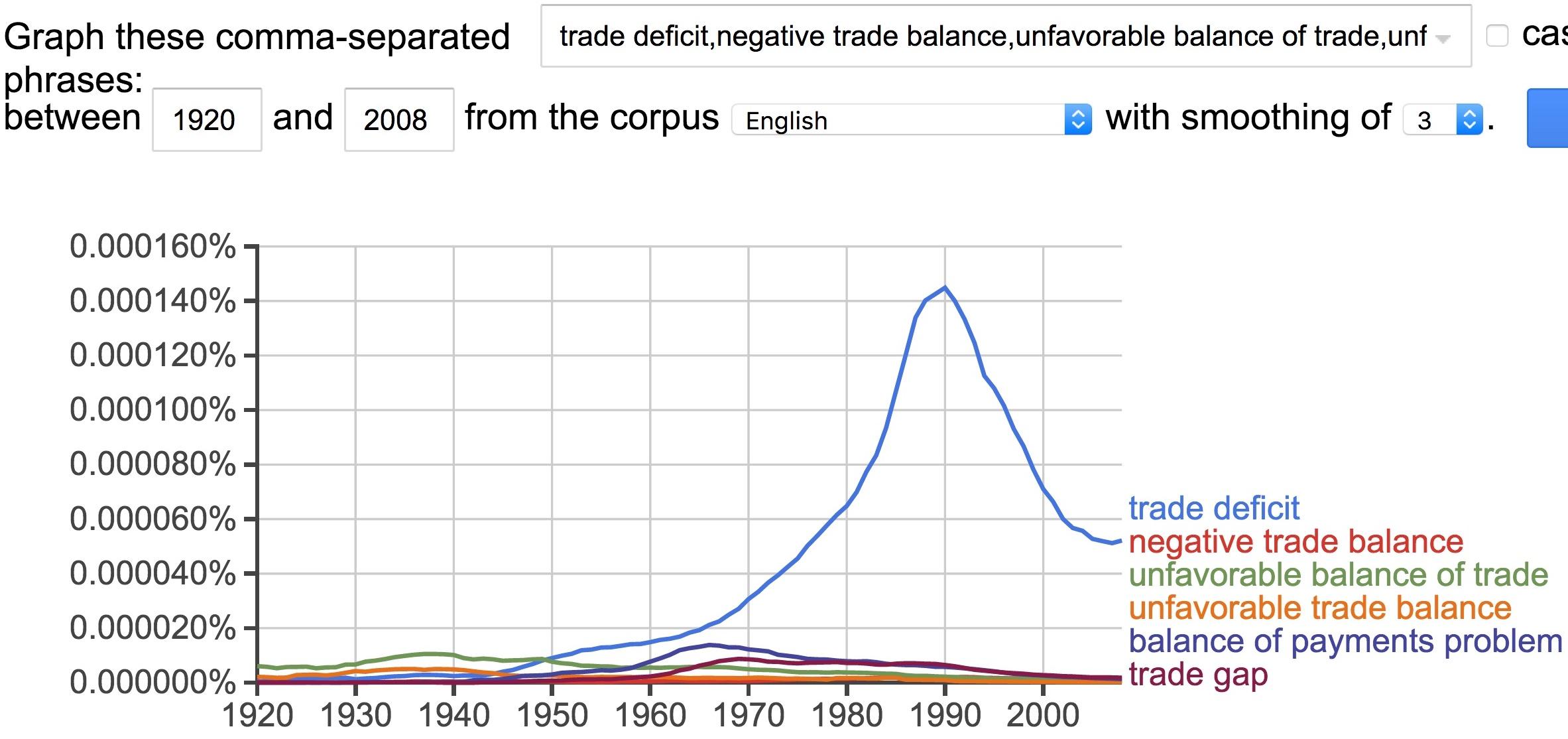

Imports-exceeding-exports should be imbued with neither a negative nor a positive valence. If so imbued, that can be used opportunistically in political battle. We favor imbuing economic terminology with valence, but only when appropriate. The underlying presumptive valence in economics remains the positive valence of peaceful, honest, voluntary exchange. The money-husbanding language of “trade deficit” started only in the postwar period, when the Keynesian system of national income accounting was created, including its terminology. The following n-gram shows the birth and rise of “trade deficit,” as well as some related terms.3

Since “deficit” sounds bad, many people think that the “trade deficit” is bad. The thought is foolish but pervasive. And others exploit the folly to argue for government interventions—privileges and unjust protections—that impoverish society on the whole.

When the term “trade deficit” came into being in the late 1940s, it gave politicians something—”the dreaded trade deficit”—to justify their fears of, and attacks on, allegedly dastardly foreigners, as they passed out protections and privileges to favored interest groups. In the 1980s, these foreigners were Japanese; today they are Chinese.

Has humankind benefited from the birth of the “trade deficit” terminology? We suggest the opposite.

If the money-husbanding and the stuff-husbanding formulations give rise to “deficit” and “surplus” talk, and that is bad, what, then, is good? How should we talk about national accounting identities?

It’s fruitful to ponder the differences between, say, exports and imports, as merely a disparity. A disparity is the separation, and its sign is secondary. The disparity in height between Dad and Mom is the same as the disparity in height between Mom and Dad. Likewise, the disparity between exports and imports is the same as the disparity between imports and exports.

Also, knowing that the “trade deficit” is misleading will help us realize that the disparity between exports and imports simply is not very relevant to real issues and problems. A lot of “trade deficit” talk serves no good purpose. Much of it exists because of the phony negative valence of “trade deficit.”

In our view, rather than elevating money over stuff or elevating stuff over money, economists ought to speak in a way that ascribes a presumptive mutual gainfulness and rightness to whatever voluntary decisions people make regarding all that is their own—that is, their money-and-stuff. That means eschewing any form of the “deficit”/”surplus” talk.

“Trade deficit” is one of those language traps that we’ve sadly fallen into. It is defective language that spawns deficient thinking. Only by recognizing the defectiveness of the term “trade deficit” can we hope to reduce the damage.

Thinking for yourself means not letting yourself be brow-beaten by language. When you hear people use “trade deficit,” recognize its defectiveness, and disdain it accordingly.

Footnotes

Thomas C. Schelling, International Economics, Boston: Allyn and Bacon, 1958, pp. 21-22.

An n-gram is an n-word long string of words. For example, “trade deficit” is a 2-gram. The diagram shows a line for “trade deficit.” That line traces the number of times the 2-gram, “trade deficit,” shows up as an annual percentage of all 2-grams in millions of scanned books. The other n-grams shown in the diagram (“negative trade balance”, etc.) are included to show that “trade deficit” did not simply displace some other equally widely used misleading expression; rather it surged above the preceding usage of other terms. N-grams are made at Google’s Ngram Viewer, which offers further explanation.

*Daniel Klein is Professor of Economics and JIN Chair at the Mercatus Center at George Mason University. He is the chief editor of Econ Journal Watch.

*Donald J. Boudreaux is Professor of Economics and Getchell Chair at the Mercatus Center at George Mason University. He blogs at Café Hayek.

Acknowledgments: We thank Jason Briggeman, Tyler Cowen, Garett Jones, Arnold Kling, Scott Sumner, Alex Tabarrok, and Larry White for valuable feedback.