When planning to study in Canada, students from certain countries must meet financial requirements to secure their study permit through the Student Direct Stream (SDS). One popular option for proving financial stability is a Guaranteed Investment Certificate (GIC), which ensures students have access to funds for living expenses. GIC Canada options include both cashable and non-cashable GICs, each serving different purposes. This blog explores the differences, benefits, and which option might be best for you as an international student.

Understanding GICs for Students

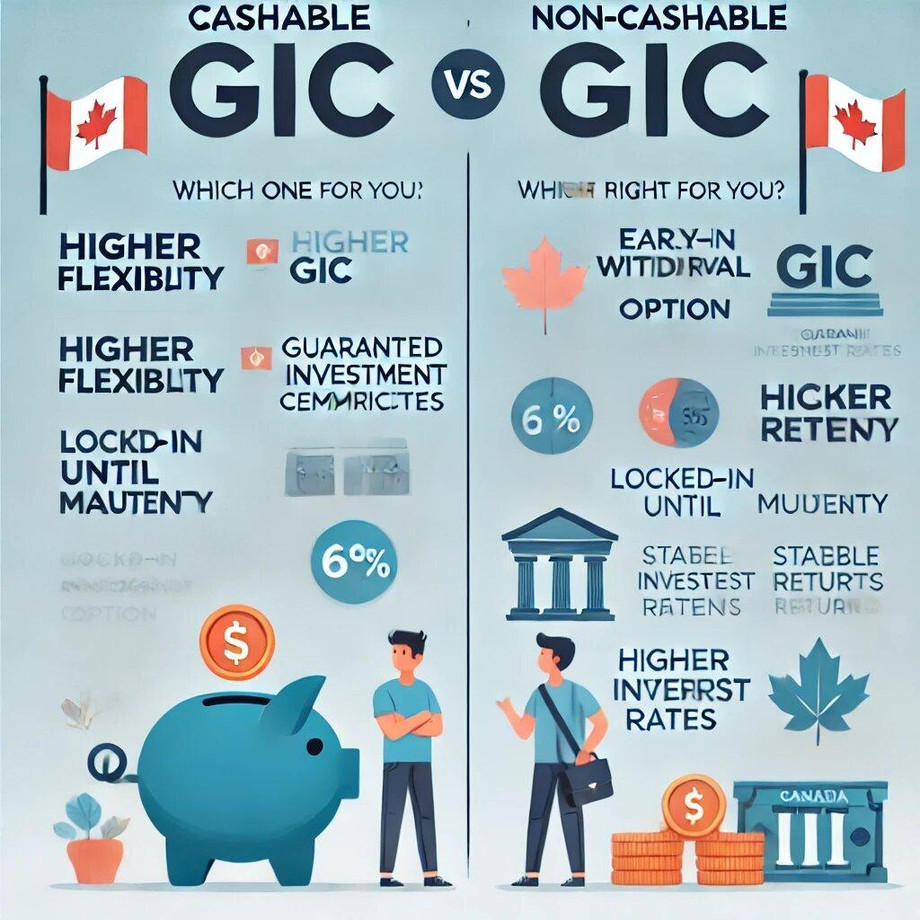

A Guaranteed Investment Certificate (GIC) is a secure investment option provided by Canadian financial institutions that offers guaranteed returns over a set period. For students planning to study in Canada, a GIC plays a dual role: it not only shows financial stability to support the study permit application but also provides access to funds during their time in Canada. Both cashable and non-cashable GICs serve these functions but vary in terms of flexibility, access to funds, and interest rates.

What is a Cashable GIC?

A cashable GIC allows you to withdraw your funds before the term ends, making it a flexible option for those who may need early access to their money. Cashable GICs generally come with shorter terms, often around one year. However, if you choose to withdraw the funds before maturity, you may receive a lower interest rate or only the original principal amount. For students who value easy access to their savings in case of emergencies, a cashable GIC can be a beneficial option.

Benefits of Cashable GICs

- Accessibility: You can withdraw funds if necessary, providing a safety net.

- Shorter Terms: Cashable GICs typically have terms as short as 30 to 90 days, which can suit students who want more control over their finances.

- Lower Interest: While flexible, cashable GICs often come with lower interest rates than non-cashable options.

What is a Non-Cashable GIC?

A non-cashable GIC locks in your funds for the entire term, typically one year, without an option for early withdrawal. While non-cashable GICs offer higher interest rates, they are best for students who can manage without accessing their funds before the maturity date. This type of GIC is often more appealing to those who prefer better returns over flexibility.

Benefits of Non-Cashable GICs

- Higher Interest Rates: Non-cashable GICs usually offer a more attractive interest rate, which can help increase your savings.

- Financial Discipline: Locking in your funds encourages better budgeting and reduces the temptation to dip into savings.

- Stability: These GICs provide a predictable, stable investment, which can be helpful for students focusing on their studies without worrying about fluctuating access to funds.

Which Option is Right for You?

When deciding between cashable and non-cashable GICs, consider your financial needs and study goals. If you anticipate needing emergency funds or more flexibility, a cashable GIC might be ideal. On the other hand, if you’re confident in your budgeting and want to maximize your return, a non-cashable GIC could be the better choice.

For students who have secured financial support from family or sponsors, a non-cashable GIC might align well with long-term plans and yield better savings. However, those without a robust financial backup may find a cashable GIC more convenient, especially if unexpected costs arise.

How Overseas Education Consultancy Can Assist

Navigating the options for GIC Canada can be overwhelming, especially if you’re new to Canadian banking practices. An overseas education consultancy can guide you through choosing the right GIC option based on your financial needs and study goals. They can help you understand the terms, calculate potential returns, and manage the application process. Additionally, they offer insights on various banks offering GICs and help you avoid hidden fees.

GIC Application Process

Whether you choose a cashable or non-cashable GIC, the application process remains similar:

- Open a GIC Account: Choose a bank offering student GICs, such as Scotiabank or ICICI Bank.

- Deposit CAD 10,000: This is a standard requirement for study permits through the SDS. The bank will hold this amount in your GIC.

- Receive Funds in Installments: Once you arrive in Canada, you’ll receive an initial portion, with the remaining balance accessible over 12 months.

Choosing between cashable and non-cashable GICs is an essential part of the financial planning process for students. By understanding the features of each, students can better align their choice with their budget and goals, ensuring a smoother transition to studying in Canada.

Also read :

How to Effectively Communicate with Canadian Universities During the Application Process