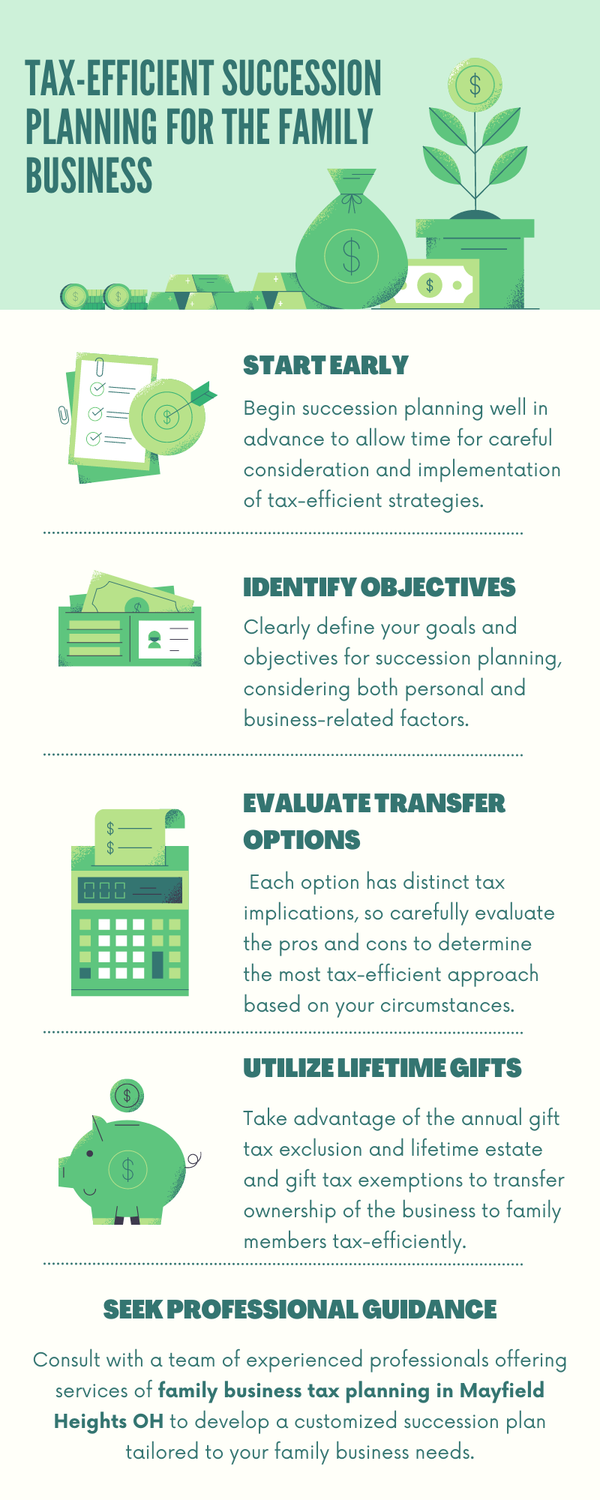

Tax-efficient succession planning for the family business involves strategies such as creating trusts, gifting shares over time, and utilizing exemptions like the lifetime gift tax exemption. Establishing a clear succession plan can minimize estate taxes, ensure a smooth transition, and preserve wealth for future generations. It's essential to consult with financial and legal advisors to tailor a plan that suits the business and family's unique circumstances while minimizing tax liabilities. To know more visit here https://www.mayfieldheightscpa.com/tax-planning-mayfield-heights-oh