Checks are still used in finance because they are secure and physical. However, due to advances in technology and security, blank check stock has emerged, giving firms and individuals more financial flexibility and control. Despite the rise of digital payment options, many organizations and people still use checks for bill payment, payroll, and accounts payable. Blank check paper allows users to print checks as needed. It shields financial activities with watermarks, microprinting, and chemical sensitivity. Printing checks in-house reduces the need for expensive pre-printed checks and simplifies check issuing, saving businesses of all sizes money.

Simplifying Financial Workflows with Blank Check Stock

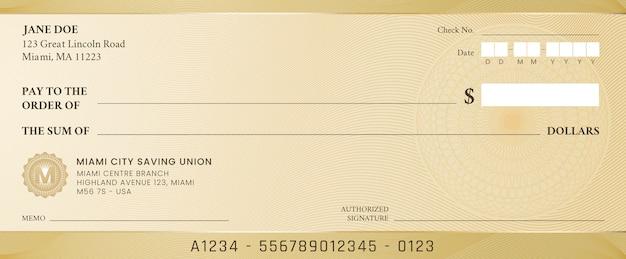

Blank check stock is paper without account information, such as the account holder's name, bank info, or check number for on-demand check printing. It is more customizable than pre-printed checks, which are ordered in bulk from printing businesses. Personalise checks with account, payee, and other data as needed. This adaptability lowers pre-printed check expenses and avoids the possibility of running out or having obsolete information. Blank check stock has multiple security mechanisms to prevent fraud and unauthorized usage. Some features include microprinting, watermarks, chemical sensitivity, and tamper-evident patterns. By integrating these safeguards, blank check stock deters counterfeiters and ensures check integrity. Some blank check material can be used with specialist check printing software to include encryption and digital signatures. Blank check printing is compatible with many printers and accounting software, allowing users to integrate it into their financial workflows while retaining security.

Cost Savings with Blank Check Stock: A Smart Choice for Businesses

Blank check stock saves money over pre-printed checks by avoiding the need to order in bulk from printing providers. Businesses can print checks on demand using their own printer with blank check stock, saving money on check ordering fees, shipping, and minimum orders. Blank check stock is purchased in bulk at cheaper unit costs, so organizations can optimize check material spending over time. It is cost-effective for organizations wishing to improve accounts and cut costs. Blank check stock lets businesses customize checks with logos, branding, and other information. Businesses can boost brand identification, professionalism, and trust by adding these visual components to checks. Personalizing checks for specific payment purposes or recipient preferences strengthens connections with clients, vendors, and partners. The convenience of printing checks as needed with customized patterns and content saves time and boosts operational productivity.

Scaling Your Small Business with Blank Check Stock

Blank check stock helps small firms scale to meet their changing needs and growth goals. It is ideal for startups and small businesses with limited budgets and fluctuating demand. Blank check stock allows firms to print checks on demand and in different numbers, saving money and eliminating waste. It can also handle growing check printing volume without extensive restocking or modifications as small firms grow. Blank check stock simplifies payroll management by issuing employee payments quickly and correctly. Businesses may process payroll quickly and comply with payroll and tax laws by printing customized employee checks. The simplicity of printing checks in-house allows firms to control their payroll procedures, reducing errors and delays from outsourcing. Blank check stock simplifies payroll operations, allowing firms to focus on strategic projects, allocate resources, and satisfy employees with consistent and reliable payments.

The Versatility and Affordability of Blank Check Stock

Blank check stock is a versatile and affordable option for organizations and individuals in today's financial world. Its on-demand printing and configurable capabilities fit current financial management's diversified needs. By not using pre-printed checks, users can avoid unnecessary ordering, obsolete information, and bulk printing costs. To ensure check integrity and fraud protection, watermarks, microprinting, and chemical sensitivity are included in each check. Control and security are essential for effective financial operations. Blank check stock provides remarkable flexibility and scalability for small businesses and startups to meet variable demands and growth goals. Printing custom checks in-house eliminates errors and delays, especially in payroll and vendor payments. Efficiency saves money and lets companies focus on strategic projects, creating a more productive and focused workplace. Blank check stock helps businesses of all sizes optimize their financial procedures, improve their professional image, and increase operational efficiency to stay competitive in a fast-changing market.

Conclusion

Today's financial institutions and individuals can use blank check stock for versatility and affordability. On-demand printing and adjustable capabilities meet diverse financial management needs. Avoid excessive ordering, outdated information, and bulk printing costs by avoiding using pre-printed checks. Each check has watermarks, microprinting, and chemical sensitivity to prevent fraud. Effective financial operations require control and security. Blank check stock gives small businesses and startups incredible flexibility and scalability to meet changing needs and growth ambitions. In-house custom check printing reduces payroll and vendor payment problems and delays. Efficiency reduces costs and allows organizations to focus on critical projects, improving productivity. Blank check stock helps businesses of all sizes enhance their financial processes, professional image, and operational efficiency to compete in a fast-changing market.