When it comes to filing taxes, deadlines can often catch individuals and businesses off guard. Fortunately, if you need more time to gather your documents or complete your tax return, you can file a tax extension. In this article, we’ll walk you through the process of filing a tax extension in the United States and how you can easily do it online.

What is a Tax Extension?

A tax extension is a request to extend the deadline for filing your tax return. It's important to note that a tax extension only grants you more time to file your return, not more time to pay any taxes you owe. The typical tax deadline in the United States is April 15th for individual filers, but if you need extra time, you can apply for an automatic extension.

Why File a Tax Extension?

There are several reasons why you may want to consider filing a tax extension. Some of the most common include:

-

Incomplete paperwork: You may be waiting for important documents like W-2s or 1099s, which may arrive later than expected.

-

Complex tax situations: If your taxes involve multiple sources of income, deductions, or credits, taking extra time to ensure everything is correct can be beneficial.

-

Avoiding penalties: Filing an extension can help you avoid late-filing penalties, giving you more time to prepare an accurate tax return.

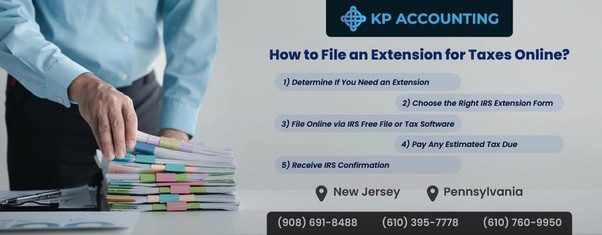

How to File a Tax Extension Online in the United States

Filing a tax extension in the U.S. is simple, especially with online tools. To file an extension for your taxes online, follow these steps:

-

Complete IRS Form 4868: This is the official form used to request an extension. You can find it on the IRS website or through many tax preparation services.

-

Submit Form 4868: Once completed, submit the form electronically through the IRS website, or use an e-filing service. Filing online is quick and efficient, and you'll receive an instant confirmation of your extension.

-

Pay any estimated taxes owed: If you owe taxes, it's essential to make a payment by the original tax deadline (April 15th) to avoid interest and penalties. Even with an extension, paying on time helps avoid these additional charges.

Key Considerations

-

Filing an extension grants you an additional six months to file your tax return, which means your new deadline would be October 15th.

-

The extension applies to both individual and business returns, giving you flexibility depending on your filing status.

-

While the extension gives you extra time to file, it doesn’t mean you won’t owe interest on any unpaid taxes. If you’re unsure about how much you owe, consider consulting a tax professional.

Conclusion

Filing a tax extension in the United States is an easy process that can provide valuable time for completing your return accurately. Whether you’re missing important paperwork or need more time to organize your finances, requesting a tax extension online is the best solution. By following the simple steps outlined above, you can stay on top of your taxes and avoid unnecessary penalties. For more information, visit KP Accounting and learn how to file an extension today!

Business Name : KP Accounting

Address 1: 6 Division Street, Somerville, NJ 08876

Address 2: 1011 Brookside Rd, Suite 100 B, Allentown, PA 18106

Address 3: 255 S Best Ave Suite F, Walnutport, PA 18088

Phone No : (908) 691-8488, (610) 395-7778, (610) 760-9950