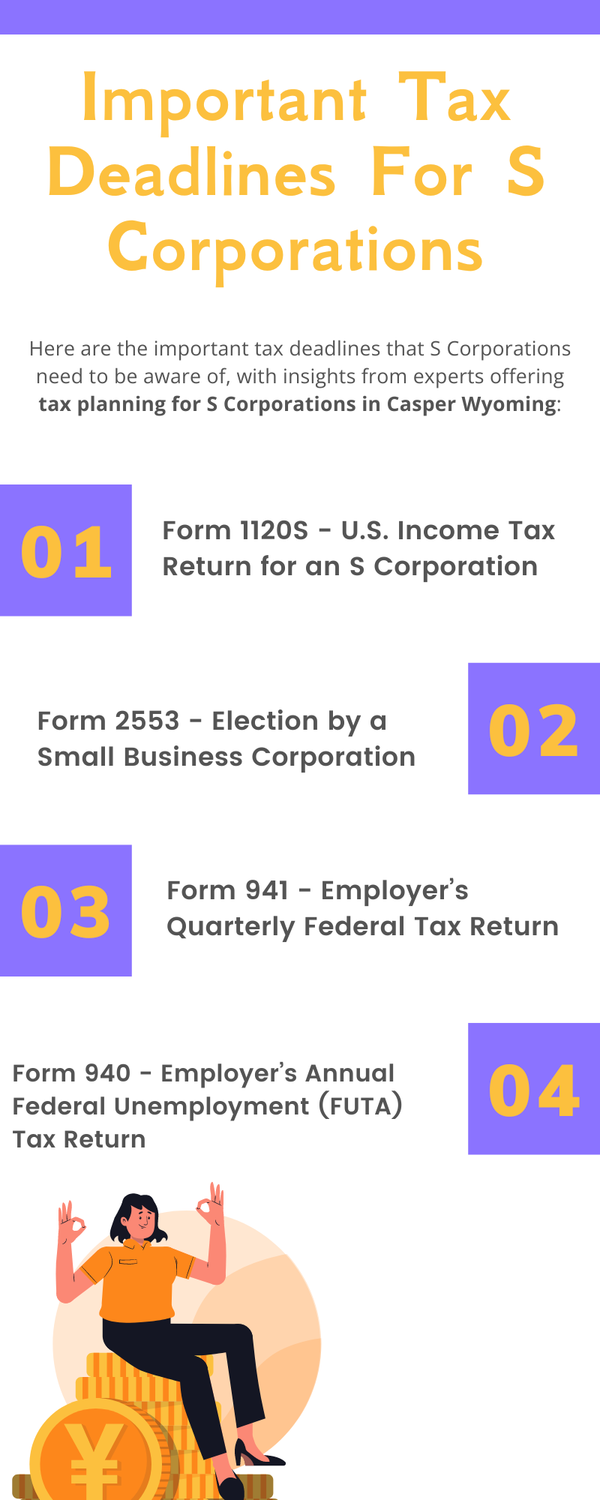

S Corporations must adhere to various tax deadlines to maintain compliance with IRS regulations and state tax authorities. Timely filing of tax returns, distribution of Schedule K-1s to shareholders, payment of estimated taxes, and compliance with other tax obligations are essential for avoiding penalties and maintaining financial integrity. To know more visit here https://www.straighttalkcpas.com/business-tax-planning-casper-wyoming

S Corporations must adhere to various tax deadlines to maintain compliance with IRS regulations and state tax authorities. Timely filing of tax returns, distribution of Schedule K-1s to shareholders, payment of estimated taxes, and compliance with other tax obligations are essential for avoiding penalties and maintaining financial integrity. To know more visit here https://www.straighttalkcpas.com/business-tax-planning-casper-wyoming