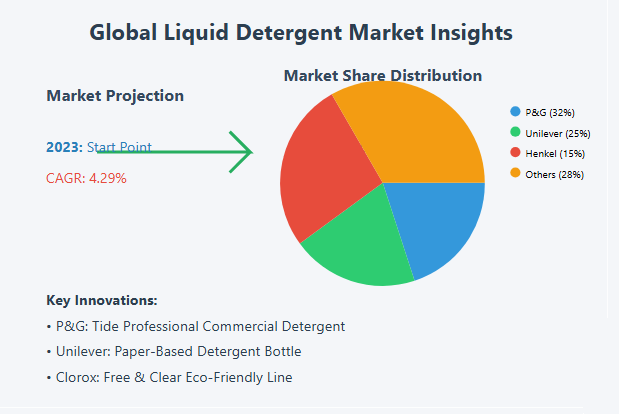

The global liquid detergent market is experiencing robust growth, propelled by leading companies through strategic mergers, acquisitions, technological advancements, and significant investments. The market is projected to reach USD 46.32 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.29% during the forecast period.

Get Free PPT: https://www.maximizemarketresearch.com/request-sample/269281/

Top 5 Companies by Market Share

- Procter & Gamble (P&G): Headquartered in Cincinnati, Ohio, USA, P&G is a global consumer goods powerhouse renowned for its innovative laundry detergent products, including well-known brands such as Tide and Ariel. In 2023, P&G reported total revenue of $82 billion.

-

Unilever: With dual headquarters in London, UK, and Rotterdam, Netherlands, Unilever is a global leader in the liquid detergent segment, offering leading brands like Persil, Surf, and Omo. The company emphasizes sustainability in its products, aiming to reduce environmental impact. In 2023, Unilever achieved a turnover of $62.72 billion, with 58% of sales originating from emerging markets.

-

Church & Dwight Co., Inc.: Based in Ewing, New Jersey, USA, Church & Dwight is a global leader in household and personal care products. Its portfolio includes 13 power brands, such as ARM & HAMMER, OxiClean, and XTRA. In 2023, the company reported revenue of $5.4 billion.

-

Henkel AG & Co. KGaA: Headquartered in Düsseldorf, Germany, Henkel is a global leader with over 145 years of experience in industrial and consumer goods. The company's portfolio includes renowned brands such as Persil and Schwarzkopf. In 2023, Henkel reported total revenue of $22 billion.

-

The Clorox Company: Based in Oakland, California, USA, Clorox is a leading multinational manufacturer and marketer of consumer and professional products. In 2023, Clorox reported total revenue of $7.5 billion.

Recent Mergers and Acquisitions

-

Henkel's Strategic Portfolio Optimization: In January 2022, Henkel announced plans to merge its Laundry & Home Care and Beauty Care business units to create a new "Consumer Brands" business unit. This strategic move aims to build a multi-category platform with around €10 billion in sales, focusing on core brands and businesses with attractive growth and margin potential.

Technological Advancements and Product Launches

- Procter & Gamble's Tide Professional: In April 2024, P&G Professional introduced Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener. Tide Professional is designed to remove stains effectively in a single wash, while Downy Professional enhances linens with exceptional softness. These innovations aim to streamline laundry operations for businesses, enabling owners to save time and focus on other critical aspects of managing their operations.

-

Clorox's Free & Clear Line: In July 2023, Clorox launched Clorox Free & Clear, a line of laundry products offering a tough yet gentle clean. Free from dyes, bleach, and ammonia, this range is safe for use around children, pets, and food while delivering effective cleaning performance. This innovation aligns with Clorox's commitment to sustainability and consumer well-being by addressing the need for eco-friendly and family-safe cleaning solutions.

-

Unilever's Paper-Based Detergent Bottle: Unilever introduced a world-first paper-based laundry detergent bottle, showcasing advancements in sustainable packaging. By using sustainable materials like paper and recycled plastic, the company addresses environmental concerns and appeals to eco-conscious consumers.

Investments and Financial Growth

-

Unilever's European Supply Chain Overhaul: In October 2024, Unilever announced an investment of over €150 million to revamp its European homecare business supply chain, which includes brands like Persil, Omo, and Comfort. This initiative aims to address years of underperformance and capture the evolving post-pandemic consumer market. The company is building new factories, adding warehouses, and upgrading production lines. Additionally, Unilever is increasing its promotions, research, and development spending by 40%.

-

Procter & Gamble's Manufacturing Expansion in India: Procter & Gamble's investment in a liquid detergent manufacturing unit in Hyderabad, India, reflects the industry's growth efforts to meet increasing demand. This strategic move enhances production capacity and strengthens market presence, contributing to overall market growth.

Conclusion

The global liquid detergent market is witnessing dynamic growth, driven by strategic initiatives from leading companies. Through mergers and acquisitions, technological innovations, and significant investments, these organizations are enhancing their market positions and addressing the evolving demands of consumers worldwide.

Concerning Us

One of the fastest-growing market research and business consulting companies with clients all around the world is . We are a proud partner of most Fortune 500 organizations because of our revenue impact and targeted, growth-driven research efforts. Serving a range of industries, including IT & telecom, chemical, food & beverage, aerospace & military, healthcare, and others, we have a diversified portfolio.