The world of insurance, a massive industry that employs millions, is undergoing a big change thanks to technologies like machine learning and computer vision. In recent times, these technologies have become more common in insurance, with new uses and applications popping up regularly.

Artificial Intelligence (AI) is making a big impact in the insurance field, making everyone in the industry quickly adapt to these changes. This includes insurance companies, customers, brokers, and others who are learning to use these advanced technologies to work more efficiently. By freshly looking at AI, we can make insurance experiences better, decisions smarter, and operations more cost-effective.

As the insurance industry embraces these new AI technologies, there's a growing need to move towards digital processes. Computer vision, a technology that allows computers to "see" and "understand" things, is playing a crucial role in this transformation. It helps computers recognize and understand objects and events even better than humans in some cases. Engineers and experts in the insurance industry are quickly developing practical applications using computer vision.

In the insurance world, computer vision and AI are particularly useful for managing risks in existing policies, assessing risks for new policies, handling claims, and keeping a real-time eye on assets and processes. This guide will explore these uses of computer vision and show how it's changing the game for the insurance industry.

Fraud Detection

Insurance fraud is a big issue, causing problems for both insurance companies and their clients. It's a challenge to detect fraud due to various types and the low number of known fraud cases in typical samples. This makes it hard to balance the costs of false warnings against loss avoidance. Machine learning and computer vision come to the rescue by creating fraud detection models based on past experiences.

Artificial intelligence tools are now used to predict fraud and even do background checks on new customers, calculating risks associated with businesses and individuals. Computer vision models, for example, can spot invalid documents or fake images and alert when such issues are detected. NLP technologies analyze unstructured data like messages and customer feedback, notifying humans about suspected fraud incidents. Modern computer vision methods also improve accuracy in predicting fraud, helping insurance companies cover more cases with fewer false alarms.

Using behavioral data, like facial expressions or tone of voice during underwriting, is a common machine learning application. In life insurance or health insurance, for instance, risk information can be gathered just by monitoring behavior. This practical use of technology helps insurance companies tackle fraud efficiently and protect both their interests and those of their clients.

Property Analysis

Leveraging data annotation in insurance, machine learning algorithms can be trained on annotated image data of properties (including damaged ones) to accurately identify structures and assess various condition issues. This empowers insurers to make informed decisions, aiding clients in scheduling repairs or evaluating repair costs and damage value. Determining the age of a roof has been a historical challenge for insurance companies.

Traditionally, insurers relied on homeowner or agent information, inspector observations, or the construction year of the house. Factors such as property modifications and adverse weather further complicate underwriting workflows. Computer vision can be employed by insurance companies to ascertain a roof's age, condition, and susceptibility to damage from hail or wind. This not only expedites the underwriting process but also enhances risk prediction. Utilizing high-resolution views and aerial photos allows insurers to monitor roof changes over time, identify potential issues, and assess risks like nearby trees, vulnerable materials, or costly additions such as solar panels.

Document Digitization

Many traditional insurance processes still involve manual handling of hand-written forms, leading to unnecessary hours of work. Adopting document digitization, particularly through the integration of Optical Character Recognition (OCR) and computer vision models, significantly enhances operational efficiency. OCR tools decipher text and numbers, converting paper documents into digital formats. When combined with computer vision models, insurance companies can achieve substantial savings of up to 80% in various legacy processes like Know Your Customer (KYC) and claims triaging.

This innovative approach enables quick extraction of essential data from ID photos, reducing the customer onboarding time from days to mere seconds. Insurers can seamlessly onboard customers through web portals and mobile apps, similar to platforms like Lemonade, resulting in reduced onboarding costs, enhanced speed, and improved customer satisfaction.

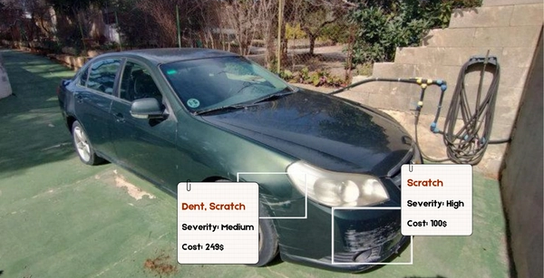

Vehicle damage Assessment

In the aftermath of a vehicle accident, insurance claims involve a time-consuming manual collision damage assessment to determine repair needs and reimbursement amounts. This process requires meticulous inspection by human assessors, relying on manufacturer-provided information. Leveraging machine learning algorithms and computer vision significantly improves the accuracy of damage assessment, enabling quick detection and analysis of damage within seconds. Integrating computer vision into insurance processes automates assessors' tasks, facilitating fair claim quotes. It's essential to prioritize data quality when considering the implementation of such AI models for efficient outcomes.

In our experience, we've encountered compelling AI applications within the insurance domain. The proficient team at TagX, specializing in data annotation, collaborated with various auto insurance companies. We have annotated images of damaged cars using bounding boxes and polygons, labeling them based on the extent of damage (heavy, light, and medium) and its specific location on the vehicle. These annotated datasets played a pivotal role in training a machine learning algorithm to accurately detect and assess the level of car damage for compensation purposes.

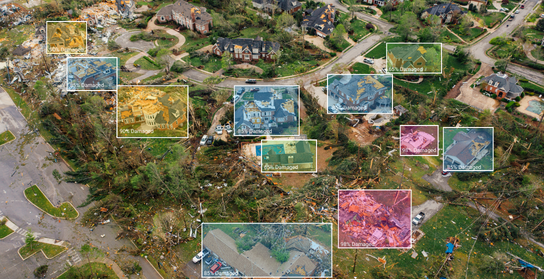

Disaster damage Analysis

Leveraging computer vision for disaster damage analysis can significantly enhance risk management and cost reduction strategies. By incorporating advanced technologies such as aerial imagery and geospatial applications, property damage assessment becomes more efficient and accurate. These tools enable a comprehensive evaluation of areas affected by disasters, identifying homes that have experienced varying degrees of damage, from complete destruction to partial impairment. The precise analysis facilitated by computer vision helps insurance companies and authorities make informed decisions during the aftermath of disasters, streamlining the claims process and expediting recovery efforts.

One key advantage of utilizing computer vision in disaster damage analysis is the ability to prevent fraudulent claims arising from weather-related events. The technology enables a thorough and objective examination of property damage, reducing the likelihood of false or exaggerated claims. By automating the assessment process, insurance companies can enhance their abili

Surveillance on Construction sites

After the construction of a home, homeowners typically secure insurance to protect their investment. This includes homeowner's insurance policies and builder's risk insurance, specifically designed for properties under construction. Builder's risk insurance provides coverage for both the structure and on-site construction materials, while also offering protection for construction company employees in case of accidents.

The deployment of computer vision surveillance on construction sites plays a pivotal role in minimizing incidents and ensuring a secure environment for workers. This implementation necessitates detailed monitoring of factors such as the proper use of equipment by eligible employees, accident coverage, adherence to prescribed processes, detection of potential failure signs causing insured damage to the site, and more. Fortunately, a computer vision-powered surveillance system addresses these concerns in real-time, enhancing overall safety and risk management on construction sites.

TagX your trusted Data & AI partner

In conclusion, the integration of AI and computer vision in the insurance industry represents a transformative leap toward enhancing efficiency, accuracy, and fraud prevention. From claims processing to risk assessment and damage analysis, these technologies empower insurance companies to streamline operations and provide more responsive and personalized services to their clients. The ability of AI models to swiftly analyze vast datasets and identify patterns contributes to faster decision-making, enabling insurers to adapt to evolving market dynamics and customer expectations.

At TagX, we take pride in being your trusted data partner, specializing in Custom AI model development and data annotation services tailored for diverse applications, including vehicle inspection solutions in the insurance sector. Our experienced team of AI and ML professionals is well-equipped to handle the complexities of data preparation, model building, and training, ensuring the seamless integration of cutting-edge technologies into your insurance processes. By leveraging our expertise, you can harness the full potential of AI and computer vision to drive innovation, reduce risks, and stay ahead in the dynamic landscape of the insurance industry.