The following passage provides a chronological overview of the events surrounding the Torchlight Energy Resources (TRCH) and Meta Materials (MMAT) reverse merger, the listing of MMTLP and subsequent trading irregularities, legal actions, and the call for transparency in the financial market.

- June 2021: Torchlight Energy Resources (TRCH) enters into a reverse merger with Meta Materials (MMAT), resulting in the creation of Series A Preferred shares representing TRCH assets. These assets include a 137,000 acre property in Texas' Orogrande Basin which is believed to contain the single largest onshore oil and natural gas discovery in the last 35 years. (https://content.equisolve.net/torchlightenergy/media/f8f9cf35e22b064d3b0a0cf6b5dfb6a9.pdf)

- October 7th, 2021: MMTLP, a symbol created to represent the Series A Preferred Shares, is listed and made tradable on the OTC market without authorization from Meta Materials. The party that made this security tradable is still unknown, and FINRA refuses to shed light on their identity(s).

- Shortly after this, John Brda informs OTC Markets that this security is trading without proper authorization. OTC Markets tells Mr. Brda that he has to "take it up with FINRA because they approved it." John Brda then does so and is told by FINRA that he has no standing to bring this type of complaint because he is no longer the CEO.

- July 15th, 2022: The first S/1, stating MMAT's intention to spin out the TRCH/MMTLP assets into a private company, is issued. https://www.sec.gov/Archives/edgar/data/0001936756/000119312522194228/d302576ds1.htm

- November 9th, 2022: After undergoing 4 revisions due to comments by the SEC, the final S/1 is issued. https://www.sec.gov/Archives/edgar/data/0001936756/000119312522281275/d302576ds1a.htm

- November 18th, 2022: A notice of effectiveness related to the S/1 is filed after the SEC offers no further comments or questions. https://www.sec.gov/Archives/edgar/data/0001936756/999999999522003344/xslEFFECTX01/primary_doc.xml

- November 25th, 2022: A form 424b4, which provides information on the dates the spin-out is to occur, is filed. https://www.sec.gov/Archives/edgar/data/0001936756/000119312522292114/d302576d424b4.htm

- November 30th, 2022: George Palikaras, CEO of Meta Materials, tweets the following: "Today, META requested FINRA to halt $MMTLP on Dec 14th at close (current distribution date)... OR to freeze trading on Dec 12th at close (current record date). Please take the time to READ the S1. NO public trading after the distribution date, i.e. there is NO ex-dividend date." https://twitter.com/palikaras/status/1598156874162978817

- December 5th, 2022: Sam Draddy, a Senior VP at FINRA sends communication to the SEC stating that he was requesting the comprehensive trading data (known as "blue sheets") on MMTLP and MMAT. (see FOIA document referenced below)

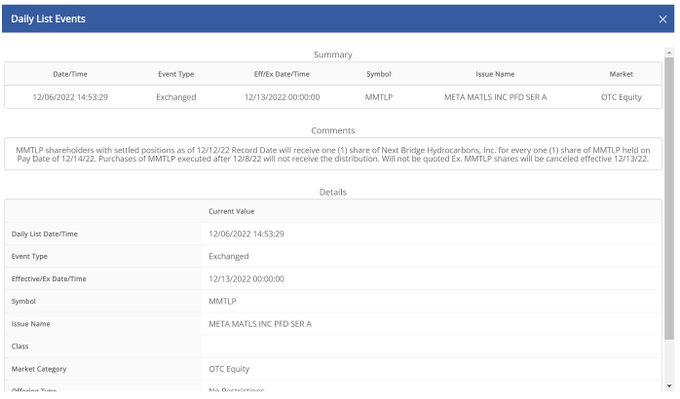

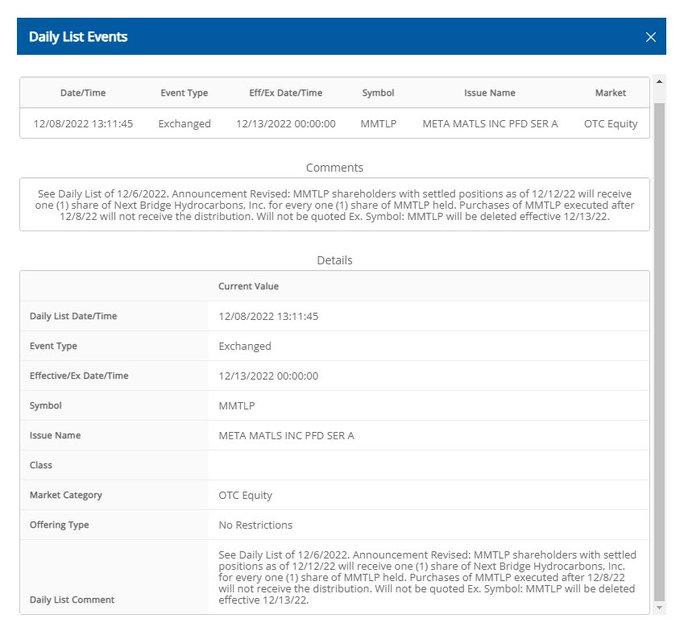

- December 6th, 2022: After no corporate action notice is issued, Congressman Peter Sessions (R-TX) sends a letter to FINRA requesting that they do their jobs and send out the corporate action notice to explain to brokers and the investing public how this spinout will occur. FINRA responds by doing so. This corporate action notice states that the shares will be CANCELLED on 12/13, and that shares of Next Bridge would be paid to clients in exchange for their MMTLP shares on the same date. (image attached below)

- December 7th, 2022: Jeff Mendl, Vice President of OTC Markets, goes on the "Trader TV" broadcast, and states numerous times, along with the host, that trading will occur through December 12th AS PER FINRA, and that at Midnight on December 13th, the symbol will be DELETED (not the shares will be CANCELLED). https://x.com/FreeCommercials/status/1678221078441918464

- December 8th, 2022: Unhappy with the corporate action notice put out by FINRA, the DTCC calls a meeting with them, and attorneys from Meta Materials. FINRA NO SHOWED THIS MEETING: https://youtube.com/clip/UgkxBTNKzoqrfauuAYuCANx3f9XT-n7Thf-P

- December 8th, 2022: FINRA issues ANOTHER corporate action notice, changing the wording from "MMTLP shares will be cancelled", to "symbol will be DELETED". They also REMOVED the pay date of 12/14. (image attached below)

- December 8th and 9th, 2022: Major broker dealers in the United States send out communications to their clients who inquire delineating the guidance that they received from FINRA stating that this was to trade on the 9th and the 12th in "position close only" fashion. Meaning, no new buying orders would be accepted. https://x.com/FreeCommercials/status/1678221078441918464

- December 9th, 2022: After being allowed to trade for 14 months and with two trading days left, trading of MMTLP is halted by FINRA five days before the assets are to be spun out into Next Bridge Hydrocarbons.

- February 6th, 2023: Cromwell Coulson, President of OTC Markets, admits in a tweet that short positions still exist in Next Bridge Hydrocarbons, which is now a private company with no intention of being tradable. He also states it "would be easier if Next Bridge shares became publicly tradable." https://twitter.com/cromwellc/status/1622648357561696260?s=20

- February 24th, 2023: Dave Lauer, an expert on securities manipulation and member of FINRA's Market Regulation Committee, calls on FINRA to address the problem, stating that "FINRA screwed up this entire situation", and "FINRA needs to come out and be radically transparent. They need to explain exactly what happened & what the full share count or audit shows, even if under investigation. If the books are reconciled, that needs to be shown - if they're not, then it needs to happen." https://twitter.com/dlauer/status/1629205424158253056

- March 16th, 2023: FINRA releases a FAQ statement on the situation, believed to be full of misrepresentations and omissions, with NO full share count or audit to back it up. https://www.finra.org/investors/insights/FAQ-MMTLP-corporate-action-and-trading-halt

- March 24th, 2023: Members of the investing public release a rebuttal to FINRA's FAQ, which FINRA later had to go back and edit due to the misrepresentations they were caught in making. https://twitter.com/bleedblue18/status/1639354486190661638

- April 1st, 2023: A FOIA request reveals emails indicating that FINRA and the SEC were aware of the MMTLP issue at the highest levels as early as November 2021. This includes Robert W. Cook, and possibly Gary Gensler. (FOIA document can be found here: https://mmtlpresources.com/wp-content/uploads/2023/04/RELEASABLE-Records-Request-No.-23-00564-FOIA.pdf)

-

April 18, 2023: Clifton Dubose, CEO of Next bridge Hydrocarbons, sends FINRA a letter requesting assistance to address ongoing issues resulting from the spin-off from Meta Materials, Inc. The letter outlines concerns related to uncovered short positions in NBH Common Stock, the trading halt, and the adverse impact that this situation has had on the investing public. Moreover, Next Bridge sought FINRA's cooperation in facilitating a temporary trading process to settle unresolved short positions, and maintain fair and orderly markets, while advising "[their] Company has contacted OTC Markets, which has indicated that [they] can apply to trade on an OTC Markets exchange for a limited period of time", and "DTCC has indicated that it is willing to help the Company have the CUSIP deleted after our delisting". https://www.finra.org/media-center/newsreleases/2023/finra-correspondence-next-bridge-hydrocarbons-april-june-2023

- May 19th, 2023: Robert Colby, Chief Legal Officer of FINRA, responds to Mr. Dubose with a letter indicating that FINRA refuses to allow NBH to faciliate a market based reconciliation of the imbalance that FINRA created by halting the security shortly before the exchange was to occur, erroneously stating that the request to do so "does not comport with FINRA’s understanding of its authority and applicable regulations, processes, or market practice." All while knowing that to allow this situation to stand without reconciliation goes against their mandate and the fundamental purpose for which their institution was created. https://www.finra.org/media-center/newsreleases/2023/finra-correspondence-next-bridge-hydrocarbons-april-june-2023

- June 7, 2023: Following a phone call with Mr. Dubose, Robert L. Colby sends a follow up letter. Seemingly sidestepping accountability, Colby makes the statement that FINRA lacks authority to compel specific investors to close short positions. Moreover, Colby's refuses to grant NBH access to blue sheet data for trading activity in MMTLP, raising further questions about transparency and the organization's intentions. Colby's response downplays concerns and omits crucial details intensifies doubts about FINRA's credibility and commitment to investor protection. https://www.finra.org/media-center/newsreleases/2023/finra-correspondence-next-bridge-hydrocarbons-april-june-2023

- July 14th, 2023: Congressman Eli Crane, representing Arizona's 2nd District, sends a letter to SEC Chairman Gary Gensler, expressing constituent concerns about the MMTLP trading halt and alleged illegal share sales. The letter requests that a briefing be provided to his office, and highlighted the need for investor protection in light of the MMTLP situation. https://twitter.com/RepEliCrane/status/1681038826234429440

- July 28th, 2023: 15 Members of the United States House of Representatives' Committee on Financial Services, send a letter to SEC Chairman Gary Gensler requesting a thorough review and substantive briefing of the MMTLP situation. The letter calls for an examination of the trading timeline, actions by regulatory bodies and relevant parties, and the transaction that produced the Next Bridge Hydrocarbons shares. The SEC is asked to provide findings by August 11, 2023, in order to address investor concerns and enhance market integrity. Chair Gensler has yet to deliver this briefing, but as of this writing, has requested to be able to do so in person in September. https://twitter.com/RepEliCrane/status/1685004414635892736

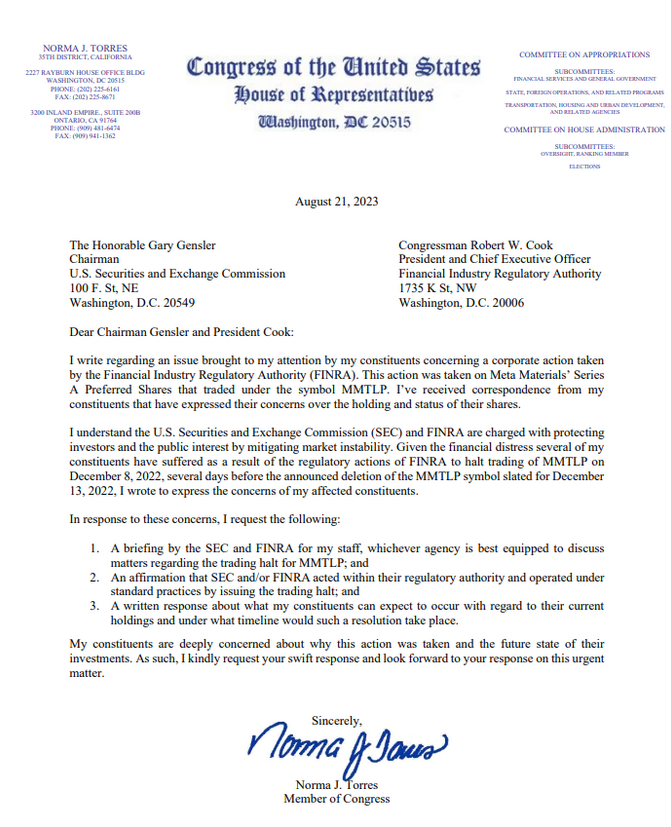

- August 21st, 2023: Congresswoman Norma J. Torres, representing California's 35th District, sends a letter to SEC Chairman Gary Gensler, and FINRA President Robert Cook, expressing constituent concerns about the MMTLP trading halt and alleged illegal share sales. Among the requests, Congresswoman Torres asks for a briefing by the SEC and FINRA, and a written response about what constituents can expect to occur with regard to their current holdings and under what timeline would such a resolution take place (image below).

- September 17th, 2023: Senator Mike Crapo (R-ID) questions SEC Chairman Gary Gensler about the MMTLP situation during a Senate hearing, seeking confirmation that the SEC is reviewing the December 2022 trading halt and requests a commitment to publicly release the SEC's findings. In a stunning display of evasion, Chairman Gensler avoids direct answers, stating that FINRA initiated the trading halt independently and did not seek the SEC's advice or permission. When pressed about the possibility of naked short selling and fraud in MMTLP, Gensler cites the need for public protection as the reason for not disclosing any current or possible investigations, and does not elaborate on the situation any further. https://x.com/unusual_whales/status/1703393616410915306?s=20

- September 19th, 2023: Congressman David G. Valadao (R-CA), expresses deep concerns in a formal letter to SEC Chairman Gary Gensler and FINRA President Robert W. Cook regarding the suspension of trading for Meta Materials' Series A Preferred Shares (MMTLP) on December 8, 2022. The letter demands transparency and accountability from both regulatory bodies, seeking information about the circumstances surrounding the trading halt, confirmation of FINRA's jurisdiction, a clear plan of action for affected constituents, and an audited count of shares held by the investing public as of December 9th, 2022. https://x.com/KarmaCollects/status/1704202996052283794?s=20

- September 26th, 2023: U.S. Senator Mike Crapo, along with Senator and Vice Presidential Candidate JD Vance (R-OH), send a formal letter to Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), requesting an examination of events related to the trading halt of MMTLP. The letter highlights that MMTLP shares began trading on the OTC market in 2021 and that the SEC approved a Form S-1 to spin off part of Meta Materials into Next Bridge Hydrocarbons in 2022. Furthermore, the senators draw attention to the trading halt that was issued by FINRA on December 9, 2022, which complicated the distribution of Next Bridge shares and caused confusion among investors. The senators urged the SEC to review these events and corporate filings to determine if any misconduct occurred and to provide detailed information and analysis to Senate offices. https://www.crapo.senate.gov/imo/media/doc/mmtlpsecletter09262023.pdf

- September 27, 2023: During a congressional hearing, Congressman Ralph Norman (R-SC) questions SEC Chair Gensler about the audited share count of MMTLP. Chair Gensler responds by stating that this information is public record. However, it is noted that the number of aggregate shares of MMTLP held by each brokerage, including their clients and various capacities, on the date of December 12, 2023, is not a matter of public record. The question sought this specific information, highlighting a discrepancy in Chair Gensler's response regarding the availability of this data. https://x.com/unusual_whales/status/1707251536898699773?s=20

- October 16, 2023: Senator Mike Crapo (R-ID), in a letter sent to FINRA President Robert W. Cook, expresses concerns regarding the suspension of trading for Meta Materials' Series A Preferred Shares (MMTLP) on December 8, 2022. The letter, similar to that sent by Congressman David Valadao, demands transparency and accountability, seeking information about the circumstances surrounding the trading halt, confirmation of FINRA's jurisdiction, a clear plan of action for affected constituents, and an audited count of shares held by the investing public as of December 9th, 2022. https://twitter.com/jen_kapela/status/1714324098275557644/photo/1

- November 6, 2023: FINRA releases a "supplemental update" to their FAQ regarding the MMTLP situation. Critics argue that this update fails to address concerns raised by Congress and the public, highlighting its failure to cover key areas such as liabilities to deliver shares, the temporary trading period requested by Next Bridge Hydrocarbons, the FOIA emails, and tax implications. Of particular note, FINRA categorizes "counterfeit shares" as being nothing more than a social media myth. Critics see the FAQ as a delaying tactic rather than a sincere attempt to address valid concerns, emphasizing the ongoing call for transparency, accountability, and fairness. https://www.finra.org/investors/insights/supplemental-faq-mmtlp-corporate-action-and-trading-halt

- November 15, 2023: MMTLP investors discover that the SEC deleted a document on their website that was being used as reference material to refute FINRA's mischaracterization of counterfeit shares being nothing more than a social media term. The document, which delves into share counterfeiting and quotes 2007 SEC Chairman Harvey Pitt stating that "Phantom shares created by naked shorting are analogous to counterfeit money," was previously available at https://www.sec.gov/comments/s7-08-09/s70809-407a.pdf. However, the document can still be accessed through the internet archive at the following web address: https://web.archive.org/web/20221022103620/https://www.sec.gov/comments/s7-08-09/s70809-407a.pdf.

- November 15, 2023: Congressman Jared Huffman (D-CA) addresses a letter to SEC Chairman Gary Gensler and FINRA President Robert W. Cook expressing concerns on behalf of affected constituents regarding the corporate action taken by FINRA on Meta Material’s Series A Preferred Shares (MMTLP). The letter seeks information on the reasons behind the trading halt of MMTLP on December 9, 2022, just days before the announced deletion of the MMTLP symbol. Congressman Huffman requests affirmation of SEC and/or FINRA's regulatory authority and standard practices, along with a written response outlining the future state of his constituents' investments and expected timelines. https://x.com/KarmaCollects/status/1724952490633040229?s=20

- November 15, 2023: Congressman Vicente Gonzalez (D-TX), a Member of the House Financial Services Committee, writes a letter to SEC Chairman Gary Gensler, urging the SEC to examine the events surrounding the FINRA decision to implement a trading halt of Metamaterials’ Series A Preferred Shares (MMTLP). Congressman Gonzalez expresses concern on behalf of adversely affected constituents, emphasizing the need for transparency in the process. The letter highlights the history of MMTLP's trading, the SEC-approved spin-off, and the subsequent trading halt by FINRA. Congressman Gonzalez requests an investigation to ensure no wrongdoing and urges Chairman Gensler to make the findings available to the public. https://x.com/KarmaCollects/status/1725007651606810984?s=20

- November 30, 2023: In a letter to SEC Chairman Gary Gensler, Congressman Josh Harder (D-CA) calls for a thorough investigation into the MMTLP trading halt by FINRA, seeking assurance of no wrongdoing. He urges the SEC to release findings, including an audited share count, publicly. Congressman Harder emphasizes the need for clear guidance to constituents on their current holdings and a resolution timeline. Specifically, Congressman Harder requests details on the SEC's steps to collaborate with Next Bridge Hydrocarbons for a swift resolution. https://x.com/KarmaCollects/status/1730653517990465703?s=20

- December 4, 2023: Congresswoman Barbara Lee (D-CA), addresses a letter to SEC Chairman Gary Gensler, expressing concerns about FINRA's actions on Meta Material’s Series A Preferred Shares (MMTLP). Congresswoman Lee requests a thorough investigation, transparency in findings, clear guidance of what can be expected for constituents affected by the MMTLP trading halt, and a timeline by which this situation will be resolved. She emphasizes the SEC and FINRA's responsibility to protect investors and uphold market integrity, urging identification of any regulatory gaps for enhanced investor protection. https://x.com/KarmaCollects/status/1731861044450959375?s=20

- December 22, 2023: In an effort prompted by the receipt of over 40,000 letters from concerned investors, Congressman Ralph Norman (R-SC), as part of a group of 74 U.S. Congress Members, addresses a letter to the SEC Chairman Gary Gensler and FINRA President Robert W. Cook. This letter urges a review of events concerning Meta Materials Series A Preferred Shares (MMTLP), emphasizing concerns about a trading halt and possible nefarious short selling. Additionally, the Congressional Members pose specific questions regarding the trading timeline, regulatory authority, and circumstances leading to the halt. This letter seeks transparency to dispel misinformation and protect investors, while specifically requesting responses to be delivered by January 31, 2024. https://norman.house.gov/uploadedfiles/rep-norman-mmtlp-letter-2023-12-22-final.pdf

-

December 29th, 2023: Bolstering the MMTLP community's claim of a massive imbalance in shares, news spreads that TradeStation has made stunning admissions to their clients that they do not have enough shares allotted to them to provide each of their clients with a physical share of Next Bridge Hydrocarbons. This admission comes in the context of TradeStation customers seeking to participate in the non-transferable subscription rights offering for NBH shares. Participation requires NBH holders to register and record ownership with AST within 60 days from the effective date of a Form S-1 Registration Statement filed by NBH with the SEC on July 26, 2023. However, under the guise of their "inability to recall lent-out shares", TradeStation informs clients of their inability to fulfill customers' requests to register and record ownership with AST. https://x.com/MMATNEWS/status/1740807329212191042?s=20

- January 9, 2024: Congressman Mark DeSaulnier (D-CA), sends a letter, addressed to regulatory bodies including the SEC and FINRA, expresses concerns about the situation surrounding his constituents holdings related to MMTLP following the December 2022 trading halt due to a corporate spinoff. The letter states that multiple constituents report dissatisfaction with the resolution process and non-receipt of expected compensation (in the form of shares) from the spinoff of Next Bridge Hydrocarbons. The letter urges regulatory bodies to take affirmative steps to address retail investors' concerns and provide more information on avenues for resolution, emphasizing the importance of maintaining investor confidence and accessible financial markets for all income levels. https://x.com/KarmaCollects/status/1745180861224608052?s=20

- January 19th, 2024: Next Bridge Hydrocarbons issues a press release expressing deep concerns about the circumstances surrounding the U3 halt of trading in MMTLP prior to the Next Bridge spinout. Notably, the statement highlights that short sellers have approached Next Bridge about buying considerably more shares than the approximate aggregate short interest position in MMTLP reported by FINRA, which was 2.65 million shares as of December 12, 2023. Next Bridge emphasizes the need for transparency, accurate information, and cooperation with regulatory agencies. The company has offered to discuss its data with FINRA and the SEC, seeking clarity on the conflicting data. In addition, Next Bridge praises the efforts of its shareholders and the "MMTLP ARMY" for bringing attention to this serious problem. Chairman and new CEO, Greg McCabe, expresses gratitude for the support and hopes that Congress and the SEC will oversee a fair and equitable solution to the situation. https://www.prnewswire.com/news-releases/next-bridge-hydrocarbons-inc-announces-preliminary-results-of-its-johnson-prospect-drilling-program-302039147.html

- January 31st, 2024: In a response letter to Rep. Ralph Norman, FINRA President Robert L. Cook addresses concerns surrounding the Meta Materials corporate action and subsequent trading halt of MMTLP. However, the letter raises several questions about the efficacy of the regulatory process and the level of investor protection provided. While outlining the steps taken by FINRA, including notification of the corporate action and implementation of a trading halt, the letter fails to address fundamental issues such as investor confusion created by the corporate action which FINRA released, and share distribution discrepancies. Additionally, the letter's assertion that there was no evidence of significant naked short selling in MMTLP is met with skepticism, as it overlooks potential loopholes and fails to provide concrete evidence to support its claims. Furthermore, FINRA's claim that they are unable to conduct a certified audited share count is in direct contracdition to FINRA rule 4140, which ironically is titled "Audit" (https://www.finra.org/rules-guidance/rulebooks/finra-rules/4140). This contradiction raises doubts about FINRA's culpability in the issue, and regulatory transparency and accuracy of the share distribution process. While quite voluminous, the letter completely failed to address many questions from Rep. Ralph Norman's initial correspondence, including, but not limited to questions 4, 5, 6, 7, 8, and of paramount importance, question 9, which requested the audited consolidated count of shares held in each brokerage. Overall, the letter's tone and content leave much to be desired in terms of addressing investor concerns and ensuring market integrity. https://norman.house.gov/uploadedfiles/2024-01-31-finra-response-to-rep-norman-regarding-mmtlp.pdf

- February 6th, 2024: In response to Rep. Ralph Norman's inquiry regarding MMTLP, SEC Chair Gary Gensler issues a letter that lacks substantive answers to the specific questions raised by Norman. Instead, Gensler defers certain inquiries to FINRA, emphasizing that requests for information and analyses performed by FINRA are best addressed by the organization itself. Despite Norman's request for share count information and inquiries about potential violations of securities laws or SEC rules, Gensler's response remains vague, citing confidentiality and enforcement protocol. Ralph Norman expressed his frustration with this response on the X platform, characterizing it as "empty" and "worthless," underscoring its arrival six days after the deadline requested and lack of meaningful information. https://twitter.com/RepRalphNorman/status/1754981831668007341

- February 8th, 2024: Next Bridge Hydrocarbons, Inc. issues a statement expressing differing perspectives on certain key points raised by FINRA and the SEC regarding the U3 halt of the MMTLP security and outstanding short positions in Next Bridge. The company called for transparency in accounting for total outstanding uncovered short positions and urged FINRA and the SEC to take proactive steps to ensure comprehensive data collection. Next Bridge raised concerns about potentially misleading information and emphasized the need for clarity regarding the limitations of FINRA's data. Additionally, they questioned the decision-making process behind the U3 halt, highlighting discrepancies between FINRA's regulatory powers as enumerated under Rule 6490, their actions and the issuers' intentions (see August 16th, 2024 entry below). This statement underscores Next Bridge's commitment to transparency and collaborative efforts to address ongoing investor concerns and regulatory challenges. https://www.prnewswire.com/news-releases/next-bridge-hydrocarbons-inc-releases-statement-302058038.html

- February 26, 2024: Additional correspondence between Next Bridge Hydrocarbons and FINRA is released via FINRA's website. In these communications, CEO Greg McCabe continues to express concerns about the U3 trading halt of MMTLP and requests a meeting with representatives of FINRA and the SEC to address these issues. Of particular interest, CEO McCabe expresses his desire to share communications from short seller representatives seeking to purchase "many multiples" of the amount of shares that FINRA has reported short, raising serious concerns about the discrepancy between reported short positions and the actual interest from short sellers, as well as the potential impact on market stability and investor confidence.. While FINRA has agreed to such a meeting, as of this writing, there has been no response from SEC representatives, including all five commissioners, regarding attendance of such a meeting. https://www.finra.org/media-center/newsreleases/2023/finra-correspondence-next-bridge-hydrocarbons

-

April 23, 2024: Devin Nunes, former Congressman and current CEO of Trump Media & Technology Group sends a letter to key House Committee Chairmen addressing concerns about potential manipulation of TMTG stock (traded as "DJT" on Nasdaq). In his letter, Nunes highlighted that DJT had appeared daily on Nasdaq’s “Reg SHO threshold list” since April 2, 2024, suggesting possible unlawful trading activities such as naked short selling. The letter underscores that these issues are reflective of a broader problem impacting financial markets, particularly regarding naked shorting and inadequate oversight of market participants. Nunes emphasized that this situation is part of a larger pattern highlighted by a recent open letter signed by 74 members of Congress, which specifically addressed the MMTLP situation and its implications for market manipulation. This connection illustrates that the problems faced by TMTG are part of systemic issues affecting the financial markets, reinforcing the need for increased regulatory scrutiny and policy reform, and further investigation into the MMTLP trading activity. https://www.sec.gov/Archives/edgar/data/1849635/000114036124021595/ny20026576x11_ex99-1.htm

- June 5, 2024: – A follow up letter is sent by 40+ Members of Congress in a bipartisan effort led by Ralph Norman and Pete Sessions, to SEC Chair Gary Gensler. The letter followed up on a previous request for the SEC to review the events surrounding MMTLP. The letter reiterates that these shares were created during the merger between Meta Materials (MMAT) and Torchlight Energy Resources (TRCH) to provide preferred stock dividends to TRCH shareholders. The letter further states that in contradiction to information relayed to the investing public,, on December 9, 2022, FINRA issued a U3 halt on trading MMTLP shares, preventing further trades. The letter mentions that the trading halt has led to over 40,000 letters from concerned constituents being sent to Congress. The letter references statements made by the SEC related to investigations that are ongoing surrounding this issue, and requests the SEC to brief Congress on the results of their investigation into these events by June 15, 2024. https://x.com/RepRalphNorman/status/1798381531305783754

- August 9, 2024: Meta Materials Inc. announces that "after consideration of all strategic alternatives, Meta Materials, Inc., a Nevada corporation (the “Company”), ceased operations and filed a voluntary petition for relief under the provisions of Chapter 7 of Title 11 of the United States Code, 11 U.S.C. §101 et seq. (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Nevada (the “Bankruptcy Court”), Case No. 24-50792". The bankruptcy filing resulted in the removal of all executives and board members. Control of the company now rests with a court-appointed trustee, who will liquidate assets and oversee the bankruptcy estate. A creditors' hearing will be scheduled, and a Notice of Bankruptcy Case Filing will be sent to known creditors. Attorney Wes Christian has confirmed that the bankruptcy process may provide access to critical trading data related to MMAT, MMATF, TRCH, and MMTLP. (https://www.sec.gov/ix?doc=/Archives/edgar/data/0001431959/000095017024094376/mmat-20240807.htm)

-

October 31, 2024: In a major development, the Chapter 7 Trustee for Meta Materials Inc. announces that they have formally retained Christian Attar and Kasowitz Benson Torres LLP as special litigation counsel. The firms will investigate and, if warranted, pursue legal action over suspected illegal trading practices, including naked short selling and spoofing, related to multiple CUSIPs: MMAT, MMATF, TRCH, and MMTLP. The Trustee has secured $11 million in litigation funding, ensuring no financial burden on the estate. This move confirms that a serious legal effort is already underway to expose misconduct and seek accountability via the Meta Materials bankruptcy court proceedings. (https://storage.courtlistener.com/recap/gov.uscourts.nvb.420818/gov.uscourts.nvb.420818.98.0.pdf) (https://x.com/palikaras/status/1889858166789136749)

- August 16, 2024: Georgios Palikaras, former CEO of Meta Materials Inc., submits an affidavit in the case "Inter-Coastal Waterways LLC v. Tradestation Securities, Inc." (Case No. 0:24-cv-60891-AHS) in the Southern District of Florida. The affidavit details the events leading to and following the MMTLP trading halt. In his statement, Palikaras disclosed that on or about December 8, 2022, FINRA unilaterally revised the language of the Company’s December 6, 2022 corporate action notice. This revision was made without the input or authorization of Meta Materials and took place after FINRA had a call discussion with DTCC on December 7, 2022, excluding Meta Materials and Next Bridge’s counsel from the call. Palikaras described how the revised notice, published on FINRA’s Daily List, altered the language to state, “MMTLP will be deleted effective 12/13/22,” a change made without the Company’s consent (a clear violation of FINRA Rule 6490). Despite Meta Materials' attempts to seek clarification and resolution through multiple inquiries and discussions with FINRA’s Office of the Ombudsman, no satisfactory explanation for the changes that were made, or the subsequent trading halt was provided. Palikaras criticized FINRA for not disclosing the reasons behind the halt upfront, which he argued contributed to shareholder confusion and did not allow the Company to address the situation effectively. While the affidavit does not explicitly call for increased accountability and transparency, Palikaras’ criticism of FINRA’s lack of communication and the impact on shareholders implies a need for greater regulatory oversight and clarity. https://storage.courtlistener.com/recap/gov.uscourts.flsd.668249/gov.uscourts.flsd.668249.39.1_1.pdf

- October 8, 2024: Next Bridge Hydrocarbons, Inc. announces that University Lands decided not to extend the Development Unit Agreement for the Orogrande asset, which was the largest underlying asset belonging to the company. The agreement is set to expire on December 31, 2024, with University Lands seeking to terminate it immediately, a decision Next Bridge has opposed. Chairman and CEO Greg McCabe expressed the company’s dismay over the decision while assuring shareholders that despite the setback, Next Bridge would continue expanding and diversifying its portfolio beyond the Orogrande asset, promising future updates on the company's progress. Many believe that the loss of the Orogrande lease is tied to Next Bridge’s failure to maintain its drilling obligations, which is seen as a direct result of the SEC's prolonged withholding of the company's ability to raise necessary funds through an S-1 offering. Since January 2023, the SEC has apparently hamstrung the offering, making it difficult for Next Bridge to secure the capital required to meet its drilling obligations and maintain the lease. Additionally, in light of McCabes statement Next Bridge had put forth what was believed to be a strong and fair proposal for renewal, there are allegations of third-party sabotage and regulatory involvement being contributing factors to Next Bridge's loss of the Orogrande lease. (https://www.prnewswire.com/news-releases/next-bridge-hydrocarbons-announces-texas-university-lands-system-decision-302270656.html)

- December 31, 2024: A FOIA request to University Lands uncovered an email from Next Bridge Hydrocarbons CEO Greg McCabe, dated April 15th, 2024, revealing that he and other company officers had been subjected to ongoing threats and harassment. The email, addressed to UL, outlines how short sellers engaged in an orchestrated attack against the company, including defamatory efforts to convince UL that NBH was fraudulent. McCabe also detailed a campaign of intimidation that escalated to anonymous threats via text and email, with one particularly egregious incident where a threatening email about him was sent to his daughter-in-law’s workplace, a private school, copying every member of the faculty. Many investors believe that these aggressive and malicious tactics ultimately contributed to the company losing its lease on the Hudspeth County drilling unit, demonstrating the extreme lengths to which short sellers went to manipulate and interfere with NBH operations. This level of interference is unprecedented and underscores the urgent need for regulatory and legal action to prevent such market abuses from continuing. (https://x.com/RedHeelzz/status/1874144952604631311)

- February 21, 2025: In a press release, Next Bridge Hydrocarbons reveals that the SEC has been very arduous to deal with in their commenting on its 2023 10-K, delaying its S-1 registration for public offering. Over two years, NBH has endured four rounds of 10-K comments and five on the S-1, forcing costly restatements of two 10-Ks and six 10-Qs over the timing of the Orogrande impairment. Despite NBH not being publicly traded, the SEC rejected a footnote correction, insisting on an extensive restatement with no clear justification. Strangely, the SEC has also demanded NBH adopt a corporate history narrative that disregards the management and shareholder transition from Meta Materials, a stance NBH called “demonstrably false.” Compounding concerns, the SEC’s latest intervention came just as NBH was set to file its pricing amendment in September 2024, raising questions about the timing and impact on the company’s capital raise. These delays have halted multiple business ventures and stalled efforts to resolve unsettled trades from FINRA’s U3 halt, further harming NBH and its 65,000 shareholders. (https://www.prnewswire.com/news-releases/next-bridge-hydrocarbons-announces-receiving-further-sec-comments-302382028.html)

-

March 6, 2025: In a major legal breakthrough, the Chapter 7 Trustee overseeing Meta Materials’ bankruptcy issues subpoenas to Citadel Securities, Charles Schwab, Anson Funds, NASDAQ, DTCC, FINRA, TD Ameritrade, Virtu Financial, and TradeStation Securities demanding the production of trading records, order routing data, electronic communications, and records related to naked short selling and failures to deliver (FTDs) in MMTLP and Meta Materials stock (MMAT). This marks the first time a court action has compelled financial institutions to turn over evidence related to the MMTLP trading halt and suspected market manipulation. This represents a critical escalation in the legal battle for transparency, as court-ordered discovery could finally expose the full extent of synthetic shares, abusive shorting practices, and regulatory failures that led to the trading halt. Widely accepted as the single most important judicial development to date, these subpoena force entities suspected of misconduct to produce hard evidence, something that lawsuits, FOIA requests, and Congressional inquiries had so far failed to achieve. (https://www.dropbox.com/scl/fi/eovssvdwg2vcgv97e1z5d/SUBPOENA-03062025.pdf?rlkey=gkzvka2osc3aov5k7utdq63v1&e=1&st=8hel515b&dl=0)

All Congressional letters addressed to the SEC and FINRA can be found at the following link: https://drive.google.com/file/d/1DA3AQ50YU2XTs-xWC45nG0Kk0deOFaJ7/view

- Concerted efforts to bring this issue to the attention of Congress have been underway since Mid March 2023.

- In June of 2023, FINRA delivered a briefing to what we are told was possibly 17 staffers for different members of the House Committee on Financial Services where it is believed that they refused to provide a share count, but acknowledged that there is indeed an imbalance.

- FINRA has faced litigation in multiple states and a pre-trial petition for discovery in New York State under CPLR §3102. These legal actions are simply calling upon FINRA to do what they are supposed to do, and provide transparency to individual investors in the form of concrete data. This is akin to having to sue the US Army to defend the country against a military attack from a foreign government. Instead of simply providing the data, FINRA has instead chosen to spend resources fighting each and every effort. All legal filings can be found here: https://mmtlpresources.com/litigation/

- Counterfeit shares and similar practices affect the entire financial market and pose a threat to national security. Anyone with a 401k, IRA, or any other type of account tied to the stock market is at risk, because this is not the only security they are doing this to. It is however, the only security that is poised to uncover this massive fraud being perpetuated against the investing public, due to the nature of the halt, and the fact that the security is no longer tradable with such a massive failure to deliver taking place.

- People have had their families torn apart, lost their homes, suffered health issues, and there has been one confirmed loss of life in the State of Arizona.

- It is believed that 80,000 or more families currently have their money frozen as a result of this situation.

- First responders, retirees, and military veterans have all been affected.

- As of this writing there are 140 United States military veterans known to have over $12 Million of their hard earned money frozen in this investment. These 140 veterans come from a sample pool of roughly 2,000 shareholders out of roughly 80,000. If one were to extend that sample size outward to account for the full shareholder base, this brings the amount of money belonging to Veterans that is currently frozen into $300m-$500m range.

- The only acceptable resolution is to reconcile outstanding shares to the authorized amount through a predetermined trading period with independent oversight (which as indicated above, the company attempted to do but FINRA denied).

With utmost respect, the first move should be for an AUDITED AGGREGATED SHARE COUNT to be performed. An audited aggregate share count from each broker dealer would provide the number of shares that each of them is obligated to deliver to their clients. However, the share count MUST be independently audited, and MUST contain the amount of shares each broker was allotted, as well as the amount of shares they are liable to deliver to their clients. This would require NO analysis, and subsequently, would cost NOTHING to analyse. If and when a share imbalance is revealed, then the next question is “How did this happen?”. The answer would like in analysis of the blue sheets (comprehensive trading data which shows exactly who did what), to be able to ascertain exactly whom is responsible for what. If indeed there is an imbalance, the expense of Congress or any other agency paying for the formation of an investigative committee, and the blue sheets to be analyzed would be justified, because at that point it becomes a matter of national security (I can assure you this is not the only stock they are doing this to). Furthermore, with Blue Sheet Data in hand, legislators can effectively be guided towards crafting necessary legislative measures to ensure that this situation never happens again. ANY member of Congress attached to an effort that would uncover such a massive fraud that is stripping the American public of their savings and wealth would be lauded as a hero.

Written by "Drew Diligence" - @KarmaCollects on Twitter