The arrival of GST in India has ignited a tax revolution, prompting businesses to upgrade their ERP and accounting systems to stay competitive in the ever-changing landscape.Companies need to ensure they correctly set up CGST, SGST, IGST, and different tax slabs, which can range from 0% to 28%, in their systems following their implementation.Setting up Indian GST in Odoo involves creating tax slabs for both intra-state and inter-state sales, configuring tax combinations, and ensuring that invoices comply with GST regulations. Techspawn can offer guidance and support with accounting needs.

Get ready to conquer the complexities of Indian GST with Odoo! Seamlessly manage taxes, set up unique tax slabs for various sales situations, and effortlessly create GST-compliant invoices with all necessary details. Let Odoo streamline your tax process and elevate your business game!Odoo’s flexible and user-friendly interface can help businesses navigate the complexities of Indian GST and ensure smooth operations in the changing tax environment.In this blog post, we will explore how to streamline and optimize Indian GST in Odoo effectively.

Table of contents:

1. What is GST?

2. What are the types of GST?

3. How we can configure the GST in Odoo?

4. How to Create tax Slabs in Odoo?

5. How to Implement E-way Bills in Odoo?

6. How to Customizing Invoice Templates?

7. What are the new features in odoo 17 india accounting?

8. Conclusion

1. What is GST?

GST, also known as Goods and Services Tax, is an indirect tax that applies to the supply of goods and services in India. It is a comprehensive taxation system that replaces several other indirect taxes like VAT, excise duty, and service taxes, aiming to streamline the tax structure for greater efficiency.

| CGST | Central collects the revenue (Intra State Sale) |

|---|---|

| SGST | State collects the revenue (Intra State Sale) |

| IGST | Central collects the revenue (Inter State Sale) |

3. How we can configure this GST in Odoo? ?

To configure Indian GST in Odoo, businesses first need to set up tax slabs for both intra-state and inter-state sales. This involves creating different tax combinations based on the various tax rates ranging from 0% to 28%. By configuring GST in Odoo, companies can ensure that their invoices comply with the regulations set forth by the government.

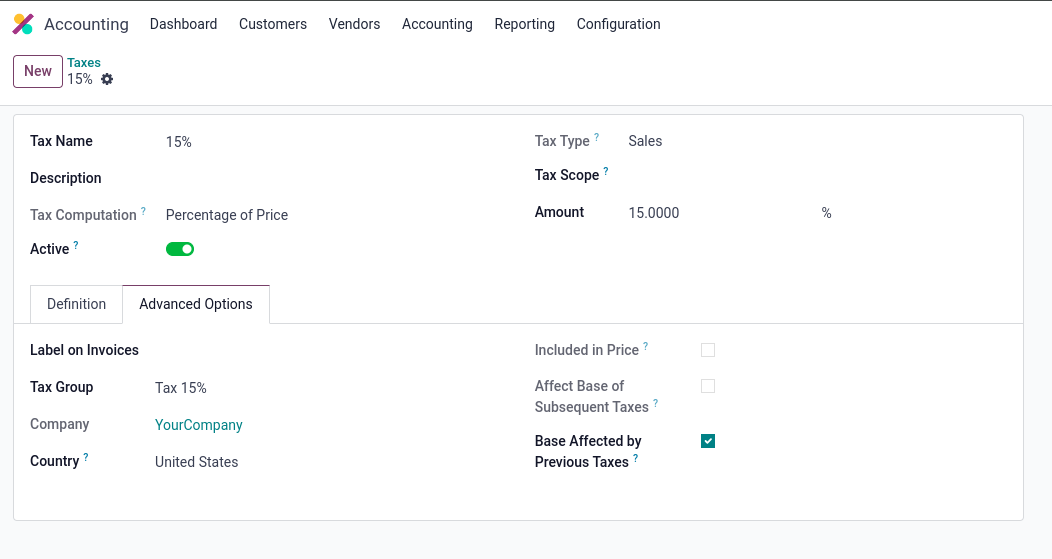

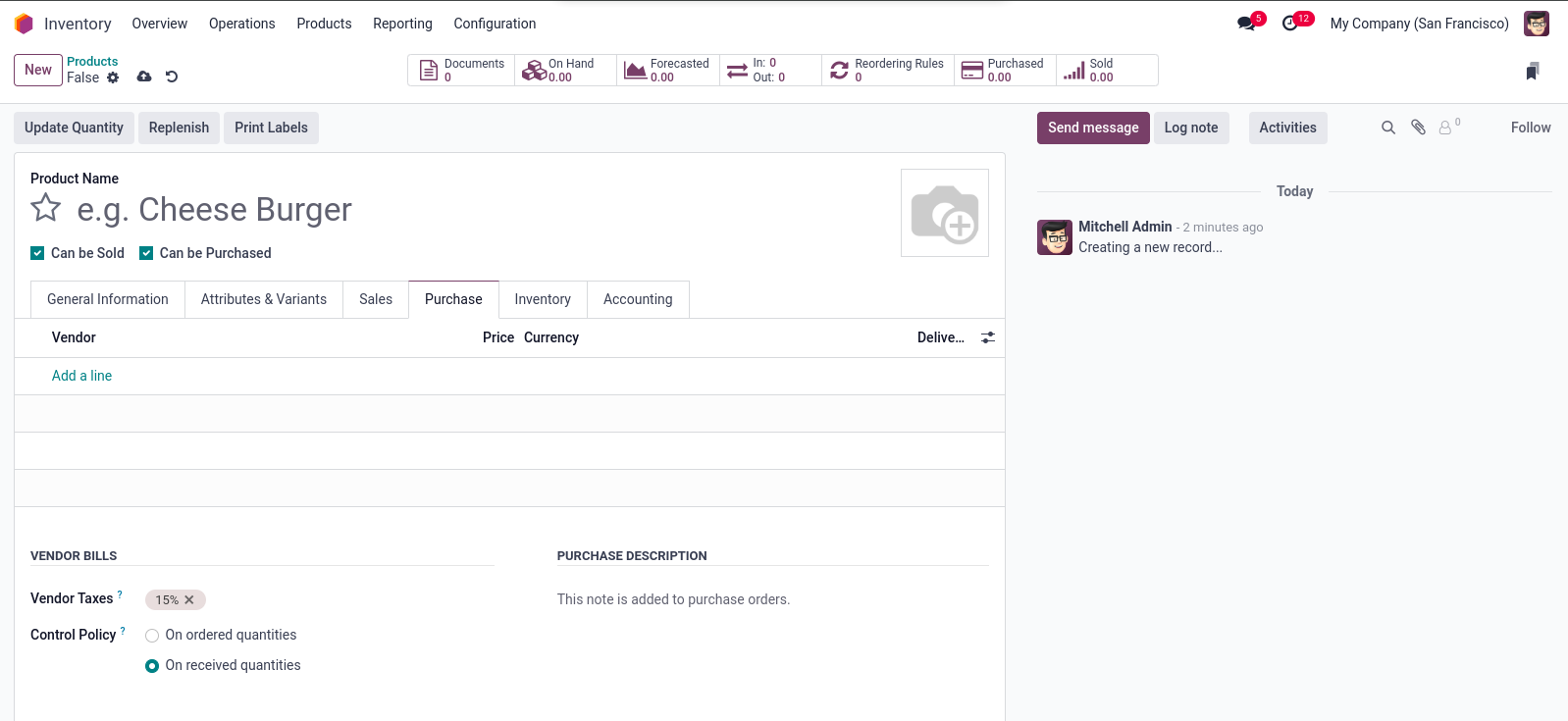

In order to streamline the GST management process, businesses can use Odoo’s user-friendly interface to set up tax slabs and customize invoice templates with all necessary details. By utilizing Odoo’s features, companies can easily navigate the complexities of Indian GST and ensure smooth operations in the changing tax environment.In Odoo, the first step in managing Indian GST is to create necessary tax configurations. Odoo’s tax system is mature, flexible, and evolving, allowing users to easily configure different types of taxes. For intrastate sales, taxes like SGST and CGST must be created, while for interstate sales, taxes like IGST should be set up. Setting up Tax Slabs is also essential.

Configuring Indian GST in Odoo involves setting up tax slabs for both intra-state and inter-state sales, creating different tax combinations based on various tax rates ranging from 0% to 28%. By configuring GST in Odoo, businesses can ensure that their invoices comply with government regulations.

Using Odoo’s user-friendly interface, businesses can easily set up tax slabs and customize invoice templates with all

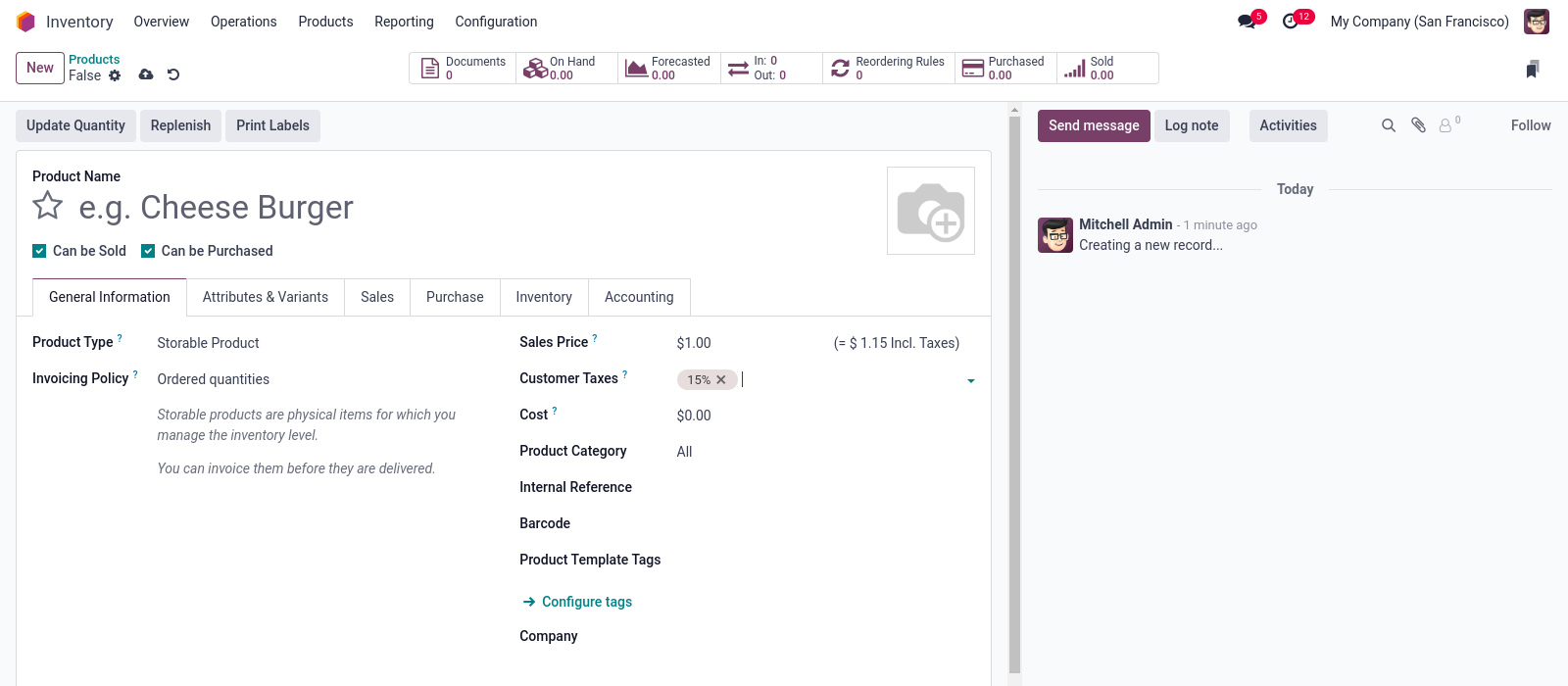

For example, if a company sells a product that falls under the 18% tax slab, they can create a tax slab named “18% GST” in Odoo and associate it with the corresponding tax configurations for intrastate or interstate sales. This way, whenever a sale is made, Odoo will automatically calculate the GST amount based on the defined tax slabs.

There are six different tax slabs in GST ranging from 0% to 28%. These slabs need to be created in Odoo to accurately calculate taxes for sales transactions. By setting up taxes for different slabs and specifying the tax computation method, users can ensure accurate tax calculations in their invoices. Generating GST-Compliant Invoices:

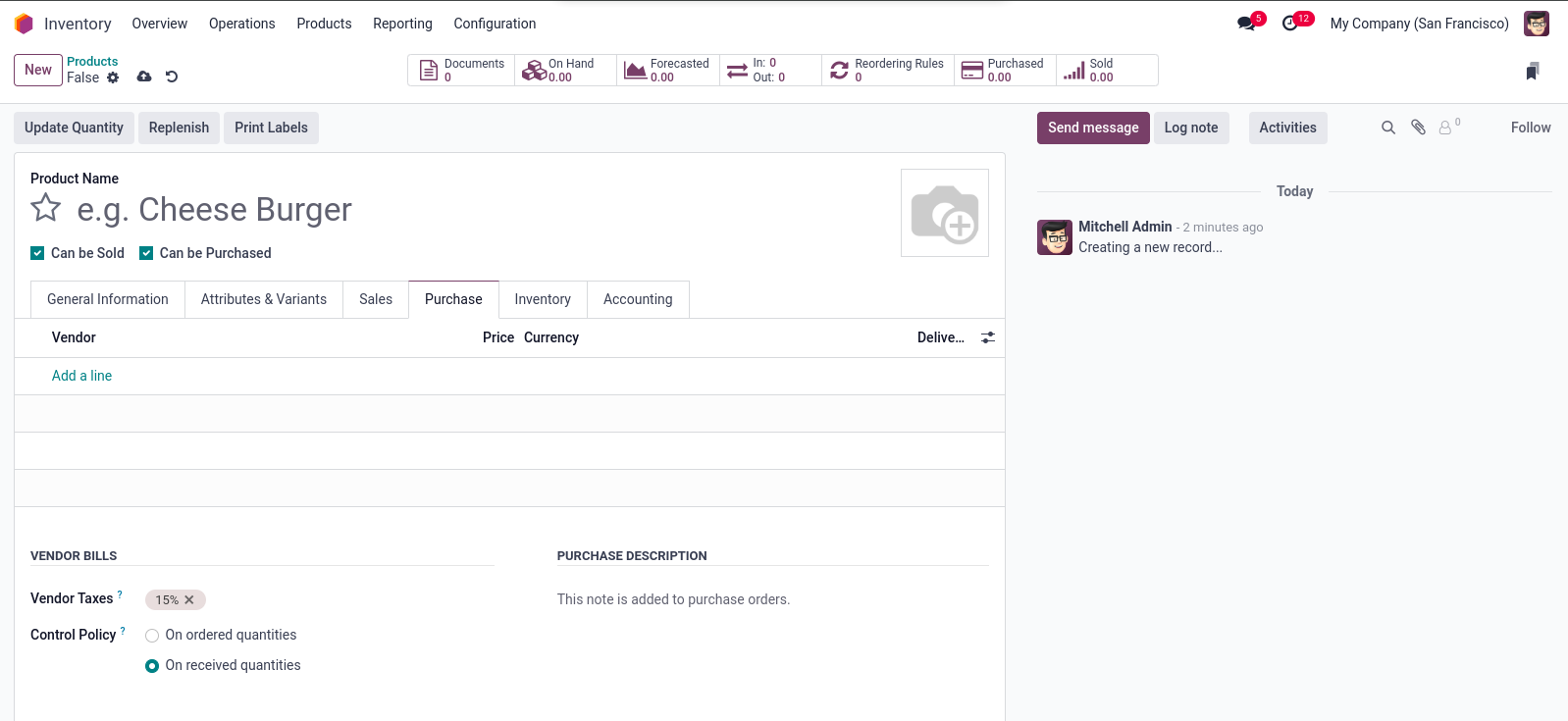

Under the GST system, businesses are eligible to claim input tax credit (ITC) for the taxes they have already paid on their purchases. Odoo provides a seamless way to manage ITC by allowing users to reconcile their purchases with the respective invoices. This ensures that businesses can accurately account for the taxes paid and claim ITC without any discrepancies.

Once the tax configurations and slabs are set up in Odoo, businesses can generate GST compliant invoices with ease. Odoo allows users to customize the invoice templates to include all the necessary information required by the GST law. This includes details such as the GSTIN of the business and the customer, invoice number, date, and other essential information. With the help of Odoo’s intuitive interface, users can easily generate invoices that adhere to the GST guidelines. Filing GST Returns:

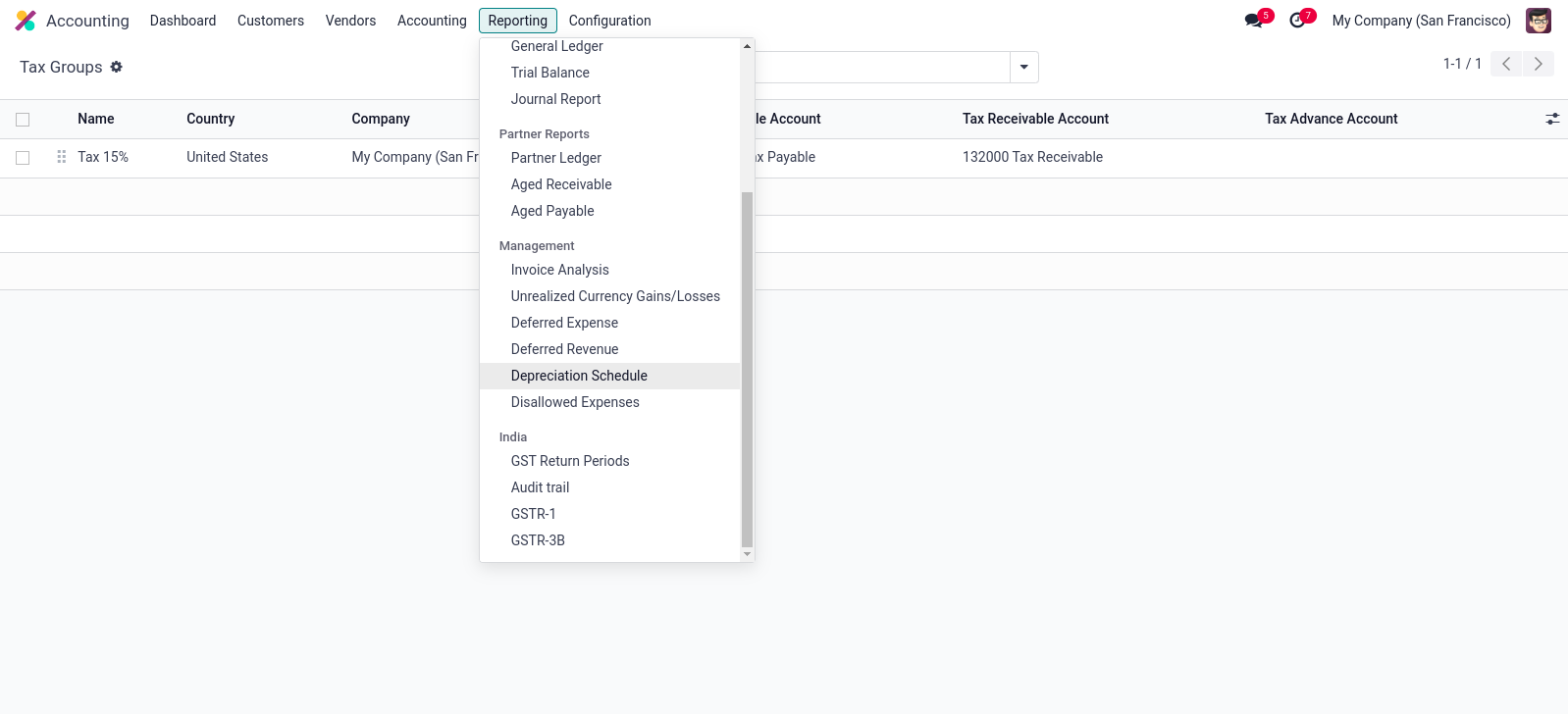

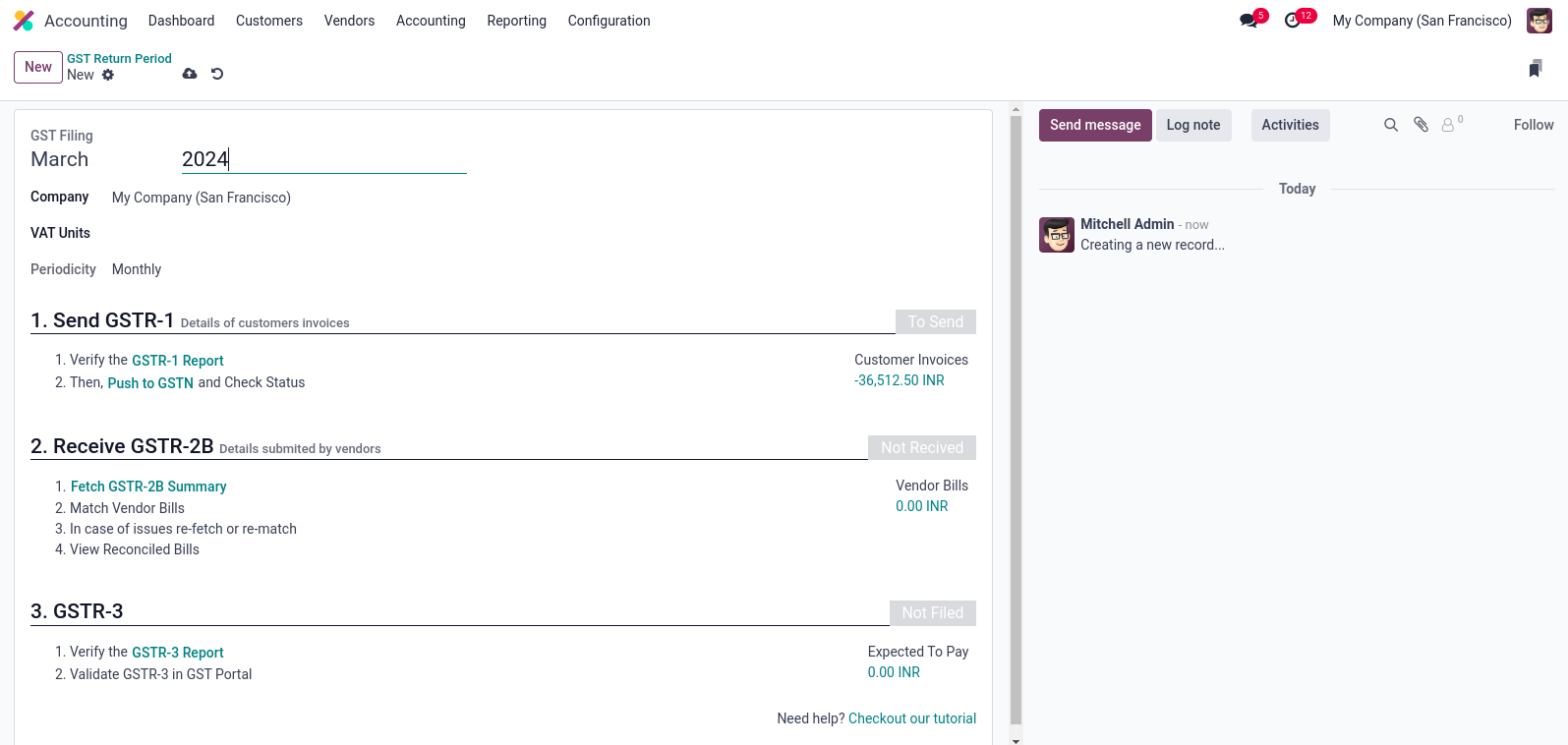

One of the crucial aspects of GST compliance is filing regular returns. Odoo simplifies this tedious process by providing an integrated solution for filing GST returns.

E-way bills are mandatory for the movement of goods worth a certain threshold in India. Odoo seamlessly integrates with the E-way bill portal to generate E-way bills for businesses. Users can generate E-way bills directly from the Odoo system, eliminating the need for manual data entry and reducing the chances of errors. The system automatically pulls the relevant information from the invoices, such as the consignor and consignee details, invoice value, and transport details, to generate the E-way bill. This streamlines the process and ensures compliance with the E-way bill requirements.

Customize your invoices in Odoo to meet GST requirements and wow your clients with detailed and personalized invoices. Add fields like GSTIN numbers, invoice details, and tax breakdowns for a unique touch. Make your invoices stand out by including extra information such as reverse charge taxes, transportation details, and place of supply. Techspawn can create customized reports to suit your accounting needs perfectly. Let’s think outside the box and stay compliant with Odoo’s invoice customization options!

By streamlining and optimizing your Indian GST management with Odoo, businesses can ensure accurate tax calculations, generate GST-compliant invoices, manage input tax credit efficiently, file GST returns seamlessly, and implement E-way bills with ease and customize your invoice templates to meet GST requirements.

Taxation

Odoo 17 brings some exciting new features to Indian accounting, specifically focusing on taxation and GST compliance. Here are some of the key features in Odoo 17 India accounting:

1. Taxation: Odoo 17 offers enhanced support for various tax configurations, making it easier for businesses to manage their tax obligations. Users can set up different tax slabs, compute taxes accurately, and ensure compliance.

2. GST Filing: Odoo 17 simplifies the process of filing GST returns by providing users with a user-friendly interface to input and reconcile their tax data. Businesses can easily generate GST-compliant invoices and track their input tax credit to ensure accurate filing.

3. Customer Taxes: With Odoo 17, businesses can set up customer-specific tax rules and apply them automatically to invoices. This feature allows businesses to streamline the invoicing process and ensure that the correct taxes are applied to each customer transaction.

4. Vendor Taxes: Similarly, Odoo 17 allows businesses to set up vendor-specific tax rules, ensuring that the appropriate taxes are included in purchase orders and vendor invoices. This feature helps businesses maintain accurate records of their tax obligations and simplify the reconciliation process.

5.TAX ID,UPI Id : Additionally, Odoo 17 introduces the ability to store and manage Tax ID and UPI IDs for vendors and customers. This feature allows businesses to easily track and verify tax information for their business partners, streamlining the process of tax compliance.

6.Tax reports :

- GSTR-1 report

The GSTR-1 report is divided into sections. It displays the Base amount, CGST, SGST, IGST, and CESS for each section. - GSTR-3 report

The GSTR-3 report contains different sections:- Details of inward and outward supply subject to a reverse charge;

- Eligible ITC;

- Values of exempt, Nil-rated, and non-GST inward supply;

- Details of inter-state supplies made to unregistered persons.

Embark on a smooth and hassle-free journey with Techspawn as we guide you through setting up Indian GST in Odoo. From tax slabs to GST-compliant invoices, we’ve got all your accounting needs covered. Say farewell to tax time woes and join us in conquering it together!Techspawn is on of the best odoo implementation company in the market, with a team of experts ready to assist you every step of the way. Don’t let GST management overwhelm you – streamline and optimize your processes with Odoo. Contact Techspawn today and take your Indian GST management to the next level!