The financial world thrives on real-time data, and businesses, traders, and developers rely on Stock Market APIs to access crucial stock-related insights. Whether you're building an investment platform, a trading bot, or an analytics dashboard, selecting the right stock market data API can make all the difference. Stock APIs provide seamless access to market data, allowing developers to integrate real-time or historical stock prices into their applications. With increasing reliance on digital platforms for financial decision-making, having a reliable API ensures that businesses stay competitive in a fast-paced market.

Choosing the right stock market API is not just about accessing data, it's about reliability, ease of integration, pricing, and scalability. Some APIs offer extensive historical data, while others focus on real-time stock tracking, tick data, and advanced analytics. The purpose of this guide is to compare the best stock data APIs available today based on their features, pricing, performance, and specific use cases. Whether you are an independent trader, a fintech startup, or a large enterprise, this guide will help you find the most suitable API for your needs.

1. TagX Stock Market Data API

TagX specializes in providing reliable and timely stock market data, ensuring that businesses and developers can make informed decisions. It offers 15-minute delayed data, end-of-day data, and pre-market & after-market data, making it a comprehensive solution for investors and financial analysts. Additionally, it provides market research data, country economic indicators, and global market coverage, giving users access to valuable insights. TagX supports 20k+ securities within 30 minutes of market close, ensuring up-to-date market information. The API integrates seamlessly into various platforms, making data collection effortless.

Pricing

- Free plan available with basic market data.

- Premium plans start at $80 per month, offering advanced analytics and enterprise-level access.

- Custom pricing options available for large-scale businesses and fintech enterprises.

Performance

TagX delivers exceptional data accuracy and seamless access to global financial insights. Its cloud-based infrastructure ensures fast response rates and minimal downtime. The API’s real-time market data capabilities provide traders and businesses with up-to-the-minute stock insights. With robust security measures and scalable API access, TagX is a preferred choice for developers looking for reliable, low-latency data transmission.

Use Cases

- Make informed trading decisions with real-time and accurate market data.

- Obtaining global market insights and in-depth financial research data.

- Enhancing financial applications with end-of-day and pre/post-market stock updates.

- Integrating seamlessly into investment tracking platforms and analytical dashboards.

- Developing trading bots and AI-driven market research solutions.

2. Finnhub

Finnhub is an AI-powered best stock data API offering a comprehensive suite of financial market data. It includes real-time stock quotes, financial statements, news, earnings reports, and insider transactions. The API supports multiple asset classes, including stocks, forex, and cryptocurrencies. Finnhub also provides sentiment analysis and alternative data sources, such as economic indicators.

Pricing

- Free plan with limited access.

- Paid plans start at $10 per month.

Performance

Finnhub is optimized for high-performance applications with low-latency data retrieval. Its AI-powered analytics provide deep market insights, making it an excellent choice for professional traders and data-driven businesses.

Use Cases

- Creating stock market analysis tools with sentiment tracking and financial reports.

- Building high-speed trading platforms with AI-driven stock predictions.

- Fetching alternative financial data for diversified investment strategies.

- Developing research platforms for institutional investors and analysts.

- Automating portfolio management with dynamic stock alerts.

3. Quandl

Quandl, a part of Nasdaq, is a robust real-time stock data API provider focusing on financial, economic, and alternative datasets. It offers stock fundamentals, economic indicators, and sentiment analysis. Quandl is widely used for academic research and professional financial modeling.

Pricing

- Free datasets available.

- Premium plans vary depending on data sources.

Performance

Quandl provides highly structured and accurate stock data. It is widely adopted by hedge funds and quantitative researchers for data analysis and predictive modeling.

Use Cases

- Back-testing trading strategies using high-quality historical stock data.

- Developing financial models with alternative data sources.

- Enhancing stock screening tools for institutional investors.

- Analyzing corporate financial health with comprehensive datasets.

- Conducting economic research with global financial indicators.

4. EOD Historical Data

EOD Historical Data is a well-rounded stock API data provider offering historical stock prices, dividends, and company fundamentals. It supports 60+ global exchanges and delivers data in multiple formats, including CSV, JSON, and Excel.

Pricing

- Free plan with limited access.

- Paid plans start at $19.99 per month.

Performance

EOD Historical Data is optimized for financial analytics and long-term stock performance tracking. Its API response times are reliable, and the historical data coverage is extensive.

Use Cases

- Developing stock research platforms for long-term investors.

- Creating historical trend analysis tools for financial analysts.

- Enhancing investment portfolios with detailed dividend history.

- Powering financial news websites with accurate stock market insights.

- Integrating stock data into financial reporting solutions.

5. MarketStack API

MarketStack API provides real-time, intraday, and historical stock market data with a simple yet scalable RESTful API. It covers over 70 global exchanges and delivers financial data in JSON format. The API supports tick-level data, currency conversion, and comprehensive stock indices. With an intuitive documentation system, MarketStack ensures a smooth integration process for developers.

Pricing

- Free plan available with limited access.

- Paid plans start at $9.99 per month.

- Enterprise solutions available upon request.

Performance

MarketStack API delivers high-speed data access with minimal latency, making it a valuable tool for financial platforms requiring up-to-date stock information. The API's caching mechanisms help improve efficiency and scalability for larger applications.

Use Cases

- Fetching global stock market data for portfolio management applications.

- Developing financial analytics platforms with historical stock price trends.

- Powering investment research tools with intraday and end-of-day stock insights.

- Creating custom stock screeners with multi-exchange data support.

- Automating market analysis for fintech applications and hedge funds.

6. Tradier API

Tradier API is designed specifically for brokerage services and allows developers to build full-fledged trading applications. It provides real-time stock market data, options pricing, and trade execution functionalities. Tradier also supports advanced order types, portfolio tracking, and market streaming data via WebSockets.

Pricing

- Free market data with account creation.

- Premium trading features start at $10 per month.

- Commission-free trading for eligible accounts.

Performance

Tradier API is optimized for high-speed trading applications and offers seamless integration with brokerage platforms. Its robust infrastructure ensures minimal latency for real-time stock trading, making it a preferred choice for algo traders and brokerage firms.

Use Cases

- Developing trading platforms with real-time stock execution capabilities.

- Automating trading strategies with programmatic trade execution.

- Enhancing fintech applications with real-time portfolio tracking.

- Fetching historical trade data for back-testing investment models.

- Building algorithmic trading bots with advanced order functionalities.

7. Twelve Data API

Twelve Data API is a powerful financial market data solution that provides real-time and historical stock, forex, and cryptocurrency data. It supports over 100,000 financial instruments across multiple exchanges. Twelve Data also offers customizable technical indicators, AI-powered analytics, and WebSocket connectivity for real-time market streaming.

Pricing

- Free tier with limited API calls.

- Paid plans start at $29 per month.

- Enterprise solutions available for large-scale operations.

Performance

Twelve Data API delivers accurate and timely market data with advanced analytics capabilities. Its cloud-based architecture ensures high availability and smooth scalability for financial applications requiring large-scale data access.

Use Cases

- Developing AI-powered investment applications with predictive analytics.

- Integrating real-time forex and crypto data into trading platforms.

- Creating advanced market visualization tools with customizable indicators.

- Automating portfolio management solutions with dynamic stock tracking.

- Powering market sentiment analysis tools for institutional investors.

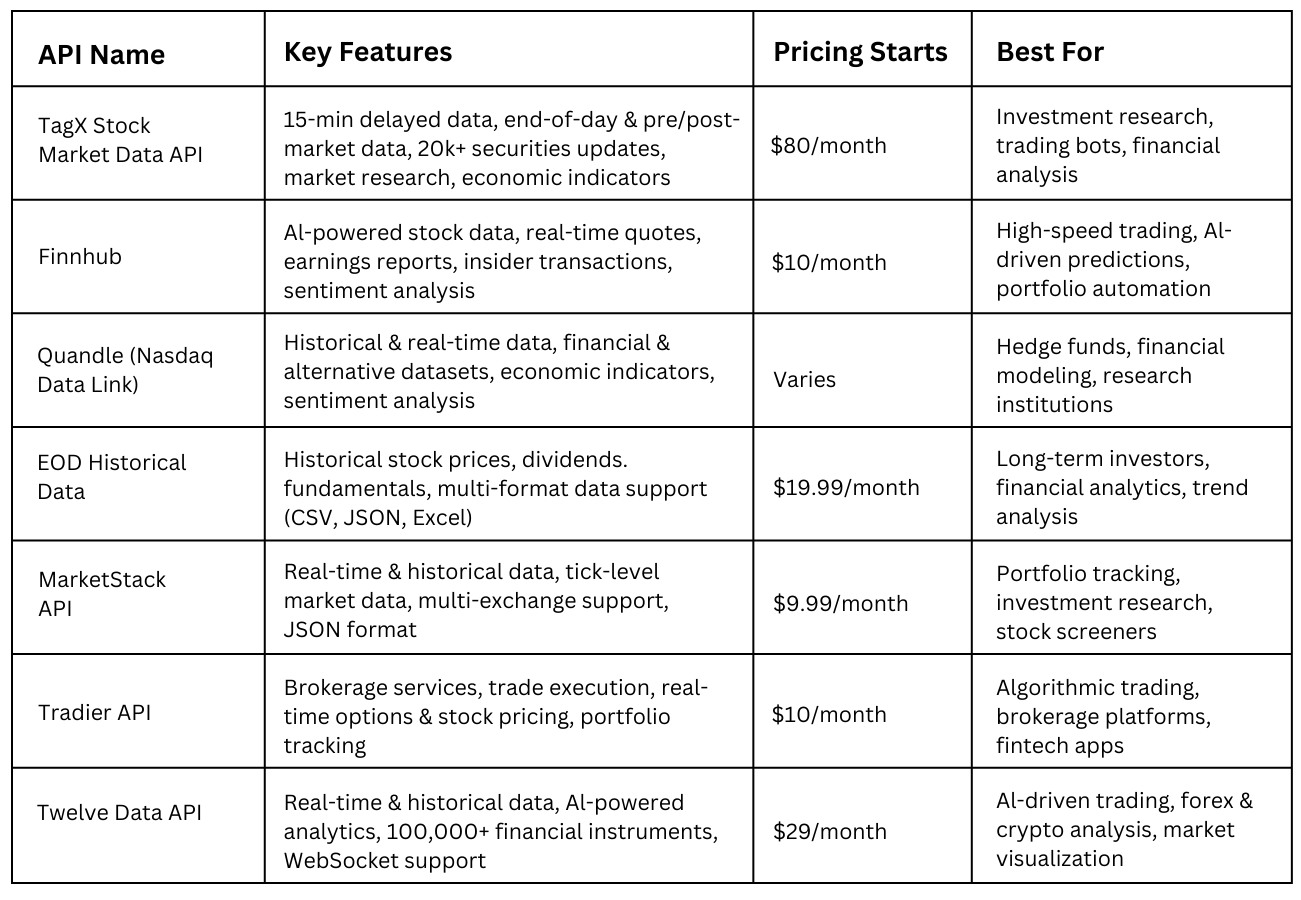

Comparison of the Best Financial Data APIs for Developers and Businesses

Why TagX is the Best Choice Among Others

If you're looking for a reliable, scalable, and data-rich stock market API, TagX offers several advantages over other providers. Here’s why TagX is the best choice:

Comprehensive Market Coverage

TagX provides extensive coverage across multiple global exchanges, making it one of the most versatile stock market APIs. Whether you're tracking stocks, ETFs, forex, or country-specific economic indicators, TagX ensures that businesses and developers have access to a wide range of financial data in one place.

Fast & Reliable Data Delivery

With 15-minute delayed data, end-of-day reports, and pre/post-market data, TagX ensures you receive timely stock market updates. More than 20,000 securities are updated within 30 minutes of market close, giving traders and analysts quick access to crucial financial insights.

Affordable & Flexible Pricing

Unlike many competitors, TagX provides a free plan for those who need basic market data. Its premium plans start at just $80 per month, offering advanced analytics and enterprise-level access. Large-scale businesses and fintech enterprises can also customize their plans to meet specific data requirements.

Seamless Integration & Developer-Friendly API

TagX offers an easy-to-use RESTful API that integrates seamlessly into trading platforms, investment tracking tools, and market analytics applications. Developers can fetch real-time and historical stock data effortlessly, reducing the time and effort required to build powerful financial applications.

Advanced Analytics & Research Data

TagX goes beyond basic stock market data by offering valuable market research insights and global financial trends. It is an ideal choice for investors and financial analysts looking for in-depth market intelligence to enhance their trading strategies and business decisions.

Low Latency & High Performance

With a cloud-based infrastructure, TagX delivers ultra-fast response times and minimal downtime. This makes it a preferred choice for high-frequency traders, financial institutions, and algorithmic trading applications that require real-time, low-latency market data.

Security & Reliability

TagX ensures enterprise-grade security protocols to protect sensitive financial data. Its robust system guarantees high reliability, making it trusted by fintech businesses, hedge funds, institutional investors, and professional traders worldwide.

Conclusion

The world of stock market data is dynamic, and having access to the right stock financial data API is crucial for developers and businesses aiming to build innovative financial applications. Each of the APIs discussed here offers unique benefits, whether in terms of real-time stock updates, historical data, or analytical insights. Your choice should depend on factors such as budget, data accuracy, latency, and scalability needs.

For businesses and developers looking for a tailored and advanced stock API solution, TagX provides cutting-edge financial APIs designed to meet diverse market demands. Their services ensure robust performance and reliability, helping businesses stay ahead in the competitive financial sector.

Ready to integrate a powerful stock market API into your platform? Explore these APIs today and take your financial applications to the next level!

Original Source, https://www.tagxdata.com/top-7-stock-market-apis-for-developers-and-businesses