Financial transactions including direct deposits, wire transfers, and online payments depend on the routing number. Knowing where to find this nine-digit code can speed up processes. The check routing number location is typically found at the bottom left corner of a check. This guide delves into the diverse sources where you can retrieve your routing number, offering a comprehensive approach to accessing this critical banking information swiftly. Have your routing number handy for periodic payments and fund transfers to simplify and avoid errors.

What Is a Routing Number?

It is crucial to understand the fundamental purpose of your routing number before proceeding to its location. This unique number, serves as a digital address required for electronic transactions. It indicates the financial institution that holds your account, whether it is a bank or a credit union, and is critical in facilitating transactions such as direct deposits, wire transfers, and electronic bill settlements. It also protects financial transactions from errors and unlawful transactions.

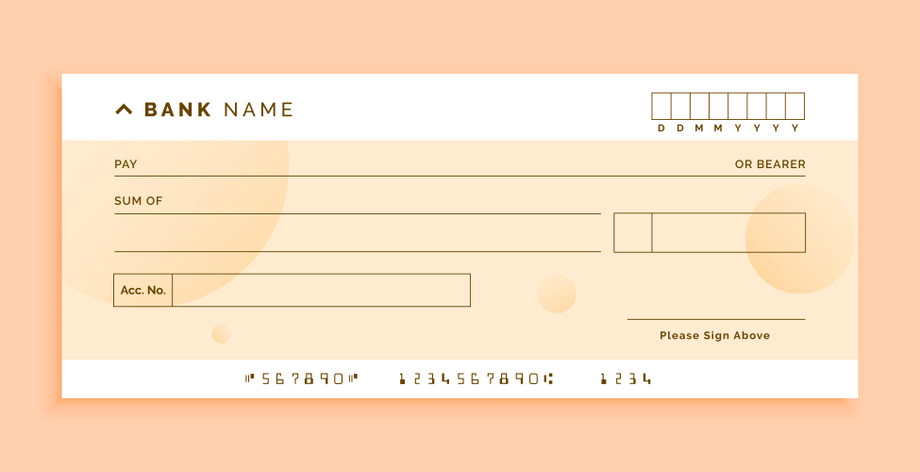

Checkbook

You can readily find your routing number on your checks, which are normally in the lower left corner. This nine-digit number is the initial sequence of digits on the bottom portion of the check. Following the routing number is your unique account number, which distinguishes your account within the bank's system. Check numbers, usually in the top right corner, helps to track the check you have issued. These details are needed for direct deposits, electronic payments, and wire transfer verification. Familiarizing yourself with the placement and significance of these numbers on your checks simplifies your banking activities and ensures accurate financial transactions.

Bank Statements

Your routing number is accessible on your bank statements, regardless of whether they are received electronically or by mail. This information can be found at the top or bottom of the statement. Bank statements serve as a dependable resource for confirming your routing number when your checkbook is not readily available. They provide a comprehensive overview of your financial transactions, making them a valuable tool for managing your accounts and verifying essential banking details.

Contact Your Bank

If you can't find your routing number using the above methods, don't worry. You can ask your bank for help. Their customer care team can help you find the right routing number to ensure accurate and reliable financial transactions. Contact your bank's customer support to avoid routing issues and transaction delays. These professionals are trained to provide correct and updated routing number information, helping you avoid confusion. Directly contacting your bank's customer service offers a tailored and efficient routing number response. This proactive strategy might improve your banking experience and financial activities. Do not hesitate to use this resource if you need help with routing numbers or other banking-related questions.

Bank routing numbers assist in simplifying financial transactions and transfer payments to the right account. Knowing your routing number accurately helps you manage your finances effectively. In cases of ambiguity or need for clarification, contacting your bank's customer care staff ensures accurate and dependable information for secure and error-free transactions. They can answer questions about routing numbers, account details, and other financial issues, giving you peace of mind and efficient banking.