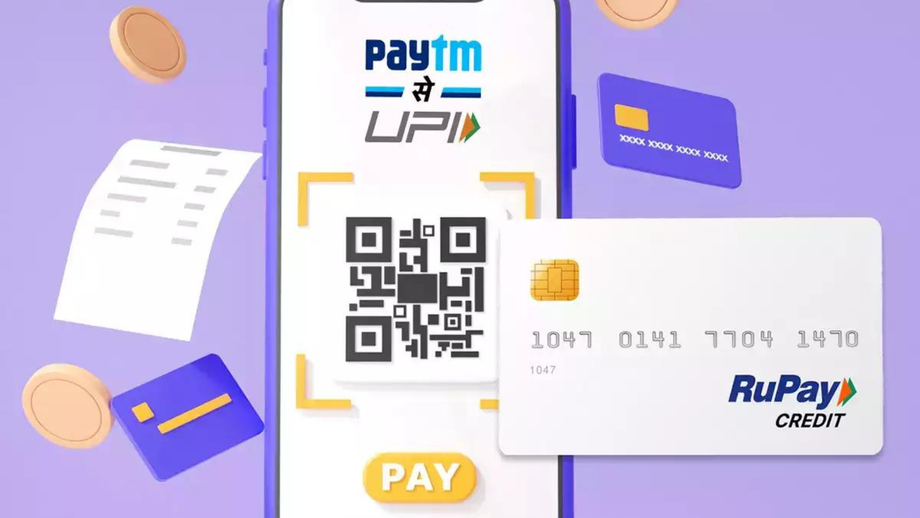

Paytm, a leading digital payment platform in India, has made a noteworthy announcement about its partnership with the State Bank of India (SBI) and the National Payments Corporation of India (NPCI) to introduce co-branded RuPay credit cards. This strategic collaboration aims to leverage the strengths of these prominent financial institutions to provide customers with enhanced payment solutions and a seamless digital banking experience. Check

Through the combination of Paytm's technological innovation, SBI's extensive banking expertise, and NPCI's robust payment infrastructure, the partnership aims to offer customers advanced payment solutions encompassing secure digital transactions, improved convenience, and an expanded acceptance network for RuPay credit cardholders.

The co-branded RuPay credit cards will prominently feature the RuPay logo, representing a widely accepted domestic card payment network across India. These cards will provide customers with a range of benefits, including appealing cashback rewards, exclusive offers, and discounts for both online and offline transactions.

In summary, this partnership marks a significant milestone in India's digital payment landscape as it seeks to revolutionize the credit card experience while promoting financial inclusion. By leveraging the combined expertise and resources of Paytm, SBI, and NPCI, the collaboration aims to enhance the accessibility and rewards associated with digital payments, ultimately contributing to the vision of a cashless economy in India.