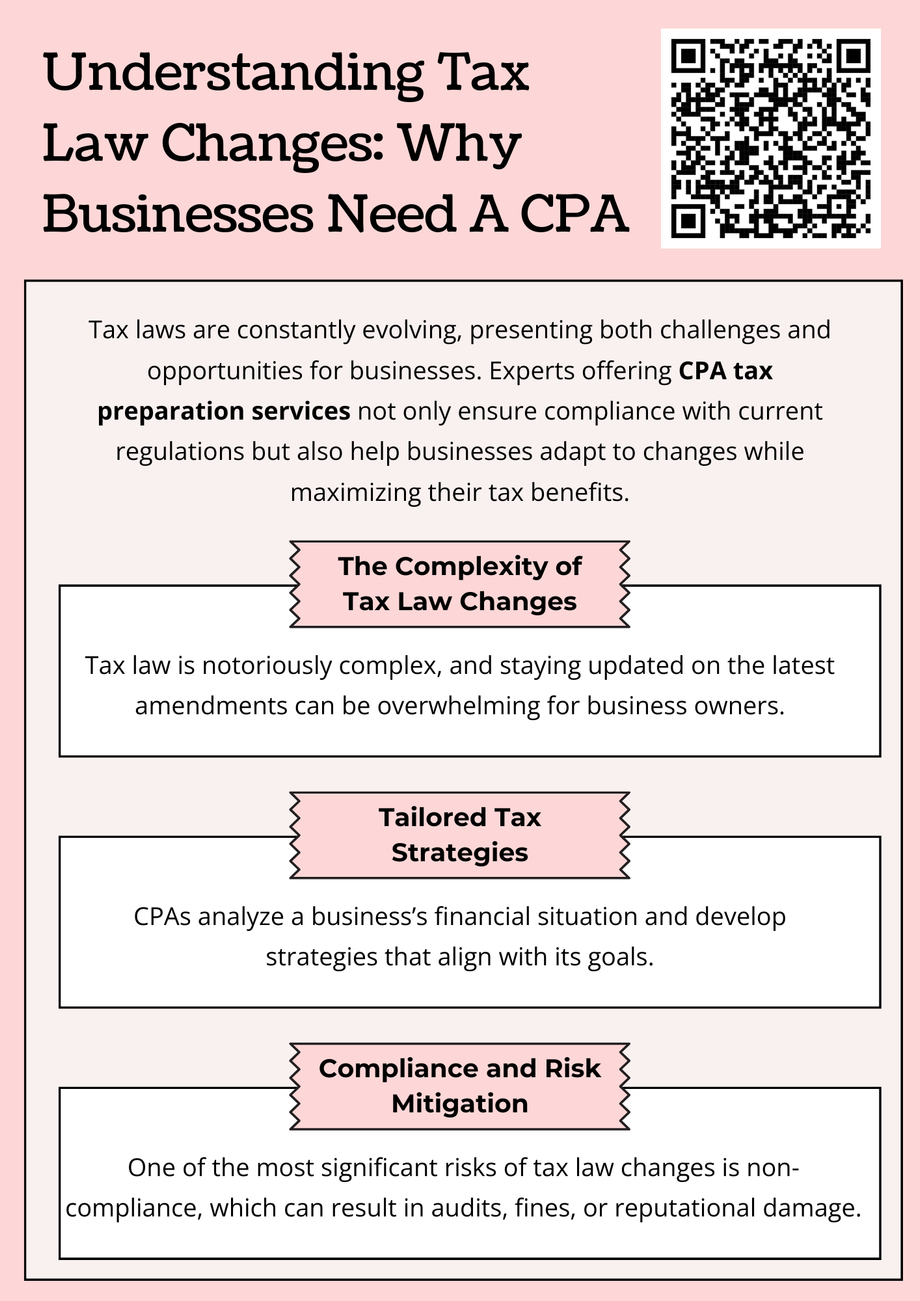

Understanding tax law changes is crucial for businesses to remain compliant and optimize tax savings. A CPA provides expert advice on new regulations, helps navigate complex tax laws, and ensures proper filings. They can identify opportunities for deductions and credits, reducing liabilities. Experts offering CPA tax preparation services help businesses stay ahead of tax law changes and avoid costly mistakes.