ATM Skimmers Exposed - How Criminals Target Your Card and PIN

Introduction and Explanation of ATM skimming

ATM Skimmers Exposed - How Criminals Target Your Card and PIN. ATM skimming is a form of financial fraud that has become increasingly prevalent in recent years. It involves the use of a small device, often referred to as a 'skimmer,' that is placed over the card slot of an ATM machine. This device is designed to capture the information stored on the magnetic strip of your debit or credit card as you insert it into the machine. Along with this, criminals also use hidden cameras or fake keypads to capture your PIN as you enter it, giving them full access to your account. This type of fraud can happen at any ATM, whether it is at your local bank, a gas station, or a grocery store, making it a widespread and serious threat to consumers. It is important to be informed about ATM skimmers and how they work in order to protect yourself from falling victim to this type of crime. Buy ATM Skimmers

The reason it is crucial to be aware of ATM skimmers is that they are becoming increasingly sophisticated and difficult to detect. Criminals are constantly finding new ways to steal your information, and it is important to stay informed about the tactics they use. Skimmers can be virtually undetectable to the average person, making it easy for criminals to gather large amounts of sensitive financial information without anyone realizing it. This is why it is important to be vigilant and knowledgeable about how criminals target your card and PIN at ATMs.

When targeting your card, criminals often place a skimmer over the card slot of an ATM, making it look like a normal part of the machine. This skimmer will read and store the information from the magnetic strip on your card as you insert it into the ATM. Some skimmers are even equipped with Bluetooth technology, allowing criminals to remotely access the stolen data without having to physically retrieve the skimmer. In addition to this, criminals may also use hidden cameras or fake keypads to capture your PIN as you enter it, giving them complete access to your account.

In order to stay safe, it is important to always be aware of your surroundings when using an ATM. Look for any signs of tampering or anything that looks out of place, such as loose or mismatched parts on the ATM. It is also a good idea to cover the keypad with your hand as you enter your PIN to prevent any hidden cameras from capturing it. Additionally, it is important to regularly monitor your bank accounts and credit card statements for any suspicious activity. If you notice anything unusual, report it to your bank immediately. ATM Skimmers for sale

In conclusion, ATM skimming is a serious threat that can result in significant financial losses. It is important to be informed about how criminals target your card and PIN at ATMs in order to protect yourself from falling victim to this type of fraud. By staying vigilant and following these precautions, you can help ensure the safety of your personal and financial information. Remember, when it comes to ATM skimmers, knowledge is power.

Definition of ATM skimming and Types of ATM skimmers

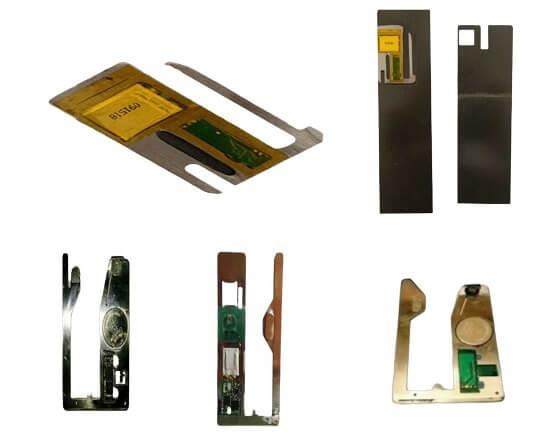

ATM skimming is a form of fraud that involves stealing sensitive information from individuals who use automated teller machines (ATMs). This illegal practice is carried out by criminals who use skimming devices for sale, which are small electronic devices that can be easily installed on ATMs to capture credit or debit card information and PIN numbers. There are various types of ATM skimmers that criminals use to carry out their fraudulent activities. The most common type is the external skimmer, which is attached to the card reader on the ATM.

This device is designed to look like a regular card slot, making it difficult for users to detect. Another type is the internal atm skimmer, which is installed inside the ATM by opening the machine and attaching the device to the card reader. This type of skimmer is harder to detect as it is hidden inside the machine. Other types of skimmers include overlay skimmers, which are placed on top of the keypad to capture PIN numbers, and wireless skimmers, which use Bluetooth technology to transfer stolen data to the criminals. buy Skimming devices are often installed on ATMs in busy areas, such as shopping malls or gas stations, where there is a high volume of transactions and customers are less likely to notice any suspicious activity. Cheap ATM Skimmers for sale

Criminals also use tactics such as installing fake keypads or cameras to capture PIN numbers and personal identification information. Once they have obtained this sensitive information, they can use it to create counterfeit cards or make unauthorized purchases. To protect yourself from falling victim to ATM skimming, it is important to always be aware of your surroundings when using an ATM. Check for any signs of tampering or unusual attachments on the card reader or keypad and cover your hand when entering your PIN number. It is also important to regularly check your bank statements and report any suspicious activity to your bank immediately.

How Criminals Target Your Card and Pin

Criminals are constantly finding new ways to target and steal from unsuspecting individuals, and one of their main targets is credit and debit cards. The process of how criminals target your card can seem complex, but it is actually quite simple. First, they gather personal information about their victim, such as their name, address, and date of birth. They may obtain this information through various means, including phishing scams, data breaches, or even by physically stealing mail or trash. Once they have this information, they can move on to the next step, which is obtaining the actual card number. This can be done through skimming devices for sale placed on ATMs or card readers, or by hacking into databases where card information is stored.

There are several common methods that criminals use to obtain card numbers, including card cloning, card-not-present fraud, and identity theft. Card cloning involves creating a duplicate of the victim's card, which can then be used to make fraudulent purchases. Card-not-present fraud, on the other hand, involves using stolen card information to make purchases online or over the phone. Identity theft is a more comprehensive form of fraud, where criminals use a combination of personal information to open new accounts or take out loans in the victim's name. where to buy ATM Skimmers

Real-life cases of card fraud are unfortunately all too common. In 2019, a group of criminals used skimming devices to steal over $2 million from ATMs across the United States. In another case, a group of hackers managed to steal credit card information from over 40 million Target customers. These are just a few examples of the many ways in which criminals target and exploit vulnerable individuals through their cards.

Not only do criminals target the card itself, but they also aim to obtain the associated PIN. The theft of a PIN can be just as damaging as the theft of the card itself. Criminals have various techniques for stealing PINs, such as shoulder surfing (watching someone enter their PIN at an ATM or checkout line), installing hidden cameras, or even physically stealing the card and observing the victim's PIN when they use it. In some cases, criminals may also use social engineering tactics to trick individuals into revealing their PINs.

There have been numerous real-life cases of PIN theft, including a group of criminals who installed a hidden camera at a gas station to capture PINs as customers entered them at the pump. They then used this information to create fake cards and withdraw thousands of dollars from their victims' accounts. In another case, a man was caught stealing credit card information and PINs from customers at a restaurant where he worked.

In conclusion, criminals are constantly evolving and finding new ways to target and steal from individuals through their cards and PINs. It is important for individuals to be vigilant and take steps to protect their personal information, such as regularly checking their credit reports and monitoring their accounts for any suspicious activity. By understanding the methods used by criminals and staying informed about real-life cases, we can better protect ourselves from falling victim to card and PIN theft. how to buy ATM Skimmers

Types of ATMs at Risk of Skimmers

There are various types of ATMs that are susceptible to different types of attacks, making them potential targets for criminals. The most common types include standalone, lobby, and drive-up ATMs. Standalone ATMs are freestanding machines that are not attached to a bank branch or building. These types of ATMs are vulnerable to physical attacks, such as ram raids or smash-and-grab attempts. Criminals can also use skimming devices to steal card information from standalone ATMs.

Lobby ATMs, on the other hand, are located inside a bank branch and are only accessible during the branch's operating hours. These types of ATMs are less vulnerable to physical attacks, but are still at risk of skimming and other sophisticated methods of fraud. Criminals may also target lobby ATMs during non-operating hours by gaining access to the bank and tampering with the machine.

Drive-up ATMs are typically located in a bank's parking lot and can be accessed by customers from their vehicles. These types of ATMs are vulnerable to physical attacks, as well as skimming and card trapping techniques. Criminals may also target drive-up ATMs by installing fake keypad overlays or cameras to capture PIN numbers.

Each type of ATM has its own vulnerabilities that make them appealing to criminals. Standalone ATMs, for example, are often targeted because they are typically located in isolated areas, making it easier for criminals to carry out their attacks without being noticed. Lobby ATMs, on the other hand, are targeted because of their accessibility during operating hours and the potential for insider collusion. Drive-up ATMs are often chosen by criminals because they offer a quick and easy escape route.

Criminals also carefully select their targets based on the potential payoff. ATM machines that are located in areas with high foot traffic or in popular tourist destinations are more likely to be targeted because they have a higher volume of transactions and potential for larger sums of money to be withdrawn. Additionally, ATMs that are located in low-income or high-crime areas are also at risk, as criminals may see them as easier targets. Can i buy ATM Skimmers?

In order to prevent attacks on ATMs, it is important for financial institutions to understand the vulnerabilities of each type of machine and take necessary precautions to secure them. This can include implementing security cameras, installing anti-skimming devices, and regularly inspecting machines for any signs of tampering. It is also crucial for customers to be vigilant when using ATMs and report any suspicious activity or devices to their bank immediately. By understanding the types of ATMs at risk and the tactics used by criminals, we can work towards making these machines safer for everyone.

How to Spot an ATM Skimmer

ATM skimming has become a common method used by criminals to steal people's credit card and debit card information. These devices are typically placed on ATMs in public places such as banks, gas stations, and convenience stores. Skimmers are designed to look like a normal part of the ATM, making it difficult for people to detect. However, there are some signs that can help you identify a skimming device on an ATM. First, check for any loose or unusual attachments on the card reader. Skimmers are often attached with double-sided tape and may appear slightly different in color or material from the rest of the ATM.

Additionally, be on the lookout for any signs of tampering, such as scratches, glue residue, or broken pieces on the card reader. Criminals may also place a fake keypad over the original one to capture your PIN, so check for any signs of a keypad overlay. Another important aspect of spotting a skimming device for saleis being aware of hidden cameras. These cameras are often placed above the keypad or on the side of the ATM and can capture your PIN as you enter it. To identify a hidden camera, look for any unusual objects or holes near the keypad and cover your hand while entering your PIN. It's also important to pay attention to your surroundings when using an ATM.

If you notice anyone acting suspiciously or loitering around the ATM, it's best to avoid using it and report it to the authorities. Furthermore, always be cautious when using an ATM in a secluded or poorly lit area, as these are prime locations for criminals to install skimming devices. In addition to these tips, it's crucial to regularly check your bank statements for any unauthorized transactions and report them immediately. Remember, being vigilant and aware of your surroundings is key to protecting yourself from falling victim to ATM skimming.

How to Protect Yourself from ATM Skimming

ATM skimming is a growing problem that can put your personal and financial information at risk. Criminals use various methods to steal your card and PIN information, such as installing fake card readers and hidden cameras on ATMs. However, there are steps you can take to protect yourself from falling victim to ATM skimming. who can buy ATM Skimmers

Before using an ATM, it is important to take some precautions. First, always choose ATMs that are located in well-lit and highly visible areas. Avoid using ATMs that are in secluded or poorly lit locations, as these are more likely to be targeted by criminals. Additionally, make sure to use ATMs that are located at reputable and trusted financial institutions. It is also a good idea to inspect the ATM for any signs of tampering, such as loose or damaged card readers, before inserting your card.

When using an ATM, there are some tips to keep in mind to ensure your safety. Always cover the keypad with your hand when entering your PIN, as this can prevent hidden cameras from capturing your information. Also, be aware of your surroundings and make sure no one is standing too close to you while you are using the ATM. If you notice anyone acting suspiciously or attempting to distract you, cancel your transaction and leave the area immediately.

Your PIN is the key to accessing your account, so it is crucial to safeguard it. Do not share your PIN with anyone, and try to choose a unique and strong PIN that is difficult for others to guess. Avoid writing your PIN down or keeping it in your wallet or purse. Instead, commit it to memory or use a secure password manager. If you suspect that your PIN may have been compromised, change it immediately and monitor your account for any suspicious activity.

In conclusion, being vigilant and taking necessary precautions can greatly reduce your chances of becoming a victim of ATM skimming. Remember to always be cautious when using an ATM and never let your guard down. By following these tips and keeping a close eye on your financial accounts, you can protect yourself from the dangers of ATM skimming.

What to do if You Fall Victim to ATM Skimming

ATM skimming, the act of stealing personal information from ATM users, is becoming an increasingly common form of fraud. If you fall victim to ATM skimming, it is important to take immediate action to minimize the damage and prevent future incidents. The first step is to act quickly and decisively. As soon as you notice any suspicious activity on your account, contact your bank and card issuer immediately. They will be able to freeze your account and prevent any further fraudulent charges. It is also important to change your PIN and password to ensure that the scammers cannot access your account again. After contacting your bank and card issuer, it is crucial to report the incident to the authorities. This includes filing a police report and notifying the Federal Trade Commission (FTC). buy atm skimmer online

These agencies can investigate the incident and potentially catch the perpetrators. Additionally, reporting the incident can help prevent others from falling victim to the same scam. In addition to taking immediate action, it is important to take preventative measures to avoid future fraud. This includes regularly checking your bank and credit card statements for any unauthorized charges, avoiding suspicious or unfamiliar ATMs, and covering your hand when entering your PIN. You may also want to consider using mobile payment options or chip-enabled cards, as they offer more secure methods of payment. It is also recommended to regularly monitor your credit report for any suspicious activity. By being proactive and vigilant, you can reduce the risk of falling victim to ATM skimming and other forms of fraud.

How Banks and Financial Institutions are Fighting Back

Banks and financial institutions have always been prime targets for criminal activities, such as fraud and theft. However, with the advancement of technology, these institutions have also been able to step up their game and implement various security measures to fight back against these threats. One of the most common security measures used by banks is the implementation of strict authentication processes. This includes the use of complex passwords, biometric technology, and multi-factor authentication to ensure that only authorized individuals have access to sensitive information and transactions.

Another area where banks have been focusing their efforts is in the prevention of skimming at ATM machines. Skimming is a method used by criminals to steal credit or debit card information by attaching a small device to the ATM machine that can capture card details. In response to this threat, banks have been continuously innovating and upgrading their ATM technology. For instance, some banks have introduced cardless ATM transactions, where customers can use their mobile phones to withdraw money instead of their physical cards. This eliminates the risk of skimming, as there is no physical card involved. Purchase atm skimmer

Banks have also been collaborating with law enforcement agencies to combat financial crimes. This includes sharing information and intelligence on potential threats and working together to track down and prosecute criminals. Some banks have even set up their own internal investigative teams to proactively identify and prevent fraudulent activities. These collaborations have proven to be effective in reducing financial crimes and increasing the safety and security of customers' assets.

In addition to these measures, banks also regularly conduct training programs for their employees to raise awareness about potential threats and how to identify and report suspicious activities. This not only helps in preventing internal fraud but also equips employees with the knowledge to assist customers in protecting their accounts and transactions.

In conclusion, banks and financial institutions have been taking strong measures to combat the ever-evolving threats in the digital age. From implementing strict authentication processes to collaborating with law enforcement agencies, these institutions are continuously working towards ensuring the safety and security of their customers' assets. With the rise of technology and financial innovations, it is crucial for banks to stay vigilant and adapt to new security measures to stay one step ahead of potential threats.

Importance of staying vigilant against ATM skimming

In conclusion, it is important to stay vigilant against ATM skimming in order to protect our financial security. Throughout this discussion, we have highlighted the various ways in which criminals can use ATM skimming devices to steal personal and financial information. From the installation of fake card readers and pinhole cameras to the use of Bluetooth technology, these tactics are becoming more sophisticated and difficult to detect. However, by being aware of these tactics and taking proactive measures, we can greatly reduce the risk of falling victim to ATM skimming. cheap atm skimmer

It is crucial to always inspect the ATM before using it, looking for any signs of tampering or suspicious devices attached to the machine. Covering the keypad while entering your PIN can also prevent criminals from obtaining this information. Additionally, regularly checking your bank statements and reporting any unauthorized charges can help catch ATM skimming attempts early on.

The consequences of falling victim to ATM skimming can be severe, ranging from financial loss to identity theft. It is therefore imperative to stay alert and take necessary precautions when using ATMs. This includes being cautious when using ATMs in unfamiliar or high-risk locations, such as at gas stations or convenience stores.

In conclusion, ATM skimming is a serious threat that requires our constant attention. By staying informed and taking necessary precautions, we can protect ourselves and our finances from falling prey to this type of fraud. It is also important to spread awareness and educate others about ATM skimming to prevent more people from becoming victims. Let us all stay vigilant and work towards creating a safer and more secure environment for ATM transactions.