Introduction

The online apparel market has transformed the global fashion industry, leveraging advancements in e-commerce, digital marketing, and logistics to provide consumers with diverse, accessible, and personalized shopping experiences. This report delves into the market size, share, trends, and growth opportunities across key regions and segments, while analyzing category performance and the competitive landscape through to 2027.

1. Market Overview

1.1 Current Market Landscape

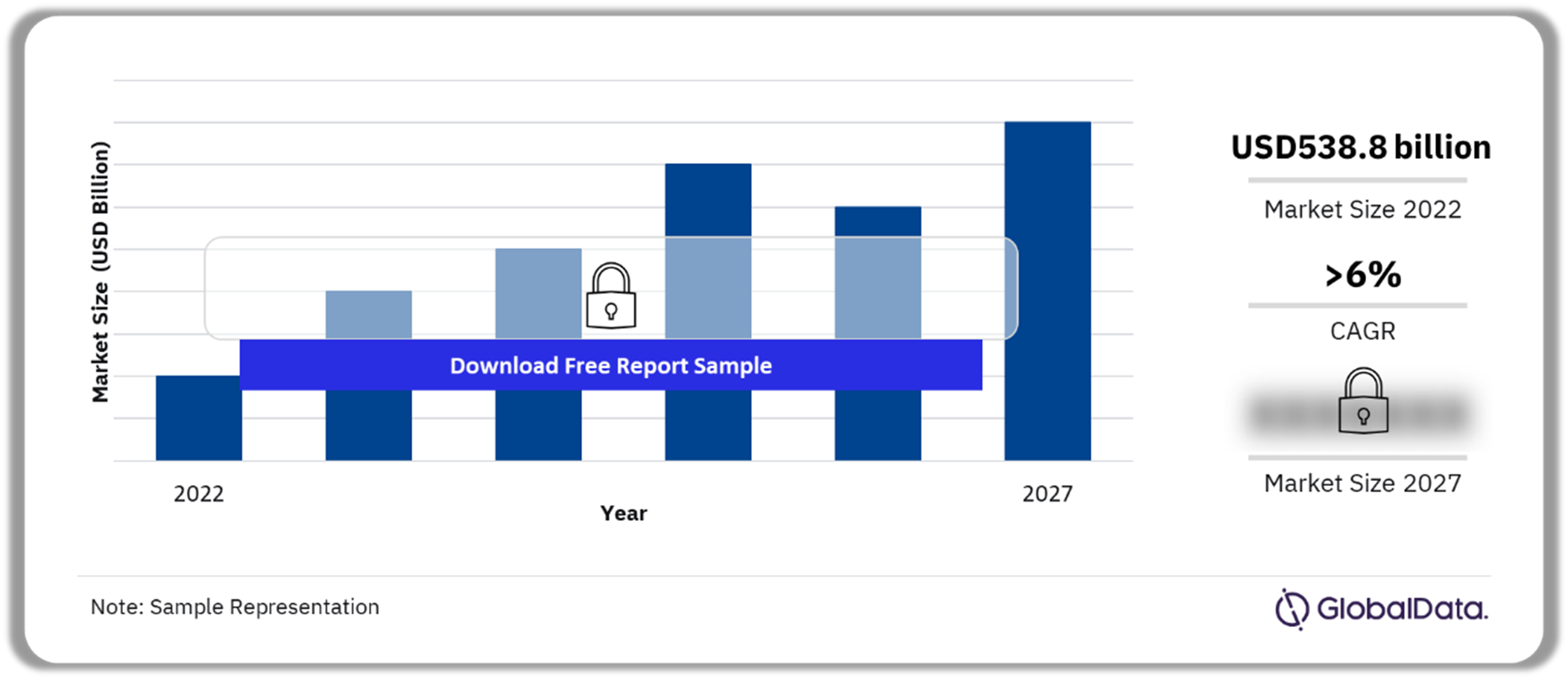

- Market Size: The global online apparel market was valued at $X billion in 2022 and is projected to grow at a CAGR of Y% to reach $Z billion by 2027.

- Dominant Categories: Casual wear, activewear, and fast fashion lead the market, fueled by changing consumer lifestyles and demand for convenience.

1.2 Key Drivers

- Shift to Digital Shopping: Accelerated by the COVID-19 pandemic, more consumers prefer online channels for convenience and wider choices.

- Technological Advancements: Virtual fitting rooms, AI-based recommendations, and AR-driven customer experiences enhance the shopping journey.

- Rising Penetration of Smartphones and Internet Access: Particularly in emerging markets, these factors have boosted online apparel sales.

1.3 Market Challenges

- High Competition: Intense price wars and promotional offers impact profitability.

- Logistics and Returns: Efficient handling of delivery and returns remains a key operational challenge.

2. Market Segmentation

2.1 By Product Segment

- Men's Wear: Growing focus on work-from-home wear and functional clothing.

- Women's Wear: Dominates the market, driven by fast fashion and inclusivity trends.

- Kids' Wear: Increasing demand for sustainability and comfort-oriented designs.

2.2 By Price Point

- Luxury Apparel: Strong growth among high-income consumers in developed markets, fueled by exclusive online platforms.

- Mass Market: Leads the sector due to affordability and frequent promotions.

2.3 By Channel

- Direct-to-Consumer (D2C): Rapidly expanding as brands launch their own e-commerce platforms.

- Third-Party Marketplaces: Platforms like Amazon, ASOS, and Zalando hold a significant share.

3. Regional Analysis

3.1 North America

- Market Share: Accounts for over 30% of global online apparel sales.

- Key Trends: High penetration of premium brands and innovation in sustainability-focused offerings.

3.2 Europe

- Market Dynamics: High demand for fast fashion in Western Europe and growing influence of e-commerce platforms like Zalando and H&M.

3.3 Asia-Pacific

- Growth Opportunities: Fastest-growing region due to rising middle-class income, smartphone penetration, and platforms like Alibaba, Flipkart, and SHEIN.

3.4 Latin America and Middle East

- Emerging Markets: Expansion in Brazil, UAE, and Saudi Arabia driven by urbanization and increased digital connectivity.

4. Category Performance

4.1 Casual Wear

- Dominates due to the rise of work-from-home trends and demand for versatile, comfortable clothing.

4.2 Activewear

- Strong growth supported by health and fitness trends, as well as collaborations between fitness brands and online retailers.

4.3 Occasion Wear

- Recovering post-pandemic, with renewed demand for weddings, social events, and formal wear.

5. Competitive Landscape

5.1 Key Players

- Amazon: Global leader leveraging vast inventory and logistics networks.

- ASOS: Known for fast fashion and strong social media presence.

- Zara (Inditex): Focus on quick turnarounds and in-season designs.

- Nike and Adidas: Strong foothold in the activewear category with robust D2C strategies.

5.2 Emerging Players

- D2C brands like Everlane, Gymshark, and Boohoo are disrupting traditional retail with digital-first strategies.

5.3 Strategies for Growth

- Sustainability: Incorporation of eco-friendly fabrics and ethical supply chains.

- Personalization: AI-powered recommendations and targeted marketing.

- Localization: Customizing offerings for regional tastes and preferences.

6. Key Market Trends

6.1 Sustainability and Ethical Fashion

- Growing consumer demand for transparency and environmentally friendly practices is driving the adoption of circular fashion and low-impact manufacturing.

6.2 Integration of AR and VR

- Virtual try-ons and augmented reality shopping experiences are enhancing customer confidence and reducing returns.

6.3 Social Commerce

- Platforms like Instagram, TikTok, and Pinterest are becoming key sales channels, driven by influencer marketing and live shopping events.

6.4 Subscription Models

- Growth of clothing rental and subscription boxes such as Rent the Runway and Stitch Fix.

7. Forecast to 2027

7.1 Growth Outlook

- The online apparel market is projected to grow from $X billion in 2023 to $Z billion by 2027, driven by increasing penetration of e-commerce in emerging markets and innovations in digital shopping.

7.2 Opportunities

- Expansion in untapped rural and semi-urban markets through localized marketing and affordable shipping solutions.

- Collaboration between brands and tech firms for integrating AI, machine learning, and AR technologies.

7.3 Regional Forecast

- Asia-Pacific: Expected to lead the growth with a CAGR of over Y%, driven by demand in China, India, and Southeast Asia.

- North America and Europe: Continue steady growth due to high internet penetration and established e-commerce infrastructure.

Conclusion

The online apparel market is set for sustained growth, driven by consumer preference for digital channels, technological advancements, and evolving fashion trends. Businesses that prioritize sustainability, personalization, and seamless shopping experiences will lead the market, capitalizing on opportunities in both established and emerging regions through 2027.