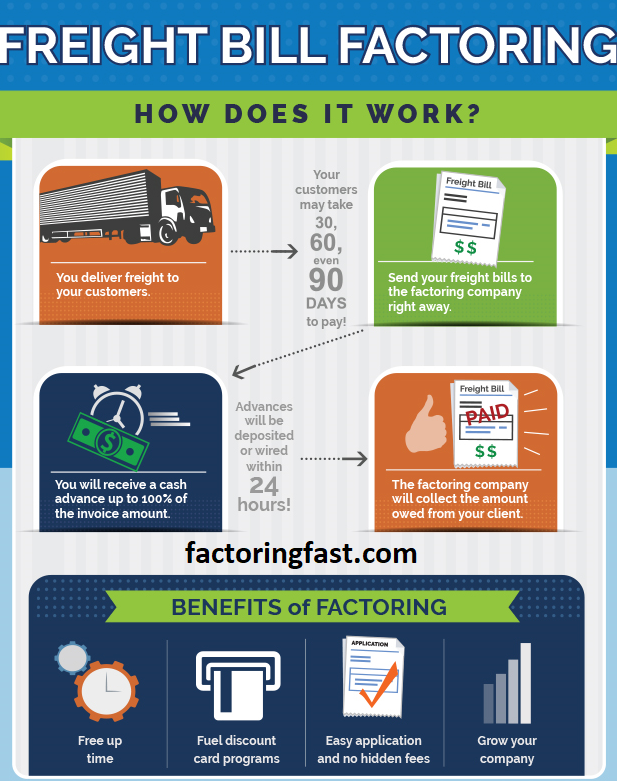

Factoring is known as one of the great financial alternatives which help the business to grow. One of the common problems that every business has to face is to sell their product and services on a credit basis. This practice reduces the cash inflows of the business to a significant level. Hence, it becomes essential for the business to improve their cash flows in order to pay off their staff without any delay or make payment for the bulk purchase. So, how can one improve or regulate the cash flows of the business? The answer is very simple that is seeking the assistance of the good accounts receivables factor. They help in streamlining the collection which improves the cash flow of the business. This helps in improving the competitive presence in the industry.

Why should one hire a factoring company?

A reputable factor receivable company makes use of the appropriate financial tools which one might require to mark an edge in the competitive market. Though one has the option of considering the private banks or any financial institutions, still there are numerous positive reasons for hiring one receivable factoring company. First of all, the factoring companies immediately respond to every call made without framing unnecessary reasons. They make sure to provide the quickest cash turnaround facilities. The interest rate is considerably lower on the factoring arrangements made when compared to the traditional banks. They complete the collection service, extend high cash advance, and quick financial stability which is essential for all the business.

Any business owner who looks up to grow their business enjoy the benefits of factoring solution even when their cash inflows are squeezed up. Moreover, they do not perform any credit checking which helps in meeting the urgent cash requirement of the business. So, this helps in increasing the sales revenue opportunity by adding up more credit-worthy customers to the list. At the same time, the company receives assistance from courteous professionals for handling all the outstanding collections, monitoring the credit facility, and providing assistance with the invoice processing work.