The key aspect to benefit from an asset class such as equity mutual funds is time. Time in the market makes a huge difference over timing the market. This means the longer you keep your money uninterrupted, it has potential to provide long term risk adjusted returns.

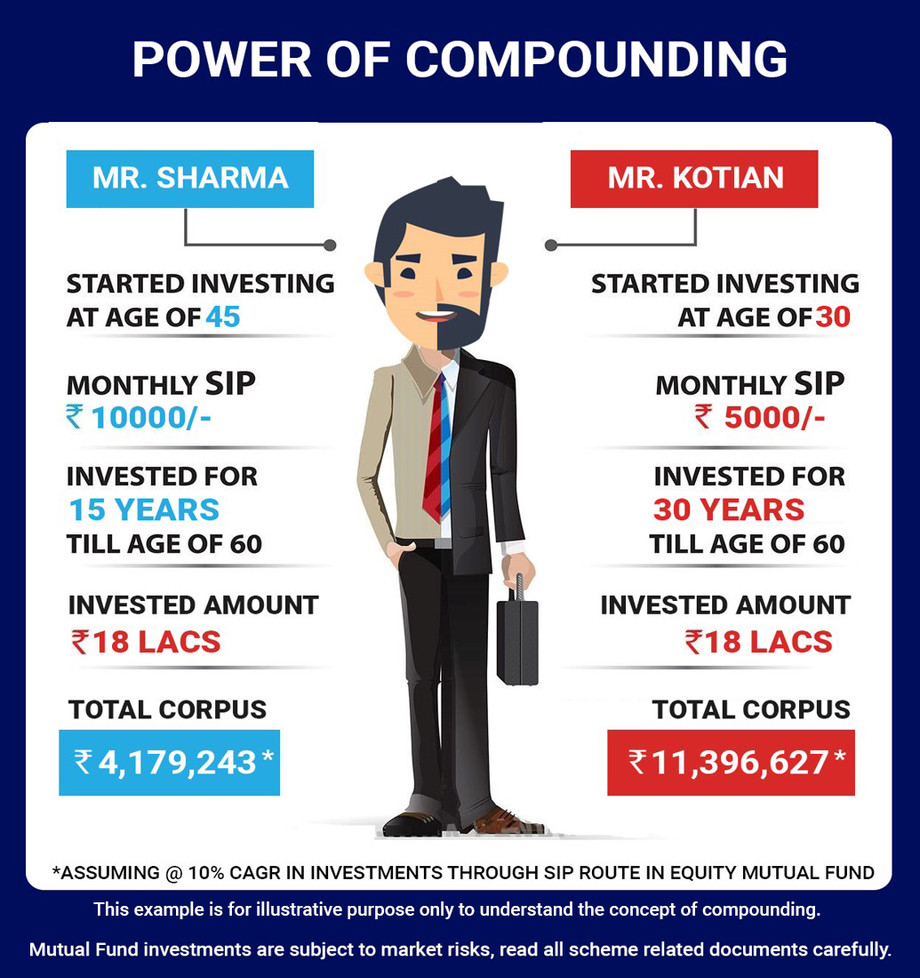

Let’s see an example of two investors Mr. Sharma and Mr. Kotian, who want to start planning for their investment at different ages; aged 45 & 30 respectively. The investor who started early at age 30 can accumulate an investment corpus more than double the size vs. an investor aged 45 years. The illustration assumes a 10% rate of return for a monthly SIP of Rs. 10,000 & Rs.5000 respectively. This illustrates the point that starting early also gives you the flexibility of keeping your SIPs smaller and at the same time gain more wealth through your returns reinvested and compounded over the long term. Investments through SIP are subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.