Introduction

Payroll management is a critical aspect of any organization, regardless of its size or industry. In today's dynamic business environment, traditional manual payroll processes are becoming increasingly outdated and inefficient. To keep pace with the ever-evolving demands of payroll management, businesses are turning to payroll management system software. These systems have revolutionized the way companies handle their payroll processes, making them more accurate, efficient, and compliant. In this article, we will explore the benefits and features of payroll management system software and why it is a must-have tool for modern businesses.

The Importance of Payroll Management

Before diving into the details of payroll management system software, it's crucial to understand the significance of payroll management in an organization. Payroll is more than just issuing paychecks; it encompasses various complex tasks, such as calculating employee salaries, deductions, taxes, and ensuring compliance with labor laws and regulations. Payroll management also involves keeping accurate records, generating reports, and maintaining employee satisfaction and trust.

Payroll Management System Software

Efficient payroll management is crucial for several reasons:

Compliance: Accurate payroll processing is essential to ensure compliance with labor laws, tax regulations, and reporting requirements. Non-compliance can result in costly penalties and legal issues.

Employee Satisfaction: Timely and accurate pay is fundamental to employee satisfaction and retention. Employees expect to be paid correctly and on time.

Cost Savings: Efficient payroll processes reduce administrative costs associated with manual calculations and data entry errors.

Data Security: Sensitive employee data, including salary information, must be handled securely to protect against data breaches and identity theft.

What is Payroll Management System Software?

Payroll management system software is a comprehensive solution designed to streamline and automate the payroll processes of an organization. It encompasses a range of functionalities, including:

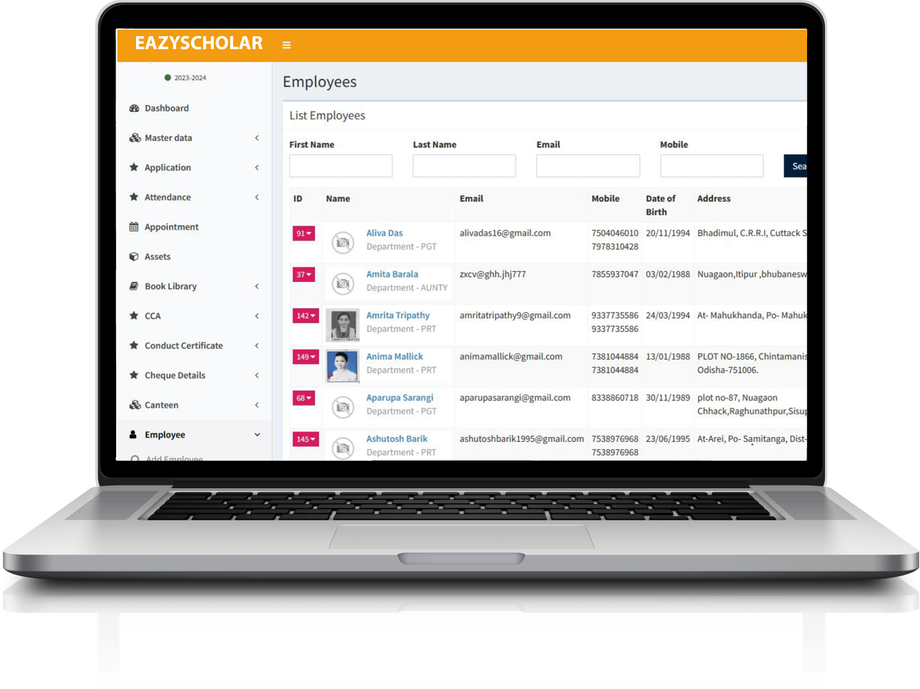

Employee Data Management: Storing and updating employee information, including personal details, tax exemptions, and bank account details.

Salary Calculation: Accurately calculating employee salaries, including deductions for taxes, benefits, and any other relevant factors.

Tax Compliance: Automatically calculating and deducting taxes based on local, state, and federal tax regulations. Generating tax forms, such as W-2s and 1099s.

Time and Attendance Tracking: Monitoring employee work hours, overtime, and leave to determine accurate pay.

Direct Deposit: Facilitating direct deposit for employee salaries, reducing the need for paper checks.

Reporting and Analytics: Generating various reports and analytics to track payroll expenses, employee costs, and compliance metrics.

Employee Self-Service: Allowing employees to access their payroll information, view pay stubs, and update personal information.

Compliance Management: Ensuring that all payroll activities adhere to legal and regulatory requirements.

Benefits of Payroll Management System Software

Implementing a payroll management system software offers several significant benefits to businesses:

Accuracy: Automated calculations reduce the risk of human errors, ensuring that employees are paid accurately and on time.

Time Efficiency: Payroll processes that would take hours or days to complete manually can be accomplished in a fraction of the time with software.

Cost Savings: Reducing administrative overhead and eliminating costly errors results in significant cost savings for the organization.

Compliance: The software automates tax calculations and helps ensure that all payroll activities adhere to legal and regulatory requirements.

Improved Employee Satisfaction: Timely and accurate pay, along with self-service options, enhance employee satisfaction and engagement.

Data Security: Payroll management system software offers secure data storage and access controls to protect sensitive employee information.

Key Features of Payroll Management System Software

A comprehensive payroll management system software typically includes the following key features:

Employee Database: Centralized storage of employee information, making it easy to manage and update details.

Payroll Processing: Automated calculation of salaries, deductions, and taxes, along with the flexibility to handle various pay structures and frequencies.

Tax Management: Compliance with local, state, and federal tax regulations, including the generation of tax forms and electronic filing.

Time and Attendance Tracking: Monitoring and recording employee work hours, overtime, and leave.

Direct Deposit: Facilitating electronic payment to employees' bank accounts, reducing reliance on paper checks.

Reporting and Analytics: Generating a variety of reports and analytics to provide insights into payroll expenses and employee costs.

Employee Self-Service: Offering employees access to their payroll information, pay stubs, and the ability to update personal details.

Compliance Management: Ensuring all payroll activities meet legal and regulatory requirements.

Choosing the Right Payroll Management System Software

When selecting a payroll management system software for your organization, consider the following factors:

Scalability: Ensure the software can grow with your business and accommodate your future needs.

Integration: Check if the software can seamlessly integrate with your existing HR and accounting systems.

User-Friendly Interface: A user-friendly interface makes it easier for your team to navigate and operate the software.

Compliance Features: Verify that the software can handle tax regulations specific to your location and industry.

Support and Training: Choose a provider that offers adequate customer support and training resources to help your team adapt to the software.

Security: Confirm that the software offers robust data security measures to protect sensitive employee information.

Pricing: Evaluate the cost of the software, including subscription fees, implementation costs, and ongoing support.

Conclusion

The manual methods of the past are no longer sufficient, given the complexities of tax regulations, the importance of data security, and the need for accurate and timely payments. Payroll management system software offers a comprehensive solution that can help streamline your payroll processes, reduce errors, improve compliance, and enhance employee satisfaction. By investing in the right payroll management system software, your organization can save time, reduce costs, and focus on what truly matters—growing your business.