Mutual funds in India have been evolving and emerging as one of the preferred investing options due to hassle free investing and professional fund management. Another reason for the growing popularity of mutual funds is its ability to exponentially grow over time due to power of compounding. This means that the returns earned is reinvested to later earn return on return.

In order to make mutual fund investing simpler and more convenient for its investors, there are various financial calculators available online which helps make informed investment decisions. Let us discuss three types of such calculators –

Lumpsum calculator - In order to get a better understanding of one-time investments, one can use this online tool called the lumpsum calculator. What this tool does is that it gives an estimated corpus one can expect after their planned investment tenure on a certain assumed rate of return.

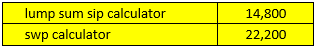

Suppose, one invests Rs. 5 lakhs today in a fund for 10 years. Assuming the return to be annual 12%, the expected corpus could be more than 15 lakhs. This calculation was done in seconds using a mutual fund lumpsum calculator. However sometime, users type lump sum SIP calculator even though they want to use lumpsum calculator.

SIP Calculator - One of the most popular for mutual funds is SIP Calculator, which helps an investor get an estimate as to how much they should invest systematically for a period to meet their goals. It is a user friendly tool that gives confidence to investors when they want to start a SIP.

Example, if one starts investing Rs 15,000 a month from age 25 for 10 years assuming the return to be12%, the future corpus can become more than Rs 34 lakh. So, by the time the investor turns 35, he/she has a substantial corpus.

At times, investors tend to search for lumpsum SIP calculator, due to lack of clarity when it comes to mutual fund concepts. But, there is no such tool - they are two separate calculators, as explained above.

SWP Calculator - Systematic Withdrawal Plan (SWP) is a mutual fund facility which allows you to draw a fixed amount from your mutual fund investments at a specified frequency (monthly, quarterly, annual etc.) Here, you can specify the day of the month when the withdrawal should be made and the predetermined amount gets credited directly to your bank account on the specified day. You can continue your SWP as long as there are balance units in your fund account.

It is difficult to make accurate calculations regarding monthly withdrawals, matured sum, units left, etc. In order to make it easy for the investor, the SWP calculator is used. SWP calculator is an online tool that can compute within seconds, the final sum in SWP investments, after the withdrawals made by you for the chosen period.

Post entering all the required values in SWP calculator, the calculator will tell you how many SWP instalments you can draw from your investment, total withdrawal amount, value of your investment at the end of the SWP period and the annualized returns of the SWP.