Gold has been and continues to be one of the most highly prized commodities in human history. However, many people don't realize that you can get a loan based on the value of your gold or other ornaments, gram for gram.

While many other loan options are available from banks and NBFCs, the quickest and easiest to obtain are those based on the current gold loan rate.

Gold loan per gram of gold in any form is a popular option among those in need of quick cash since, like Personal Loans, it allows for flexible repayment terms and easy, upfront costs.

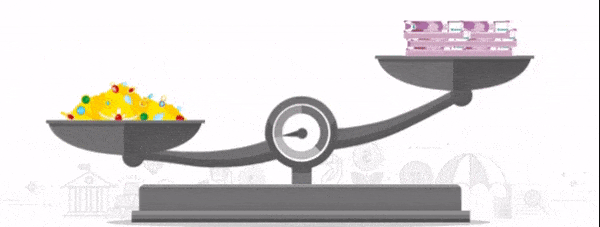

Gold loan and Personal loan

Personal loans are the best option for short-term money demands. It is widely held that a personal loan is the most practical solution to any sudden financial need, whether it is for emergency medical care, a last-minute trip, or anything else.

To get the money you need from a lender, you can get a gold loan where the lender gives you a certain amount of money for every gram of gold you have. Calculating the current gold loan rate and the interest they give for gold under various terms and conditions are essential steps in securing a gold loan.

Why Gold Loan is the better option for fast cash?

Many factors influence a person's decision to borrow money at today's gold loan rate from any of the NBFCs and banks. In this article, I will describe the advantages of getting a gold loan for every gram of gold you have in ornaments, coins, and the like, and why you should do so.

Fast processing

Gold loans per gram of collateral are only available to those who can provide actual gold. Because of the high value of the service they provide and the low-interest rate, financial institutions such as banks are eager to lend money to individuals.

Credit intermediates may rest easier knowing that they will be repaid if a borrower defaults on a loan secured by gold since they can immediately resell or auction off the gold to recover their losses at a rate close to the market rate for gold loans per gram.

Therefore, financial institutions often disburse such loans within the next few hours. Borrowers benefit from shorter wait times as a result of shorter lines.

No need for a credit history

The amount of money supplied by banks and NBFCs is often based on an applicant's ability to repay the gold loan per gram, plus interest and credit score. Banks and NBFCs do not consider your credit rating when you apply for a gold loan per gram of gold.

When applying for a loan at the current gold lending rate, you are typically not required to reveal any past loans or financial obligations.

Safety of the collateral

The gold you offer to the moneylender as collateral for a gold loan will be kept safe in its physical form until you have paid out the loan in full, including the interest. NBFCs and banks will lend you money in exchange for your gold after analyzing the current market gold loan rate and other factors.

The security of collaterals may be a concern for many borrowers of various types of personal loans. With a gold loan, the lender will store the gold in a partner bank with the highest level of security. When the borrower repays the gold loan per gram they received from the lender, the bank releases the gold.