Innova Captab Incorporated in 2005, Innova Captab Limited is an Indian pharma company, operating in three main segments. It provides contract development and manufacturing services to Indian pharmaceutical companies and deals in branded generics in the domestic market. And in the third segment, it is also dealing with branded generics in international business.

Innova Captab products include capsules, tablets, dry syrups, dry powder injections, ointments and liquid medicines. In FY23 and till the first quarter of FY24, it produced and sold more than 600 different types of generic medicines.

Innova Captab is distributing its products, under the company's own brands in the Indian market through the widespread network of 5,000 distributors and stockists and over 150,000 retail pharmacies operating across the country.

The company's manufacturing facility is located in Buddi, Haryana and employs a team of 29 scientists and engineers in its research and development laboratory. And in FY23, Innova Captab is exporting, its branded generic products to 20 countries.

As of Oct 31, 2023, the company has 200 active product registrations and 20 registrations pending renewal with international authorities. Furthermore 218 new registration applications are being processed with international authorities.

Innova Captab has customers from leading pharma companies operating in India and overseas countries. Its customers include Cipla Limited, Mankind Pharma Limited, Intas Pharmaceuticals Limited, Wockhardt Limited, Glenmark Pharmaceuticals Limited, Leeford Healthcare Limited, Ajanta Pharma Limited, Corona Remedies Private Limited, Lupin Limited, Cachet Pharmaceuticals Limited, Emcure Pharmaceuticals Limited, Zuventus Healthcare Limited, Indoco Remedies Limited, J. B. Chemicals and Pharmaceuticals Limited, Medley Pharmaceuticals Limited, Smart Laboratories Private Limited, Eris Healthcare Private Limited and Oaknet Healthcare Private Limited.

Innova Captab IPO Objectives

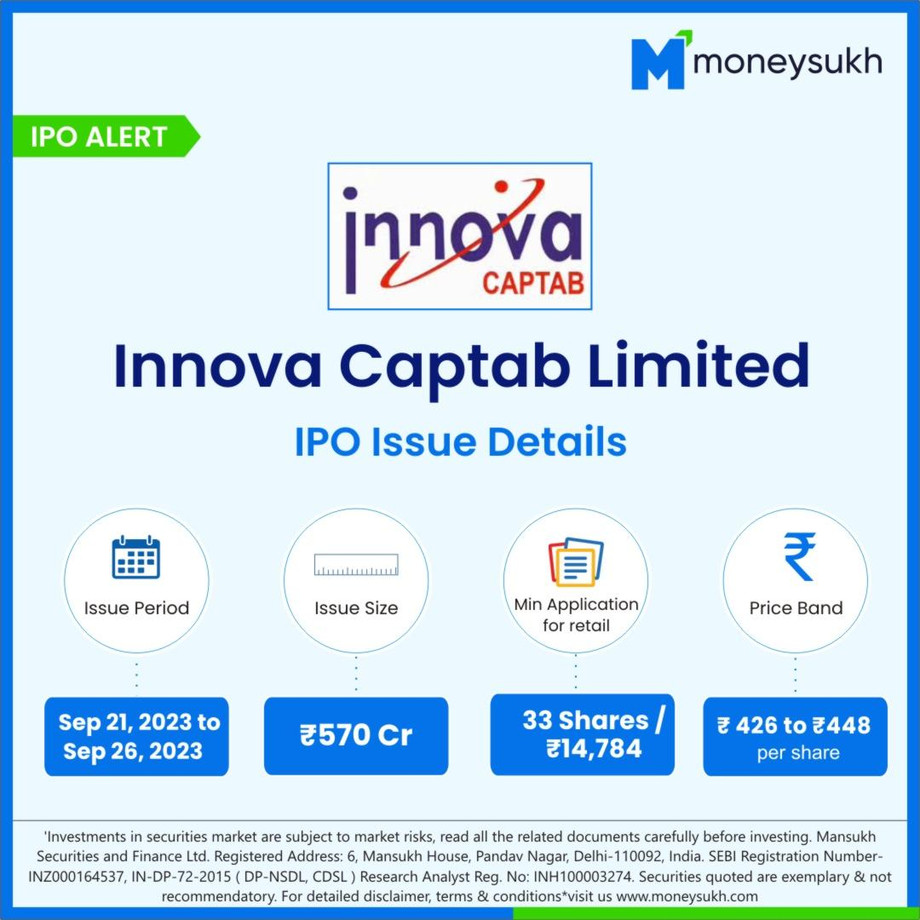

Out of the total issue size of Rs 570 Crore, Rs 250 crore will be offered for sale by the promoters and shareholders of the company. And the remaining Rs 320 crore will be raised by issuing the fresh issue of approx. 5,580,357 equity shares by the company.

Hence, the fund raised through the fresh issue of shares in IPO, will be used for the repayment of debts and borrowings of the company. Part of the fund will be also used to invest and repay the partial or full outstanding loans of its Subsidiary, UML.

Some of the portions of the fund will be also used to meet the working capital requirements of the company and general corporate purposes.

Innova Captab Financial Performance

The revenue of the Innova Captab has not shown significant growth in the last three financial years. In the first three months of the first quarter of FY24, the revenue of the company stood at Rs 233.24 crore, which was Rs 926.38 crore in the full year FY23. This revenue has grown at a CAGR of 50% from Rs 410.66 crore in FY21, while EBITDA for the same period grew at a CAGR of 48.30% from FY21 to FY23. In the first three months of FY24, the EBITDA was Rs 32.42 crore.

The Profit after Tax of the company also grew well, from FY21 to FY23. In the June quarter ended FY24, the PAT of the company reached at Rs 17.59 crore, while it was Rs 67.95 crore in FY23 and Rs 34.5 crore in FY21 registering a CAGR growth of Rs 40.35% during the same period. The EBITDA margin of the company remained between 13% to 14% during FY21 to FY23, while the PAT margins were also trailing between 7% to 8% during the same period.