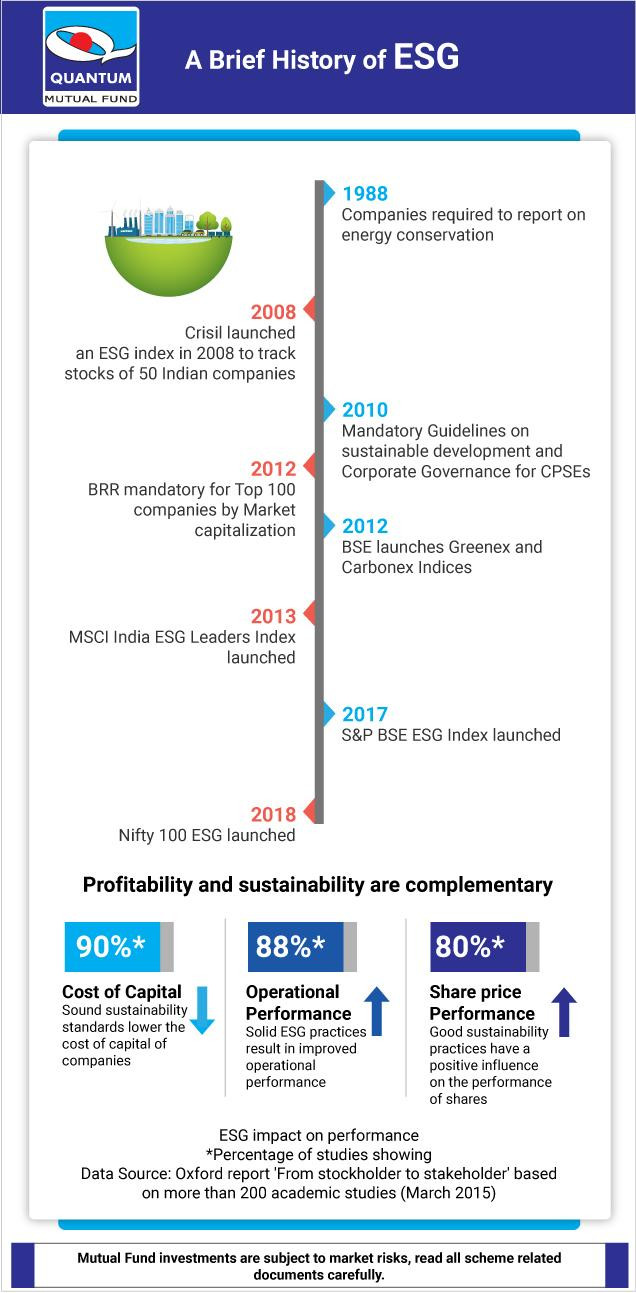

The story of ESG investing began in January 2004 when UN took initiative to find ways to integrate ESG into capital markets with the support of the International Finance Corporation (IFC) and the Swiss Government. In India, it began in 1988, where companies were required to report on energy conservation. The very first index was launched in 2008 which tracked the stocks of 50 Indian companies. In 2010, a mandatory guideline on sustainable development and corporate governance for CPSEs was established. In 2012, BRR (Business Responsibility Report) was made mandatory for top 100 companies by market capitalization. In 2013, MSCI India ESG Leaders Index was launched. In 2017, the S&P BSE ESG Index was launched followed by the Nifty 100 ESG in 2018.

ESG has gradually gained popularity in India since the launch of the Nifty 100 ESG 2018. Historical trends show that a business that has good ESG practices has the potential to deliver good risk-adjusted returns in line with the lower cost of capital and improved operational performance.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.