Financial Market: A Pillar of Economic Growth and Stability

Introduction: The financial market is an important part of any economy since it serves as a venue for the trading of various financial instruments. It is critical in terms of capital allocation, price discovery, and risk management. The financial market gives opportunities for investment, financing, and hedging by providing a space for individuals, businesses, and governments to trade financial assets.

Stocks, bonds, commodities, derivatives, currencies, and other financial instruments are all part of the financial market. These instruments are traded via a variety of channels, such as stock exchanges, over-the-counter (OTC) markets, and electronic platforms. Individual investors, institutional investors, banks, insurance firms, hedge funds, and other financial intermediaries are all players in financial markets.

Types of Financial Markets:

- Capital Market: The capital market is the place where long-term debt and equity instruments are transacted. It is divided into two parts: the primary market, where new securities are issued, and the secondary market, where existing assets are sold between investors. The capital market allows firms to raise funds and investors to receive returns on their investments.

- Money Market: The money market is concerned with short-term borrowing and lending of monies. Treasury bills, commercial paper, certificates of deposit, and repurchase agreements are examples of such instruments. The money market provides liquidity to participants, allowing them to meet short-term funding needs and efficiently manage their cash positions.

- Foreign Exchange Market: The foreign exchange market, commonly known as the Foreign exchange market, allows anyone to purchase and sell currencies. It is essential for international trade and investment because it allows firms and individuals to convert one currency into another. The Foreign exchange market is open 24 hours a day, 7 days a week, reflecting the global nature of currency trading.

- Derivatives Market: Contracts in the derivatives market derive their value from an underlying asset. Options, futures, swaps, and forwards are all part of this market. Derivatives are used to manage risk, speculate, and arbitrage. They allow market participants to hedge against negative price changes and capitalise on market opportunities.

Classifications of Financial Markets:

1. By Nature of Claim:

- Debt Markets: These markets allow traders to trade debt instruments and fixed claims such as bonds and debentures. Traders can purchase these financial holdings in debt markets for a fixed yield and a predetermined maturity period.

- Equity Market: The equity market is intended for residual claims. In such markets, investors can deal in equity financial holdings.

2. By maturity of claim:

- Money Markets: Certificates of deposit, treasury bills, and other securities are accessible for trade in these Markets. These are typically short-term financial holdings that can be traded online because these markets do not exist in person.

- Capital Markets: Capital Markets are classified into primary and secondary Markets in the classification of Financial Markets. Primary markets enable newly listed firms to offer new securities, as well as listed companies to issue new shares.

3. By Timing of Delivery:

- Cash Markets: These markets provide real-time transactions that are resolved quickly between different sellers and buyers.

- Futures Market: Among the numerous forms of Financial Markets and their activities, these Markets provide transactions in which settlements and commodities are delivered at a later period.

4. By organizational Structure:

- Exchange-Traded Market: These are centralized trading markets with massive daily trading volumes. These have defined protocols that govern how they operate while trading financial assets such as stocks.

- Over-the-Counter Market: These markets have customizable procedures and are not centralized. Traders can conduct deals without involving a broker. Investors can trade in these Markets online, which often offer shares from small businesses.

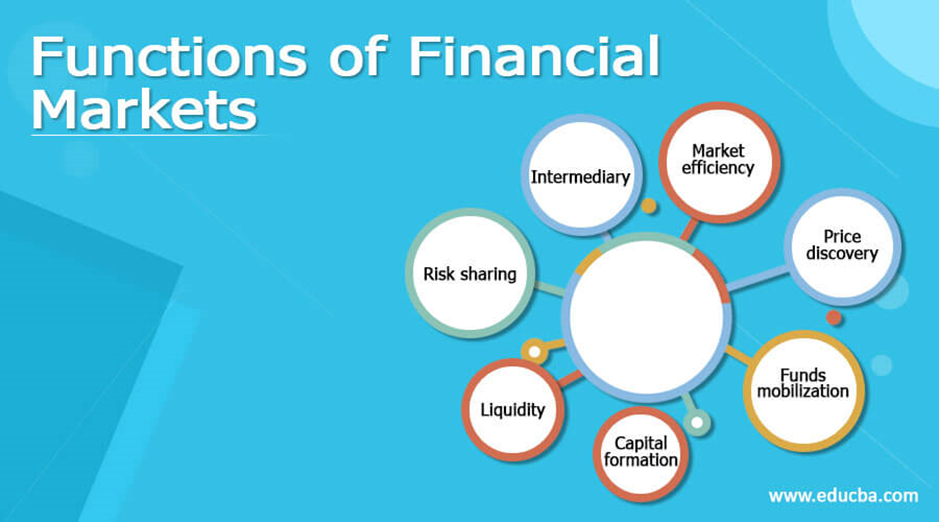

Functions of Financial Markets:

- Capital Formation: Financial markets make it easier to direct savings and capital into productive activities, allowing enterprises to raise cash for expansion and innovation. Investors lend money to businesses in exchange for securities, fostering economic growth and development.

- Price Determination: Financial markets provide a venue for buyers and sellers to interact and negotiate the value of financial assets. Price discovery is driven by market dynamics of supply and demand, which reflect market sentiment and expectations.

- Risk Management: Financial markets include a variety of risk management instruments and tactics. Market participants can protect themselves against adverse price movements, interest rate variations, and other risks by using derivatives and insurance products.

- Liquidity Provision: Financial markets provide liquidity by allowing investors to quickly acquire and sell financial assets. This liquidity improves market efficiency by allowing players to turn their investments into cash when necessary.

Importance of Financial Markets:

Financial markets play a vital role in the overall economic development of a country. They aid in the effective allocation of capital to productive sectors, ensuring that funds flow to where they are most needed and have the most potential for return. This capital distribution promotes investment, innovation, and entrepreneurship, all of which fuel economic growth and employment creation.

Furthermore, financial markets contribute to economic stability. Central banks can impact interest rates, money supply, and credit availability through their monetary policy tools. These activities aid in the management of inflation, the control of economic cycles, and the promotion of financial system stability. Central banks can influence borrowing costs by modifying interest rates, so influencing investment decisions and total economic activity.

Role of Financial Markets in the Economy:

Financial markets serve as a link between savers and borrowers, bringing together individuals with excess funds and those in need of finance. They facilitate the flow of cash from families, corporations, and governments to finance infrastructure, R&D, education, and other critical sectors. This financial infusion drives economic growth and technical progress, resulting in higher living standards and general prosperity.

Furthermore, financial markets encourage competitiveness and efficiency. They improve the liquidity and transparency of financial assets by offering a platform for buyers and sellers to engage. This helps market participants to make informed judgments by promoting fair pricing and reducing information asymmetry. Financial markets that are efficient ensure that resources are distributed optimally, resulting in enhanced production and economic efficiency.

Conclusion:

The financial market is an important component of the global economy, serving a variety of roles necessary to economic growth, stability, and development. Its significance stems from its ability to efficiently allocate capital, manage risks, discover prices, and supply liquidity. Furthermore, the financial market is critical to economic growth, efficiency, monetary policy implementation, and the reflection of economic conditions. Recognizing the importance of the financial market, as well as guaranteeing its effective regulation and operation, is critical for a successful economy and a prosperous society.