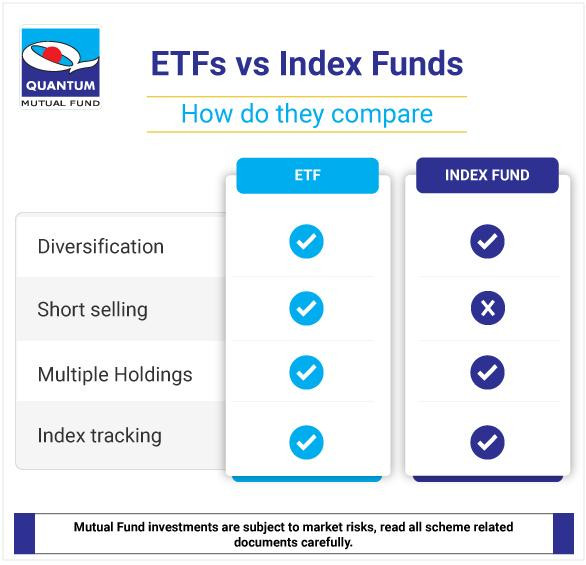

Both ETF and index funds share several similarities while differing in certain other characteristics. Let’s evaluate the differences. An index fund is a passive mutual fund that aims to achieve capital appreciation by imitating or replicating an index, such as the Sensex or Nifty

While ETFs (Exchange Traded Funds) is a basket of stocks that replicate and mirror a benchmark index. Both index funds and ETFs offer the benefit of diversification. They give exposure to several stocks or securities. They both try and replicate or track a benchmark index. They have multiple holdings similar to the index that they track.

ETFs are traded like a stock on an exchange. And similar to a stock, investors can short-sell an ETF. While the index fund units can be bought and sold by placing a request with the fund house either online or through a distributor, which means you cannot do short-selling with an index fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

www.Quantumamc.com