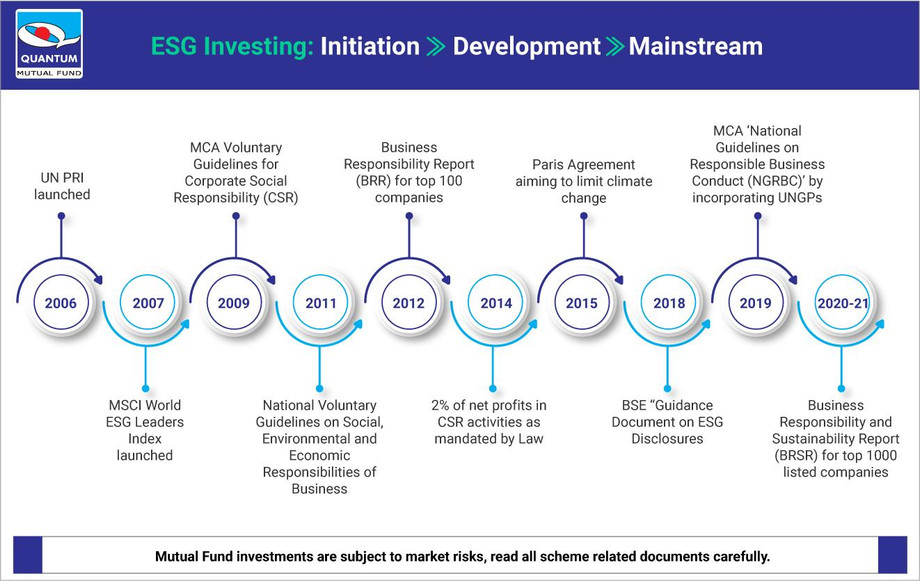

ESG investing is also called sustainable investing. ESG Mutual Fund is a category of Equity Mutual Fund that invests in companies following the ESG (Environmental, Social and Governance) parameters. These parameters are non-financial, however have a material impact on the long-term performance of the company. The Principles of Responsible Investing, an UN-backed global initiative was launched in April 2006 at the New York Stock Exchange. It records more than 3,000 signatories to date.

The MSCI World ESG Leaders Index was established on Oct 01, 2007, with a view to provide institutional investors with a transparent tool to integrate ESG considerations in their investment portfolios. In 2009, the Ministry of Corporate Affairs (MCA) in India has laid down the Voluntary Guidelines for Companies to provide details about CSR (Corporate Social Responsibility) initiatives in terms of expenditure incurred. MCA in an endeavor towards mainstreaming the concept of business responsibility, established the 'National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business, 2011 (NVGS)’ after extensive consultations with several stakeholders.

In 2012, SEBI had introduced non-financial reporting in the form of BRR (Business Responsibility Report) as part of annual reports for the top 100 listed companies which were later extended to the top 1000 listed companies. As per CSR policy (Corporate Social Responsibility), u/s135 of Companies Act 2013., the Board of Directors are to ensure that the company spends a minimum of 2% of the average net profits made in the financial year for CSR activities. Through all of these milestones and counting, ESG investing evolved gradually from a buzzword to a mainstream investment philosophy.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.