Gold acts as a risk-reducing portfolio diversifier, primarily due to its low correlation to equities. All the investment options mentioned below simplify the gold buying process as it is in electronic form, thus offering you the convenience of buying gold from the comfort of your home.

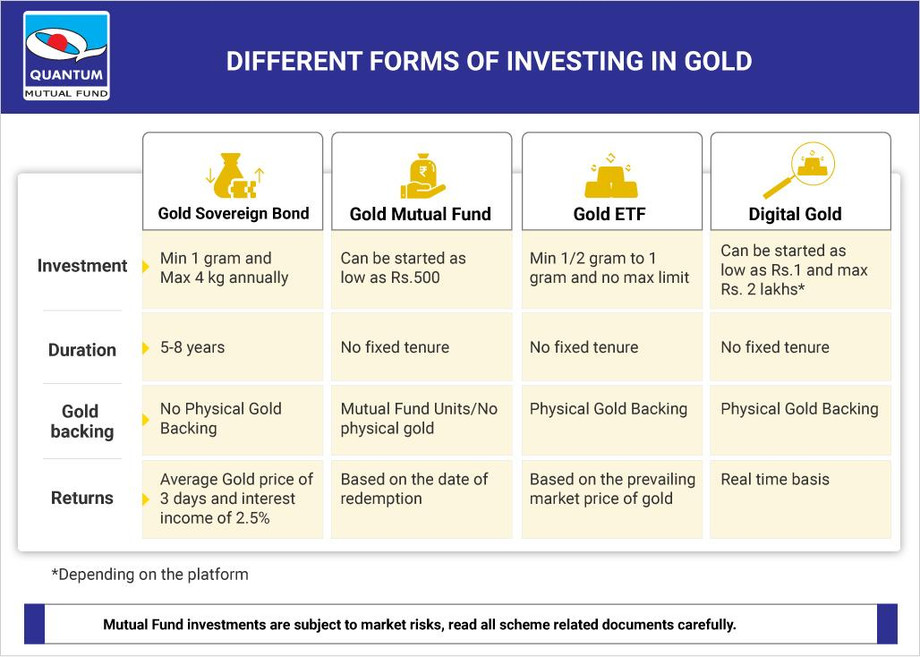

1. Sovereign Gold Bonds are securities issued by the RBI on behalf of the Government. It helps you to gain capital appreciation and receive interest income for a fixed term of 8 years. The price is determined by the Indian Bullion and Jewelers Association Limited (IBJA) based on the average of the last 3 days closing prices of 99.9% purity Gold.

2. Gold Mutual Funds allow you to invest through the SIP (Systematic Investment Plan) route. It does not require a DEMAT account. It is suitable for any wallet size, start an SIP low as Rs.500.

3. Gold ETFs or Gold Exchange Traded Fund is an open-ended fund that trades on stock exchanges and tracks the market price of Gold. You can invest in Gold ETF using a DEMAT account and can be redeemed at the prevailing price of Gold. These ETF units are backed by physical gold that is 99.5% pure, with each unit representing ½ or 1 gram of gold.

4. Investment in Digital Gold can be started as low as Rs. 1 and a maximum of Rs. 2 lakhs. It has no fixed tenure and can be redeemed against physical gold and you can redeem on a real time basis at the prevailing market price of Gold.

Investors can allocate upto 20% of their overall portfolio to Gold to offer portfolio diversification and stability.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.